JETRO Invest Japan Report 2024

Chapter3. Recent Government Measures Section4. Partial Revision of the Industrial Competitiveness Enhancement Act

Aiming to strengthen domestic investment in strategic areas such as green technologies and digital

Japan is now in a changing tide of wage increases and domestic investment at their highest levels in 30 years due to changes in the macro environment such as the expansion of geopolitical risks and new industrial policies referred to as New Direction of Economic and Industrial Policies that provide large-scale, long-term, and systematic support to help solve human and social issues such as climate change and digitalization.

Sustaining these changes can generate inflation accompanied by wage increases and economic revitalization. To achieve this, it is necessary to realize structural reform of the economy by strengthening innovative efforts such as "expanding strategic domestic investment" and "promoting innovation and metabolism that lead to expanded domestic investment," which is a prerequisite for strengthening supply capacity through domestic investment and putting the Japanese economy on a growth track.

The Industrial Competitiveness Enhancement Act will be partially revised to implement large-scale and long-term tax measures for investment and production in strategic sectors and tax measures to strengthen location competitiveness as R&D centers, expanding strategic domestic investment, and at the same time to provide intensive support for medium-sized enterprises and startups that are the driving force of the economy, promoting innovation and rejuvenation that will lead to increased domestic investment. It will take effect in April 2025.

| No. | Points of Revision | Specific Details |

|---|---|---|

| 1 | Establishing a tax system to promote domestic production in strategic sectors | The Strategic Sector Domestic Production Promotion Tax System, a new unprecedented investment promotion measure has been established in response to the growing competition for investment in strategic sectors around the world, in order to strongly promote domestic investment in strategic sectors, especially those with high costs at the production stage. Specifically, tax credits based on production and sales volume will be provided for electric vehicles, green steel, green chemicals, sustainable aviation fuel (SAF), and semiconductors (microcomputers and analogs) for an applicable period of 10 years. |

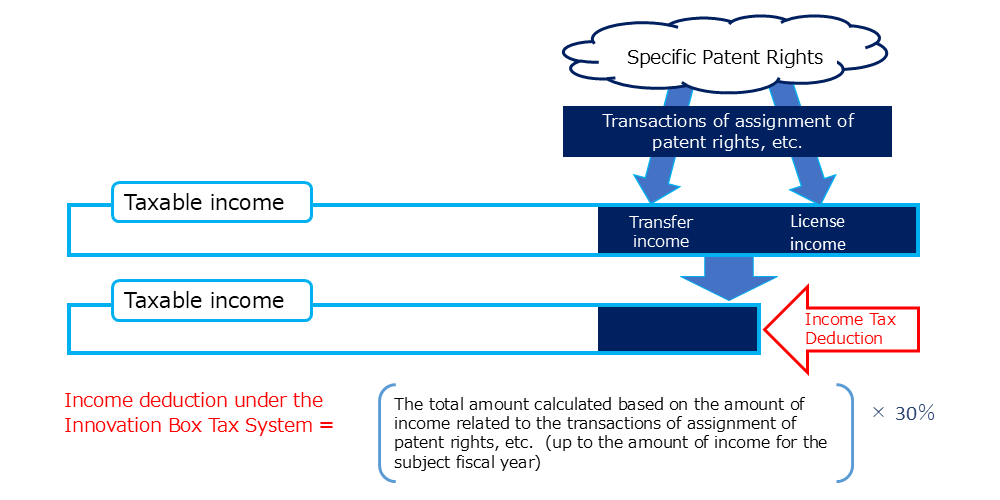

| 2 | Establishing the innovation center tax system (Innovation Box Tax System) | The Innovation Box Tax System, an innovation center taxation system will be established and the applicable period will be set at seven years. The tax system provides a 30% income deduction for license income and transfer income arising from intellectual property rights (patents, copyrights for AI-related programs) that have been independently researched and developed in Japan, in order to strengthen the location competitiveness of innovation centers and to develop a business environment comparable to that of overseas. |

-

Source:

Based on "Revision points of tax system in related to Economy, Trade and Industry (FY 2024)" by the Ministry of Economy, Trade and Industry

Reference

Innovation Box Tax System

To strengthen location competitiveness as R&D, The Innovation Box Tax System will take effect in April 2025

The Innovation Box Tax System, an innovation center tax system will be established, with the aim of strengthening location competitiveness as R&D centers and encouraging investment in intangible assets by the private sector amid intensifying international competition for innovation.

The System is a tax system that applies an income deduction of 30% to license income and transfer income arising from intellectual property rights (patents and copyrights to AI related software) due to the tax reform in FY 2024. This tax system will take effect in April 2025 and last for a period of seven years.

-

Source:

Based on 5. Establishment of Innovation Box Taxation System, "Summary of Revisions to Corporate Tax Laws and Regulations" by the National Tax Agency

JETRO Invest Japan Report 2024

-

Section1.

-

Section2.

-

Section3.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

[Column]

-

[Column]

-

Section5.

-

[Column]

-

Section6.

-

[Column]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

Laws and Regulations on Setting Up Business in Japan Pamphlet

The pamphlet "Laws & Regulations" is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan. It is available in 8 languages (Japanese, English, German, French, Chinese (Simplified), Chinese (Traditional), Korean and Vietnamese).

You can download via the "Request Form" button below.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices