JETRO Invest Japan Report 2024

Chapter2. Trends in Inward FDI to Japan Section4. Trends in Greenfield Investment in Japan

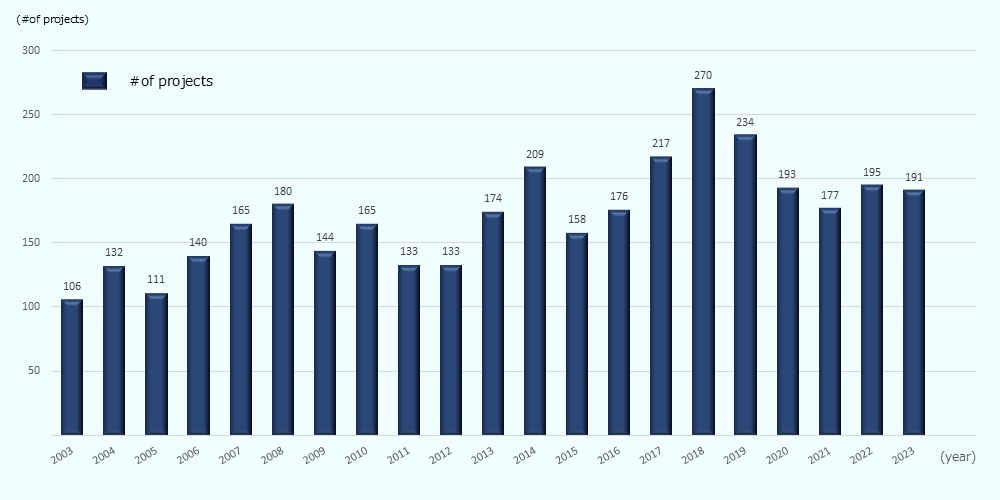

1. Changes in the Number of Cases

Maintains almost the same level as the previous year

The number of greenfield investments in Japan in 2023 (based on the date of publication) decreased by 2.1% from the previous year to 191. Even in the midst of a stagnant global economy, it remained almost unchanged from the previous year.

-

Source:

Based on "fDi Markets" by the Financial Times

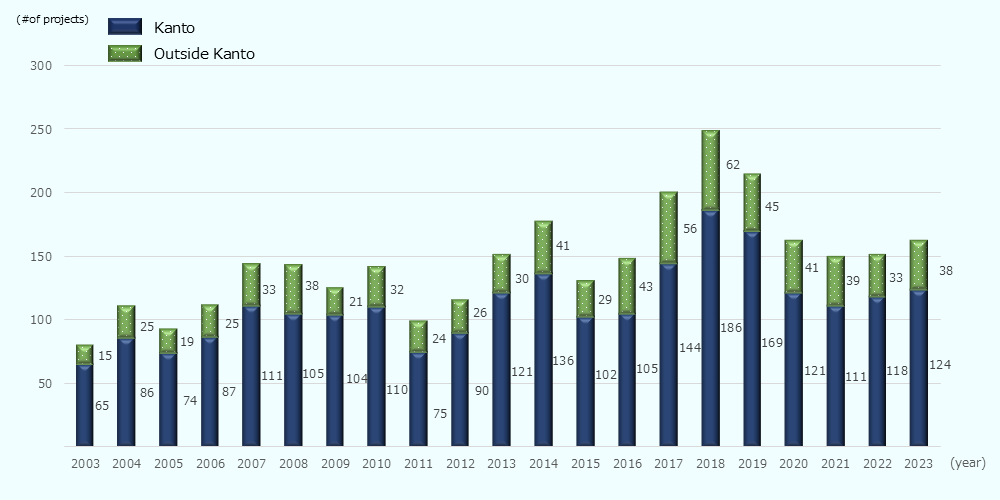

2. Trends in Investment by Region (Kanto region and non-Kanto region)

Investment in the Kanto region is about three times that of other regions

Dividing cases where the investment destinations are known into Kanto region and other regions, we found that there were 124 projects in Kanto region and 38 projects outside the Kanto region in 2023. The number of cases in the Kanto region increased by 6 over the previous year, while that outside the Kanto region increased by 5.

-

Note:

Kanto region includes Tokyo and six prefectures; Ibaraki, Kanagawa, Gunma, Saitama, Chiba, and Tochigi. Excluding investment unknown areas.

-

Source:

Based on "fDi Markets" by the Financial Times

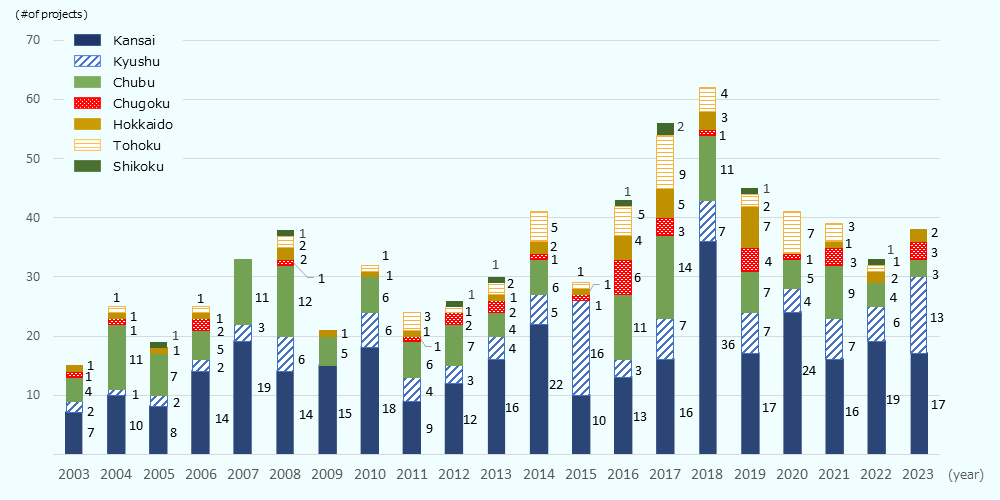

3. Trends in the Number of Greenfield Investments in Japan by Region (Outside Kanto Region)

The number of cases in Kyushu region doubled from the previous year

Looking at the number of non-Kanto region among cases where the investment destination is known, the number of cases in the Kyushu region increased by 7, while that in the Chugoku region increased by 3. Of the 13 investment cases in Kyushu, 6 or about half were from Taiwan, the largest number. Of the 17 investment cases in Kansai, the largest number by region, about half (8) were from the United States.

-

Source:

Based on "fDi Markets " by the Financial Times

Column: Saga Prefecture's "Karatsu Cosmetics Initiative" Utilizing Overseas Perspectives

In Saga Prefecture, industry, academia and government are working together to promote a sustainable cosmetics industry, introducing new products and technologies.

One of the projects is the Karatsu Cosmetics Initiative, which aims to create a cluster of beauty and health industries centered around the Karatsu/Genkai region around northern part of Kyusyu.

It all started in 2012, when a group from a French cosmetics manufacturer, a member of which was the former chairman of the French Cosmetic Valley Association*1, visited Karatsu.

On that occasion, it was suggested that Karatsu could become a “Japanese version of the Cosmetic Valley” due to the geographical advantage of its proximity to East Asia, the existence of a mini-cluster of cosmetics-related companies (currently Karatsu Cosmetic Park), the abundance of raw material resources from its rich natural environment and agricultural technology, and other factors. This led to the discovery of the potential for promoting the cosmetics industry through the supply chain of cosmetics using locally produced materials, and in 2013, Karatsu City and the French Cosmetic Valley Association signed a Memorandum of Understanding (MOU) and the Japan Cosmetic Center (JCC) has established .

With the JCC as the driving force, this initiative aims to revitalize economic activities and create jobs by making the most of regional resources through industry-academia-government collaboration, and is still being promoted strongly with the "Made in Japan" brand, taking advantage of its geographical location.

The JCC signed MOUs with Barcelona, Spain and Crema, Italy in 2015, with Tainan, Taiwan in 2016, with Bangkok, Thailand in 2017 each. They promotes investment in Karatsu by overseas cosmetics companies. In February 2023, the JCC signed an MOU with IBITA, a South Korean cosmetics industry cluster association, and has been holding business meetings and other events to pursue business opportunities between the two countries.

-

*1 :

French Cosmetic Valley is the world's largest cosmetics industry cluster, with approximately 600 companies, eight universities, and 200 research institutes concentrated around the Chartres region in central France.

4. Top 5 Countries/Regions and Top 5 Industries

Asia showed remarkable increase and Singapore doubled

Looking at greenfield investments in Japan in 2023 by investor country, the United States had the largest number of 64 cases, up 16.4% from the previous year. Singapore, which ranked fifth with 10 cases in the previous year, moved up to second place (20 cases, up 100.0% from the previous year), and the United Kingdom remained in third place with 18 cases (up 12.5%). France, which ranked second last year with 17 cases, decreased to four cases, and Germany also dropped out of the top 5 countries, falling from 11 cases to five cases. On the other hand, China and Hong Kong were among the top 5 with 11 cases (up 120.0% from the previous year) and six cases (down 14.3%), respectively.

By industry, software & IT services decreased by 46.4% from the previous year to 37 cases, but still had the largest number, followed by business services with 31 cases, up 3.3%. Financial services, which ranked third as in the previous year, saw a large increase in the number of cases to 26 (up 85.7% from the previous year), with these three industries accounting for the majority of the cases.

| Ranking | Country/Region |

# of Projects |

Growth rate(YoY) | Share |

|---|---|---|---|---|

| 1 | United States | 64 | 16.4 | 33.5 |

| 2 | Singapore | 20 | 100.0 | 10.5 |

| 3 | United Kingdom | 18 | 12.5 | 9.4 |

| 4 | China | 11 | 120.0 | 5.8 |

| 5 | Hong Kong | 6 | -14.3 | 3.1 |

| ― | Total | 191 | -2.1 | 100.0 |

-

Source:

Based on "fDi Markets" by the Financial Times

| Ranking | Sector |

# of Projects |

Growth rate(YoY) | Share |

|---|---|---|---|---|

| 1 | Software & IT services | 37 | -46.4 | 19.4 |

| 2 | Business services | 31 | 3.3 | 16.2 |

| 3 | Financial services | 26 | 85.7 | 13.6 |

| 4 | Industrial equipment | 16 | 23.1 | 8.4 |

| 5 | Real estate | 16 | 166.7 | 8.4 |

| ― | Total | 191 | -2.1 | 100.0 |

-

Source:

Based on "fDi Markets" by the Financial Times

6. Major Greenfield Investment Projects from January 2023 to September 2024

Large semiconductor-related projects stand out

The greenfield investment projects in Japan during the above period include a number of projects related to the construction of production plants and upgrading and expansion of facility capacity by a major Taiwanese semiconductor manufacturer, Taiwan Semiconductor Manufacturing Company (TSMC), and U.S. semiconductor manufacturers, such as Micron. They also include some projects related to data center construction. In addition, it is noteworthy that the renewable energy projects related to storage batteries have become full-scale (Chart 2-16).

| Company name |

Country/ Region |

Sector | Investment destination (prefecture) | Outline |

Date (Based on announcement/ media reports) |

Value (Million US$) |

|---|---|---|---|---|---|---|

| Japan Advanced Semiconductor Manufacturing (JASM) | Taiwan | Semiconductors | Kumamoto | Japan Advanced Semiconductor Manufacturing (JASM) is a semiconductor contract manufacturing subsidiary of Taiwan Semiconductor Manufacturing Company (TSMC), of which TSMC owns a majority stake. TSMC, Sony Semiconductor Solutions, Denso, and Toyota Motor Corporation announced that they would make additional investments in JASM and build a second factory in Kumamoto Prefecture. The second factory aims to start operations by the end of 2027. Including the first factory, which is scheduled to start production in 2024, capital investment in JASM is expected to exceed 20 billion US dollars. | July 2023 | 10,000 |

| Ada Infrastructure | Singapore | Communications | Tokyo and Kansai regions |

Ada Infrastructure is a global data center business brand launched in September 2023 by Singapore-based logistics facility developer GLP. The company announced the start of construction of its second data center (DC) in the Tama area of Tokyo. Overall, it has planned to build three DCs (with a total IT power of 31MW), with construction scheduled to start and be completed sequentially through 2028. When the company announced its full-scale entry into the DC business in February 2022, it said that it planned to invest more than 1 trillion yen in the future, aiming for a supply capacity of 900 MW around 2027–2028 at the latest. Of this capacity, suitable sites for approximately 600 MW have already been acquired in the Tokyo and Kansai regions, and this is part of that project. |

May 2024 | 5,900 |

| Micron Technology | United States | Semiconductors | Hiroshima | Micron Technology, a leading U.S. semiconductor memory company announced plans to invest up to 500 billion yen over the next several years in 1γ (gamma) generation technology at its Hiroshima Plant (Higashi-Hiroshima City). | May 2023 | 3,700 |

| Asia Pacific Land | United States | Real Estate | Fukuoka | Asia Pacific Land Group, a U.S. real estate investment and development company, announced the construction of a large-scale data center in Kitakyushu city, Fukuoka Prefecture. Its total power receiving capacity, which indicates the scale of the data center, will be 120MW, one of the largest in the Kyushu region. | August 2023 | 879 |

| Octopus Energy | United Kingdom |

Renewable Energy |

Tokyo, others |

Octopus Energy is developing its renewable energy business in partnership with Tokyo Gas. In addition to a £600 million investment in solar and wind power, the company announced its plans to invest another £300 million to advance technological innovation and position Tokyo as a retail hub. | May 2023 | 745 |

| SC Capital Partners | Singapore | Real Estate | Osaka | SC Zeus Data Centers, a data center investment company under the Singapore-based real estate investment management company SC Capital Partners, announced its entry into Japan by launching a large-scale data center development project with a total power receiving capacity of 50MW in Osaka City. The company plans to start the operation of 25 MW data center as the first phase in 2027, and has already secured a site of approximately 4,000 tsubo (approximately 13,000 m2) in close proximity to a group of Internet exchanges and data centers in the center of Osaka. | November 2023 | 669 |

| Gurin Energy | Singapore |

Renewable Energy |

Undecided | Gurin Energy, a Singapore-based renewable energy company, announced plans to develop, construct, and operate Japan's biggest large-scale lithium-ion secondary battery power storage system. The large-scale stationary storage battery system, which is scheduled to begin construction in 2026, is a project with an output of 500 MW and a maximum capacity of 2,000 MW (=2 GW), with a total project cost of 91 billion yen invested over six years. This will increase the output of Japan's current large-scale stationary battery systems by 125% and its capacity by 220%. | December 2023 | 635 |

| Mapletree Investments | Singapore | Real Estate | Osaka | Mapletree Investments, a logistics investment company in Singapore, announced that it had acquired a newly constructed data center in Osaka. The acquisition was made through the purchase of trust beneficiary rights for a total amount of 52 billion yen. The power receiving capacity will be 10 MW. | May 2023 | 508 |

| United States | Communications | Mie and Ibaraki | Google announced that it would invest 1 billion US dollars in laying submarine cables in Japan. The plan is to connect the United States and Japan by laying two new submarine cables, Proa and Taihei, and expanding existing submarine cables. | April 2024 | 500 | |

| ESR | Hong Kong | Real Estate | Tokyo | ESR, a leading logistics real estate company in Hong Kong, announced that it would develop its fourth domestic data center in Japan, in central Tokyo. The planned power receiving capacity is 60MW, with construction scheduled to begin in the second quarter of 2026 and service to begin in the fourth quarter of 2028. This data center will be the one following those in Osaka City, Osaka Prefecture (130 MW), Higashikurume City, Tokyo (30 MW), and Soraku-gun, Kyoto Prefecture (100 MW). | May 2024 | 357 |

| Prologis | United States | Real Estate | Osaka and Okayama | Prologis, a U.S. logistics real estate company, is currently developing and deploying the advanced logistics facility Prologis Park, and Prologis Urban, which is designed to function effectively as a distribution hub for the last mile in urban areas. The company announced the groundbreaking ceremony for Prologis Park Okayama, a multi-tenant logistics facility to serve as a logistics hub for the Chugoku and Shikoku regions. In the same month, it decided to develop Prologis Park Sakai as a logistics facility exclusively for specific companies. | April 2024 | 357 |

| LaSalle Investment Management | United States | Real Estate | Aichi | LaSalle Investment Management, a U.S. real estate investment advisory firm, announced that it would build a multi-tenant logistics facility in Nagoya City, Aichi Prefecture, in collaboration with NIPPO, with construction scheduled for completion in June 2025. In addition to serving as a wide-area distribution center for the entire Tokai area, it is planned to function as a relay center between the Tokyo metropolitan area and the Kansai region. | January 2024 | 357 |

| Goodman Group | Australia | Real Estate | Ibaraki | Australian real estate giant Goodman Group plans to develop a new data center campus in Japan and provide 1,000 MW of power. The company announced that site preparation and infrastructure work were underway in Tsukuba City, Ibaraki Prefecture, with the first data center scheduled for completion in 2026 with a power receiving capacity of 50 MW. | January 2024 | 357 |

| Fidelity Investments | United States | Real Estate | Chiba | Fidelity Investments, a U.S. mutual fund company, announced that its subsidiary, Colt Data Center Services, a global provider of hyperscale data center solutions for large enterprises, had begun construction of its fourth major data center in Inzai City, Chiba Prefecture, in a joint venture with Mitsui & Co. The power capacity will be approximately 20MW, changing the total IT power capacity with the expansion in Inzai to approximately 70MW. | April 2023 | 357 |

| Samsung Electronics | South Korea | Semiconductors | Kanagawa | Samsung Electronics, a South Korean semiconductor manufacturer, has decided to establish a new research center for next-generation semiconductor packaging technology in the Minato Mirai 21 district in Nishi-ku, Yokohama. The scale of investment is expected to exceed 40 billion yen over the next five years. Heterogeneous integration, which connects different semiconductors horizontally and vertically, is used to integrate more transistors in a smaller package, allowing different functions to be implemented in a single package. | May 2023 | 280 |

| Vantage Data Centers | United States | Communications | Osaka | Vantage Data Centers, a leading provider of hyperscale data center campus management in the U.S., announced that it had begun construction of its first campus in Japan, Osaka (KIX1). The campus, to be built in Ibaraki City, Osaka Prefecture, will provide up to 68MW. The campus will support both cloud and high-density implementations, providing hyperscalers and cloud providers with flexibility and scalability to meet market needs. | May 2024 | 273 |

| Industrie De Nora | Italy | Electronic components | Okayama | Industrie De Nora, an Italian multinational electrolysis and electrode equipment manufacturer, announced the opening of a new production facility in Okayama Prefecture to solidify its position as a leading global supplier of electrolysis equipment in Japan. The company is one of the world's leading suppliers of water filtration and disinfection technologies, and has developed and owns a portfolio of electrodes and components for hydrogen production by electrolyzation of water, which is essential for the energy transition. | December 2023 | 200 |

| Akaysha Energy | Australia |

Renewable Energy |

Undecided | Akaysha Energy, an Australian renewable energy solutions company announced that it had signed a strategic partnership agreement with Itochu, a general trading company, to collaborate in the grid storage battery business. The company is a business development platform whose parent company is an infrastructure fund managed by the BlackRock Group, a U.S. asset management company, and it promotes the development, ownership, and operation of grid storage solutions globally. | September 2023 | 196 |

-

Note:

In order of investment amount based on company announcements or media reports

-

Source:

Based on "fDi Markets" by the Financial Times and company announcements

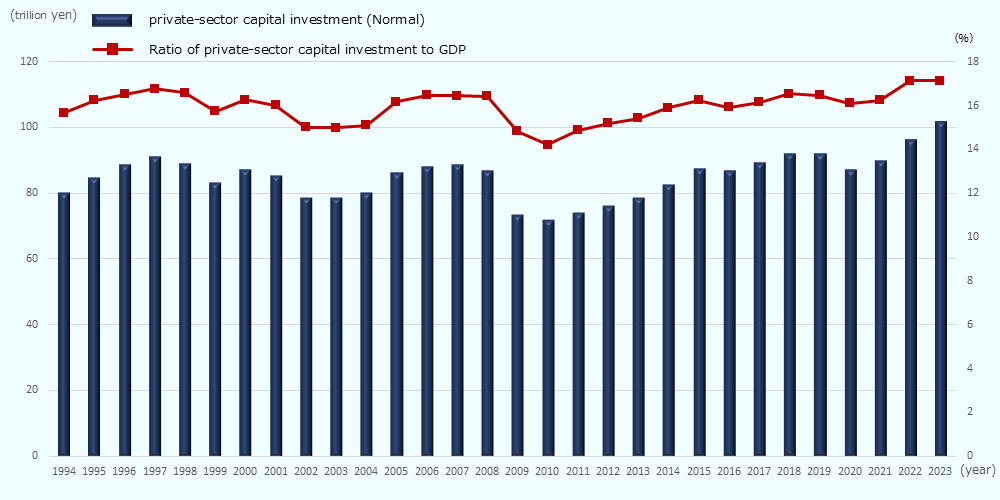

Column: Private-Sector Capital Investment Exceeds 100 Trillion Yen, Aiming for 115 Trillion Yen in fiscal 2027

Private-sector capital investment, which declined to 87 trillion yen in 2020 due to the impact of Covid-19 pandemic, recovered as the disaster subsided and exceeded the 100 trillion yen, marking 102 trillion yen in 2023.

At the 2nd Public-Private Partnership Forum on Increasing Domestic Investment (April 2023), Keidanren Chairman Tokura said, "It is important to shift the 'signs of change' from the current strong capital investment to 'dynamism' and restore the dynamism of the Japanese economy. The private sector is committed to achieving the goal of '115 trillion yen in capital investment in fiscal 2027' through the public-private partnerships."

Looking at the changes in private-sector capital investment since 1994 (see Chart), the "ratio to GDP" fell sharply in the three years following the Lehman's collapse in 2008, but then it has gradually recovered, remaining at the 16% level since 2015, which is the level before the Lehman's collapse. Recently, the consumer price inflation rate, the wage increase rate in "Shunto" (spring labor offensive), and the Nikkei Stock Average have reached their highest levels in about 30 years, indicating a change in the situation toward an exit from the deflationary economy. Companies also appear to be more willing to make capital investments.

According to the Cabinet Office's survey on corporate behavior (as of January 2024), the percentage of companies planning to increase capital investment over the next three years exceeded 70% for the third consecutive year, while those planning to decrease it fell below 10% for the second consecutive year.

In addition, of the 1,537 companies that responded to the Survey on Business Operations of Foreign-affiliated Companies in Japan conducted by JETRO in October 2023, a majority of the companies reported year-on-year revenue growth, with business performance rising for the second year in a row. Regarding future business plans in Japan, 60.6% responded that they will "strengthen/expand," up 4.5 points from the 2022 survey and up 8.0 points from the 2021 survey, indicating that foreign-affiliated companies are also increasingly inclined to strengthen or expand their businesses.

Recognizing this changing trend, the government has announced that it will utilize the Domestic Investment Promotion Package*1, which was formulated from an inter-ministerial and cross-sectoral perspective, to achieve the Keidanren's target of "115 trillion yen in capital investment in fiscal 2027" through public-private partnerships.

-

*1 :

The Domestic Investment Promotion Package (December 2023) includes a promotion of public-private investment with sector-specific promotion strategies such as Green Transformation (GX) and Digital Transformation (DX), as well as a set of items to be addressed across 11 ministries and agencies (the Ministry of Economy, Trade and Industry, Cabinet Office, Ministry of Internal Affairs and Communications, Ministry of Finance, Ministry of Education, Culture, Sports, Science and Technology, Ministry of Health, Labor and Welfare, Ministry of Agriculture, Forestry and Fisheries, Ministry of Land, Infrastructure, Transport and Tourism, Ministry of the Environment, Financial Services Agency, and Fair Trade Commission), giving concrete shape to the budget, taxes, and regulations.

-

Source:

Based on the "Statistical Table List" (Quarterly Estimates of GDP: April – June 2024 (The Second Preliminary)⇒GDP (Expenditure Approach) and Its Components Nominal calendar year basis)) by the Cabinet Office

JETRO Invest Japan Report 2024

-

Section1.

-

Section2.

-

Section3.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

[Column]

-

[Column]

-

Section5.

-

[Column]

-

Section6.

-

[Column]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

Laws and Regulations on Setting Up Business in Japan Pamphlet

The pamphlet "Laws & Regulations" is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan. It is available in 8 languages (Japanese, English, German, French, Chinese (Simplified), Chinese (Traditional), Korean and Vietnamese).

You can download via the "Request Form" button below.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices