JETRO Invest Japan Report 2024

Chapter3. Recent Government Measures Section3. National Strategic Special Zones "Special Zones for Financial and Asset Management Businesses"

Aiming to activate investment specializing in financial and asset management in four cities in Japan

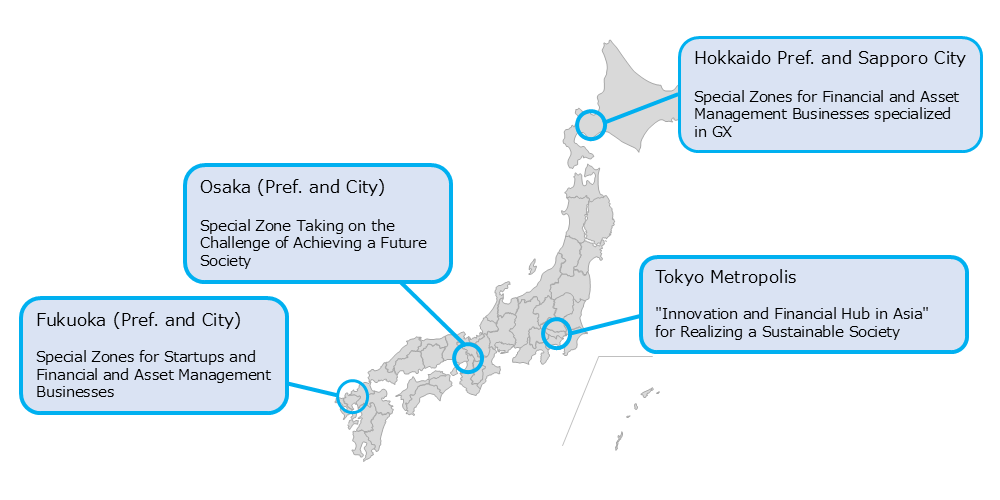

In June 2024, the Financial Services Agency announced that it would designate the four regions of Hokkaido and Sapporo, Tokyo, Osaka (Pref. and City), and Fukuoka (Pref. and City) as Special Zones for Financial and Asset Management Businesses.

This special zone is designed to realize a "virtuous cycle of growth and distribution" that accelerates the flow of funds through the reform of asset management. By allowing special deregulation and support measures in the target areas, new investments will be attracted from both within and outside Japan , leading to the development of the financial industry and regional industries.

In the Special Zones for Financial and Asset Management Businesses, efforts will be made from the perspectives of (1) clustering domestic and foreign financial and asset management companies, (2) having those financial and asset management companies support the fostering of regional growth industries, and (3) promoting and fostering growth industries themselves. Specifically, the national government will implement regulatory reform and operational measures not only for the financial sector but also with regard to the business and living environments and industries targeted for investment. In that process, for matters subject to regulatory reform for which demonstrative measures by limiting target areas are preferable, the system of National Strategic Special Zones is to be utilized.

Each of the four target regions has a special zone concept and vision that capitalizes on its unique characteristics. In order to realize these goals, each region will promote initiatives in cooperation with a wide range of stakeholders.

-

Source:

Based on "Policy Package to Achieve Special Zones for Financial and Asset Management Businesses" by the Financial Services Agency

Hokkaido and Sapporo

—Special Zones for Financial and Asset Management Businesses specialized in Green Transformation (GX)

Focusing on GX

Hokkaido prefecture and Sapporo City will fully utilize the prefecture's potential to produce the largest amount of renewable energy in Japan and Sapporo's attractive feature, a well-balanced harmony of city functions and nature, aiming to create an Asian and world financial center where funds, human resources, and information concerning GX concentrate. In addition, they will strengthen financial functions and build a supply chain for the GX industry and create employment opportunities as a renewable energy supply base for the whole nation.

Under the initiative of the Team Sapporo-Hokkaido, a GX-financial consortium consisting of 21 organizations, which was established in June 2023 in collaboration among the industry, the academia, governments, and the financial sector, Hokkaido and Sapporo will promote the vitalization of financial transactions through GX investments.

| No. | Targets | Specific Activities |

|---|---|---|

| 1 | Clustering of funds, human resources, and information related to GX |

Against the backdrop of Hokkaido's renewable energy potential, the following eight projects related to investing in GX are being focused on, and AI will be utilized in promoting demonstration and implementation of each project. In addition, efforts will be made to secure highly skilled personnel for each project. |

| 2 | Strengthening/clustering of financial functions | In addition to building supply chains and creating jobs for GX industry, create and nurture startups that generate new technologies and innovations, and attract asset management companies and other financial functions from around the world to Hokkaido and Sapporo. |

-

Source:

Based on "Policy Package to Achieve Special Zones for Financial and Asset Management Businesses" by the Financial Services Agency and briefing materials of proposal for "GX Financial and Asset Management Special Zone" by Sapporo City

Case Study:

Zero Carbon Challenger

as one of the measures to promote GX

The Zero Carbon Challenger is an initiative to achieve "Zero Carbon Hokkaido," which aims to achieve virtually zero greenhouse gas emissions by 2050.

Registered companies aim to promote decarbonization and economic revitalization at the same time. The Japan Finance Corporation's SME Program and Hokkaido are working together to create a new loan program, which is linked to this activity.

2.Tokyo—Innovation and Financial Hub in Asia

Aiming to become a global top-class financial city and conducting various promotional activities

Tokyo aims to further develop the environment as an international financial center and promote the development of sustainable finance and startups in Japan and Asia, contributing to the growth of Japan and Asia as a gateway to attract funds, talent, technology, and information around the world. For that purpose, the Tokyo metropolitan government has set up three pillars: the leading city for sustainable finance, the city where global Startups are born, and the city with the global standard for business in English.

In order to promote these initiatives and achieve a sustainable society, the Tokyo metropolitan government collaborates with the Organization of Global Financial City Tokyo (FinCity.Tokyo), which is the first public-private financial promotion organization in Japan, with diverse public and private players relating to finance and startups, and also with major overseas financial cities such as the city of London, the United Kingdom (concluded an agreement on exchange and cooperation).

| No. | Targets | Specific Activities |

|---|---|---|

| 1 | Leading city for sustainable finance |

(1)Relaxation of requirements for entry of foreign asset management companies (2)Establishment of a new registration system for fund management companies (3)Relaxation of regulations on investment management business for qualified investors (4)Relaxation of the mandated reporting on the net asset values of private placement funds for professional investors (5)Development of laws on issuance of digital securities by local governments (6)Expansion of the range of the finance and insurance industry subject to the credit-guarantee system (7)Abolishment of withholding tax on investment profits of foreign investors (8)Expansion of investment fund contributions to new asset management companies (9)Preferential treatment for investment in infrastructure funds |

| 2 | City where global startups are born |

(1)Development of an environment of startup investment by public university cooperations (2)Further expansion of investment in startups by bank groups (3)Financing for startups by means of investment trust (4)Support for startups in the later stage through sovereign wealth funds |

| 2 | City with the global standard for business in English |

(1)Enhancing procedures in English at the time of founding (2)Establishment of open status of residence to attract diverse talent (3)Promotion of information disclosure in English |

-

Source:

Based on "Policy Package to Achieve Special Zones for Financial and Asset Management Businesses" by the Financial Services Agency and "Proposal for a Sustainable Society: Tokyo—Innovation and Financial Hub in Asia" by the Tokyo Metropolitan Government

Case Study:

The Organization of Global Financial City Tokyo (FinCity.Tokyo)

FinCity.Tokyo is an organization that aims to boost the attractiveness of Tokyo's financial markets and raise its profile as a top-class global financial city, while conducting various promotional activities through private–public partnerships. With members comprising financial institutions, operating companies, industry groups, and government agencies, we are striving to showcase Tokyo as a convenient financial city, while providing relevant institutions with information on user experiences.

3. Osaka—Special Zone Taking on the Challenge of Achieving a Future Society

Strengthening initiatives for post Expo 2025 Osaka, Kansai

Osaka Prefecture and Osaka City aim to create an environment to enable startups and universities, etc. to boldly take on challenges, instead of wasting the opportunity of the EXPO 2025 OSAKA, KANSAI, JAPAN merely as a temporary event, with the final aim of achieving a future society where new innovations are created one after another. For that purpose, they will implement regulatory reform to satisfy the global standard and strengthen financial functions by attracting investments from overseas.

These activities will be led by the Global Financial City OSAKA Promotion Committee (participated in by 40 organizations as of February 2024), which was established in March 2021 and is an all-Osaka collaboration of Osaka Prefecture, Osaka City, and related organizations in industry, government, and academia. For the time being, efforts will be intensively made to attract human resources, companies, and funds from Asia and the rest of the world and cluster startups that will be investment targets.

| No. | Targets | Specific Activities | Shared Initiatives to Realize the Targets 1 and 2 |

|---|---|---|---|

| 1 | Global city that develops by leveraging finance |

(1)Promote financial initiatives for attractive community development (2)Encourage diversity in financing to revitalize startups and local communities (3)Strengthen hub functions to improve resilience (4)Revitalize domestic financial markets |

1)Establish attractive living conditions for foreign nationals 2)Create a business environment that attracts companies and people from within Japan and abroad 3)Disseminate information and conduct promotion activities 4)Collaborate with overseas entities 5)Osaka Prefecture and City to implement innovative and impactful initiatives |

| 2 | Front-running city in finance |

(1)Create cutting-edge, innovative financial products and markets (2)Implement initiatives for an advanced city in sustainable finance (3)Encourage a review of regulations related to financial services (4)Nurture highly skilled professionals in the field of finance |

-

Source:

Based on "Policy Package to Achieve Special Zones for Financial and Asset Management Businesses" by the Financial Services Agency and "Global Financial City OSAKA Strategy" by the Global Financial City OSAKA Promotion Committee

Case Study:

Osaka Global Finance One-Stop Service Center

To realize Osaka as a global financial city, the Center offers one-stop services in both Japanese and English for professional inquiries on financial licenses and other matters, and consultation on business and daily life to foreign financial companies and foreign investors wishing to set up operations in Osaka.

4. Fukuoka—Special Zones for Startups and Financial and Asset Management Businesses

Attracting foreign and domestic investments with the geographical advantage of proximity to Asia

Fukuoka Prefecture and Fukuoka City will cluster global financial institutions and their affiliated companies, and highly-skilled financial specialists by leveraging the characteristics of Fukuoka as a gateway to Asia. While capturing the vitality of Asian countries, they provide growth funds for startups in Fukuoka and Kyushu, as well as for companies in growth industries clustered within the prefecture, thereby strengthening the ecosystem.

These activities will be promoted by TEAM FUKUOKA, an industry-government-academia collaboration established in September 2020 to attract global financial functions. As of the end of April 2024, twenty-four companies have been attracted from inside and outside Japan, and the area will continue to focus on asset management companies, fintech firms, and operations for BCPs (Business Continuity Plans), which are highly compatible with Fukuoka's regional characteristics, and will continue to work on attracting companies and improving the environment.

| No. | Targets | Specific Activities |

|---|---|---|

| 1 | Establishing internationally competitive systems |

(1)Tax system (tax reform in FY 2021: corporate tax, income tax, and inheritance tax) (2)Providing administrative services in English and simplifying the procedures (3)Relaxing residence status (4)Building a one-stop support system |

| 2 | Providing a comfortable business environment |

(1)Securing a high-value-added office environment (2)Securing English-speaking specialized professionals (3)Nurturing local highly skilled professionals to support the asset-management business and FinTech (4)Strengthening the functions of Fukuoka Airport's international routes |

| 3 | Providing a comfortable living environment |

(1)Securing residences for foreign highly skilled professionals (2)Enhancing international schools (3)Enhancing daily support (including medical support) in English |

| 4 | Conducting promotional activities | (1)Promotional activities utilizing networks and other tools |

-

Source:

Based on "Policy Package to Achieve Special Zones for Financial and Asset Management Businesses" by the Financial Services Agency and "TEAM FUKUOKA Direction of Attracting International Financial Functions" by the TEAM FUKUOKA Office

Case Study:

TEAM FUKUOKA

An all-Fukuoka organization of industry-academia-government collaboration to promote the attraction of international financial functions to Fukuoka City. The team staff, who are well-versed in the finance industry and fluent in English and Chinese, provide support as a "one-stop" center to foreign financial institutions considering a business expansion into Fukuoka City.

JETRO Invest Japan Report 2024

-

Section1.

-

Section2.

-

Section3.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

[Column]

-

[Column]

-

Section5.

-

[Column]

-

Section6.

-

[Column]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

Laws and Regulations on Setting Up Business in Japan Pamphlet

The pamphlet "Laws & Regulations" is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan. It is available in 8 languages (Japanese, English, German, French, Chinese (Simplified), Chinese (Traditional), Korean and Vietnamese).

You can download via the "Request Form" button below.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices