JETRO Invest Japan Report 2024

Chapter2. Trends in Inward FDI to Japan Section5: Trends in Inbound M&A in Japan

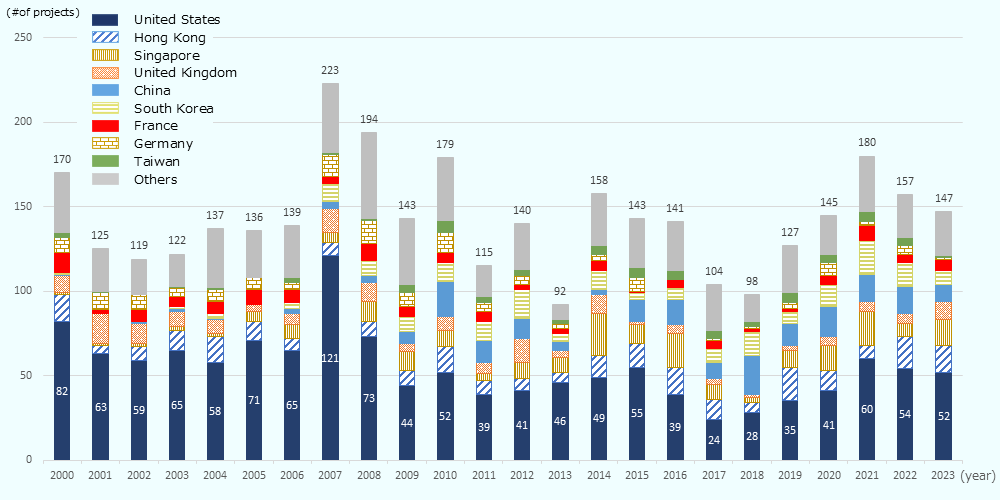

1. Number of M&A Deals and Top 5 Countries and Regions

Number of M&A deals in Japan declined slightly, with a marked decrease in deals from Asia.

In 2023, the number of cross-border M&A deals in Japan (hereafter "inbound M&A deals") was 147 (on a completion date basis), down 6.4% from the previous year. The number of inward M&A deals in Japan has been declining since 2021. In 2023, world direct investment declined for the second consecutive year, and cross-border M&A hit a record low in 10 years. Thus, Japan may have also been affected by this.

Looking at the number of inbound M&A deals in 2023 by investor country, the United States was the largest with 52 deals (35.4% of the total), followed by Hong Kong (16 deals, 10.9%), and Singapore (15 deals, 10.2%). The United Kingdom, which had six deals in 2022, ranked fourth with 11 deals, while China, which ranked third with 16 deals in 2022, came in fifth with 10 deals.

-

Source:

Based on "Workspace" by Refinitiv

| Ranking |

Country/ Region |

# of Projects |

Growth rate(YoY) | Share |

|---|---|---|---|---|

| 1 | United States | 52 | -3.7 | 35.4 |

| 2 | Hong Kong | 16 | -15.8 | 10.9 |

| 3 | Singapore | 15 | 87.5 | 10.2 |

| 4 | United Kingdom | 11 | 83.3 | 7.5 |

| 5 | China | 10 | -37.5 | 6.8 |

| — | Total | 147 | -6.4 | 100.0 |

-

Source:

Based on "Workspace" by Refinitiv

2. Major Inbound M&A Deals in Japan from January 2023 to September 2024

Management buyout (MBO) deals stand out

Among the major inbound M&A deals during the above period, there were a number of cases of management buyouts (MBO) in which, with the support of investment funds, the target company's management team purchased its own shares from shareholders through a takeover bid (TOB) in order to review management or delist the company from the stock exchange. These include the "Outsourcing" deal by U.S. investment fund Bain Capital, the "Benesse Holdings" deal by Swedish private equity investment firm EQT, and the "Nihon Housing" deal by U.S. investment fund Goldman Sachs. There were also some friendly M&A deals in which the acquired company expressed its support for the TOB. These include the "Uzabase" deal and the "Iwasaki Electric" deal by U.S. investment fund Carlyle, and the "T&K TOKA" deal by U.S. investment fund Bain Capital.

| Completion | Target Company | Sector |

Acquiring company (Substantial acquiring entity *Note 2) |

Country/ region of the acquiring company's ultimate parent company | Sector | Outline | Values (million U.S.$) |

|---|---|---|---|---|---|---|---|

| February 2023 | Hitachi Transport System | Manufacturing Industry |

HTSK (KKR) |

U.S. | Finance | U.S. investment firm KKR acquired Hitachi Transport System through a special-purpose company HTSK and others, and Hitachi Transport System has changed its name to LOGISTEED. The company aims to promote the logistics outsourcing business in a strategic partnership with Hitachi, Ltd., the parent company of the former Hitachi Transport System. | 5,985 |

| April 2023 | Evident | Healthcare |

BCJ-66 (Bain Capital) |

U.S. | Finance | Olympus transferred all shares of its wholly owned subsidiary Evident, which is involved in the scientific business such as biological microscopes and industrial endoscopes, to BCJ-66 led by U.S. investment fund Bain Capital. The scientific business, which has different business characteristics from the medical field, will be taken over by Evident, and the two companies each will establish management structures suited to their respective characteristics. | 3,110 |

| June 2024 | Outsourcing | Service |

BCJ-78 (Bain Capital) |

U.S. | Finance | TOB deal for MBO purposes by BCJ-78 led by Bain Capital, a U.S. investment fund. Outsourcing, which provides temporary staffing services to manufacturers and other companies in Japan and overseas, is finding management difficulties due to business expansion through aggressive M&A. By utilizing Bain Capital's management resources, the company says that they will be able to accelerate the drastic restructuring of its internal control system and global governance structure. | 2,223 |

| May 2024 | Benesse Holdings | Service |

Bloom 1 (EQT) |

Sweden | Finance | Bloom 1, an acquisition company established by Swedish private equity fund EQT, conducted a TOB of Benesse Holdings shares to take the company private as part of an MBO. Benesse Holdings plans to flexibly and steadily implement measures such as increasing operational efficiency through digitalization and diversifying services in the education business by allocating management resources to the group through EQT. | 1,263 |

| February 2024 | Sogo Medical Group | Service |

SO1 Holdings (A corporation funded by a fund advised by CVC Capital Partners for investment) |

United Kingdom (Island of Jersey) | Finance | SO1 Holdings, a corporation funded by a fund advised in investment by CVC Capital Partners, a European investment fund, acquired Sogo Medical Group, a major dispensing pharmacy company (already taken private in 2020). | 1,198 |

| March 2023 | Hotels & leisure facilities owned by Prince Hotels (26 assets in total) | Real Estate |

Reco Sky (GIC) |

Singapore | Finance | As part of efforts to strengthen the financial and business structure of the Seibu Holdings Group, Prince Hotels, a consolidated subsidiary of the Group, transferred 26 assets including its owned hotels to Reco Sky, an affiliate of the Singapore government investment fund GIC. The transfer price of the assets was 123.7 billion yen. | 906 |

| January 2023 | KITO | Manufacturing Industry |

Lifting Holdings BidCo (Fund advised by KKR for investment) |

U.S. | Service | TOB deal by Lifting Holdings BidCo, a company established by funds advised by U.S. investment fund KKR and others. It enhances corporate value through synergies from the management integration of KITO, a leading manufacturer of material handling equipment (hoists and cranes), and Crosby Group (U.S.), a leading provider of lifting and rigging solutions. The planned purchase price on an announced basis is 56.5 billion yen. | 479 |

| February 2023 | Multi-family residential portfolio 33 assets | Real Estate |

AXA IM Alts (AXA Investment Managers) |

France | Finance | AXA IM Alts, the AXA Group's alternative investment business, has begun acquiring a new residential portfolio in Japan. The seller is an Asia Pacific real estate company affiliated with J.P. Morgan Asset Management of U.S.. The acquisition price announced is approx. 59 billion yen. The properties include 33 buildings located in Tokyo, Nagoya, and Osaka; mainly studio apartments near train stations. | 458 |

| March 2023 | Royal Hotel (Rihga Royal Hotel Osaka) | Real Estate |

Sakura LLC (BentallGreenOak) |

Canada | Finance | BentallGreenOak, a group of companies that operates real estate private equity funds under Sun Life Financial, a major Canadian life insurance company group, acquired trust beneficiary rights of land and buildings of Rihga Royal Hotel (Osaka) through a special purpose company (Sakura LLC) established for the acquisition of real estate. | 418 |

| July 2023 | Daiwa Resort | Real Estate |

Ebisu Resort (SC Capital Partners, Abu Dhabi Investment Authority subsidiary, Goldman Sachs Asset Management) |

Singapore, United Arab Emirates, United States | Finance | Ebisu Resort, a special purpose company of an international private fund consisting of three companies: Singapore-based real estate developer SC Capital Partners; a subsidiary of Abu Dhabi Investment Authority of the United Arab Emirates; and Goldman Sachs Asset Management of the U.S., has acquired all the shares of Daiwa Resort, a Daiwa House industry's subsidiary that operates and manages hotels and other resort facilities. Daiwa Resort, which operated 24 hotels nationwide, was facing the problem of aging facilities and changes in the environment surrounding the hotel industry, and the added impact of the COVID-19 pandemic finally made it difficult for the company to envision a future growth scenario. Ebisu Resort entrusted the management of its hotel business to Accor, a French company that operates the Grand Mercure and Mercure brands. | 407 |

| February 2023 | Uzabase | High Technology |

THE SHAPER (KKR) |

U.S. | Finance | Carlyle Group, a U.S. investment fund, through THE SHAPER acquired all shares of Uzabase through TOB, which runs news apps such as NewsPicks. In the course of discussions with Carlyle, Uzabase decided that, based on the Carlyle's track record, it was the ideal candidate to partner with to drive the company's medium to long term growth in corporate value. | 398 |

| June 2024 | Nihon Housing | Real Estate |

Marcian Holdings (Goldman Sachs) |

U.S. | Finance | Goldman Sachs, a U.S. investment fund, conducted a TOB of Nihon Housing's shares as part of an MBO by Marcian Holdings GK, a company established for investment purposes. Nihon Housing expressed its opinion in favor of the TOB and resolved to recommend that Nihon Housing's shareholders apply for the TOB. Through the MBO, the company aims to strengthen the foundations of its existing businesses and enhance its corporate value in the medium to long term. | 336 |

| April 2024 | Sasaeah Holdings | Healthcare | Virbac | France | Healthcare | ORIX Corporation announced that it had signed an agreement to transfer all shares of Sasaeah Holdings, its animal pharmaceutical subsidiary, to France-based Virbac. Virbac will take a leading position in the industrial animal vaccine market in Japan, particularly in the cattle sector and achieve a broad portfolio in the veterinary medicine market covering all major animal species. | 304 |

| October 2023 | Qualicaps | Healthcare | Roquette Frères | France | Healthcare | The Mitsubishi Chemical Group has reached an agreement with Roquette Frères SA, a French manufacturer of healthcare-related products, to transfer all shares of Qualicaps, its wholly owned subsidiary that manufactures pharmaceutical capsules, and has signed a share transfer agreement. In 2013, the Mitsubishi Chemical Group acquired Qualicaps to strengthen its pharmaceutical-related business. | 302 |

| June 2023 | KOKUSAI ELECTRIC | Manufacturing Industry |

Qatar Holding (Government of Qatar) |

Qatar | Finance | Qatar Investment Authority, a Qatar's sovereign wealth fund, announced that it had acquired shares of KOKUSAI ELECTRIC through its subsidiary Qatar Holding LLC. With this acquisition, Qatar Holding LLC became a minority shareholder with a 4.9% stake in the company. KOKUSAI was established by U.S. investment fund KKR when it acquired Hitachi Kokusai Electric in 2018 and spun off its semiconductor equipment division. The company relisted in October 2023 and aims to increase its corporate value as a manufacturer specialized in semiconductor manufacturing equipment. | 298 |

| October 2023 | Moritex | High Technology | Cognex | U.S. | Manufacturing Industry | Cognex Corporation, a leading U.S. industrial machine vision company, has acquired Moritex Corporation, a leading provider of optical components for machine vision applications, for approx. 40 billion yen from a fund affiliated with Trustar Capital, the private equity arm of CITIC Capital Holdings (Hong Kong), a subsidiary of Citic Group Corporation in China (CITIC). Machine vision is a technology that processes images captured by cameras and operates equipment based on the processing results. It provides industrial equipment with human vision and the ability to make discriminations with that. | 273 |

| September 2023 | Real estate portfolio 25 assets | Real Estate | City Developments | Singapore | Real Estate | City Developments, a Singapore-based global real estate company, acquired 25 rental condominium properties in Tokyo (total of 836 units) from BentallGreenOak, a group of companies operating real estate private equity funds under Sun Life Financial, a major Canadian life insurance company group. The total acquisition amount was 35 billion yen. All of the properties are conveniently located within 10 minutes from the nearest station, and the investment was made in anticipation of strong demand for rental housing in the 23 wards of Tokyo. | 234 |

| June 2023 | Impact Holdings | Media |

BCJ-70 (Bain Capital) |

U.S. | Finance | BCJ-70, led by a U.S. investment fund, Bain Capital, has implemented an MBO of Impact Holdings, which is primarily engaged in in-store marketing business for the distribution and retail industries, through a TOB. Impact Holdings had published Notice Regarding Implementation of MBO and Recommendation to Tender. In particular, it was determined that it would be beneficial to utilize external management resources to address management challenges such as the risk of losing demand due to intensifying competition in the data marketing field, which has significant room for growth. | 210 |

| June 2023 | Iwasaki Electric | Manufacturing Industry |

Cosmo Holdings (Carlyle) |

U.S. | Finance | Cosmo Holdings, established by a fund owned by Carlyle, a U.S. investment fund, conducted TOB of Iwasaki Electric as part of an MBO. Iwasaki Electric published Notice Regarding Implementation of MBO and Recommendation to Tender regarding this TOB, and the TOB was successful. The domestic LED lighting market, which is the company's main product, has been shrinking and its growth is slowing. In order to address management issues in a flexible manner, the company decided that it needed to go private. | 207 |

| April 2024 | T&K TOKA | Chemicals |

BCJ-74 (Bain Capital) |

U.S. | Finance | BCJ-74, led by U.S. investment fund Bain Capital, conducted TOB of T&K TOKA, which manufactures and sells various printing inks and synthetic resins for printing, paints, and adhesives, as part of an MBO. For this TOB, T&K TOKA published Notice Regarding Implementation of MBO and Recommendation to Tender, and the TOB was successful. The business environment is becoming increasingly challenging due to the continuing decline in demand for paper-based printed materials as a result of the progress of digitization, and the company intends to carry out fundamental management reforms by taking the company private. | 205 |

-

Note1:

Major transactions are listed. The nationality of an acquisition company is based on the location of its ultimate parent company.

-

Note2:

If the tender offeror is an SPC (special purpose company), etc., the substantive acquiring entity is also listed.

-

Note3:

In order of investment amount based on company announcements or media reports

-

Source:

Based on "Workspace" by Refinitiv

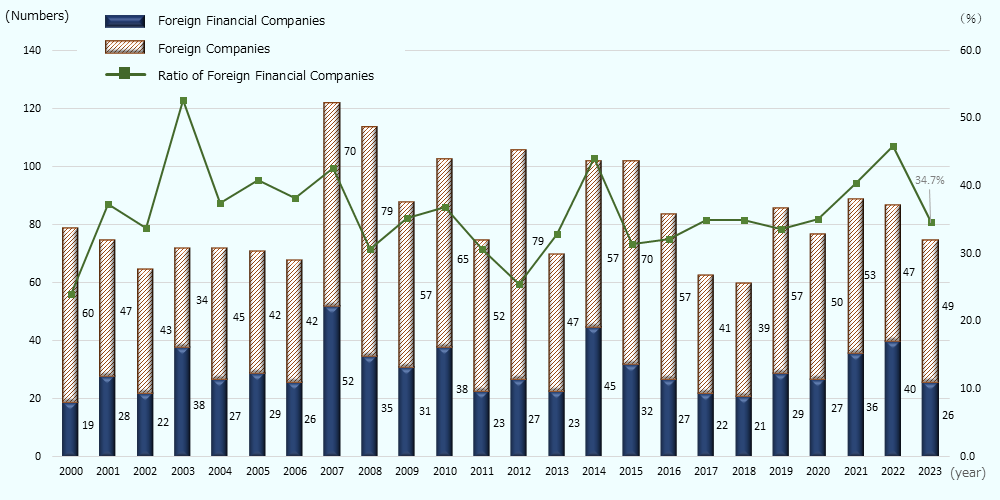

Column: Diversification of buyers and methods over M&A transactions in Japan

The number of M&A transactions (OUT-IN) in Japan by foreign capital since 2000 has been around 80 in recent years, although there is some variation from year to year*1. M&A transactions by foreign capital have been greatly influenced by the global and Japanese economic and social environment at the time. The line in the chart shows the percentage of the foreign financial institutions on the acquiring side in the total number of cross-border M&A transactions made in Japan. Due to the impact of the Lehman's collapse in 2008 and other factors, the number of cross-border M&A transactions by foreign investors in Japan also declined in the following some years. The significant increase in the number of transactions in 2014 might be triggered in part by a sense of undervaluation of transaction prices due to the falling Japanese yen against the U.S. dollar, as well as by the formulation of the Corporate Governance Code and Stewardship Code at this time, which improved the investment environment in Japan with an awareness of global standards. The most recent decline in 2023 is thought to be due to global supply chain disruptions and other factors that have restrained M&A investment in Japan.

Until now, foreign investment funds have often been associated with Western investment funds such as Carlyle, Bain, Goldman Sachs, and CVC Capital. Recently, however, Mubadala Investment, a sovereign wealth fund of the United Arab Emirates (UAE), Qatar Investment Authority, a sovereign wealth fund of Qatar, both in the Middle East, and GIC, a sovereign wealth fund of Singapore, have assessed that Japan has a comparative advantage in terms of its supply chain resilience against geopolitical risks and that the investment environment is also well-developed *2. In addition, they are showing a positive attitude toward investment in Japan, taking advantage of the current economic environment of a weak yen.

Against this backdrop, traditional investment funds have been devising cross-border M&A transaction methods in Japan with schemes that take into account the needs of the acquiree (e.g., promoting carve-out M&A or providing MBO fund)*3.

The government's promotion of corporate governance reform and the Tokyo Stock Exchange's announcement of Action to Implement Management that is Conscious of Cost of Capital and Stock Price (March 2024), among other factors, have led companies to formulate effective management strategies and improve profitability over the medium to long term. The use of inbound M&A in Japan may attract even more attention as an option for Japanese companies to solve management issues and accelerate growth.

-

*1.

The breakdown of the number of M&A transactions consists of "acquisition of majority interest" and "acquisition of residual interest," and does not include "acquisition of minority interest." Note that in "Figure 2-17: Changes in the number of inbound M&As in Japan" in Chapter 2, Section 5 of this report, the number includes "acquisition of minority interest."

-

*2.

In the above chart, the cumulative number of cases since 2015 in which the final parent company of the acquiring company is located in the Middle East (UAE, Qatar, Saudi Arabia, and Kuwait) is 13, while the number of cases in Singapore is 112.

-

*3.

"Case Studies relating to the use of inbound M&A transactions" (April 2023) by Ministry of Economy, Trade and Industry

For carve-outs, see Pattern A: Explanation/Characteristics (Sale of subsidiary/transfer of business (carve-out)), PP.16-29.

For MBO, see Pattern C: Explanation/Characteristics (Sale of owner-operated company, acceptance of capital (e.g., business succession etc.)), PP.42-53. -

Source:

Based on "Workspace" (as of September 20, 2024) by Refinitiv

JETRO Invest Japan Report 2024

-

Section1.

-

Section2.

-

Section3.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

[Column]

-

[Column]

-

Section5.

-

[Column]

-

Section6.

-

[Column]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

Laws and Regulations on Setting Up Business in Japan Pamphlet

The pamphlet "Laws & Regulations" is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan. It is available in 8 languages (Japanese, English, German, French, Chinese (Simplified), Chinese (Traditional), Korean and Vietnamese).

You can download via the "Request Form" button below.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices