JETRO Invest Japan Report 2024

Chapter2. Trends in Inward FDI to Japan Section6: Assessment of Business Environment in Japan by Global Companies

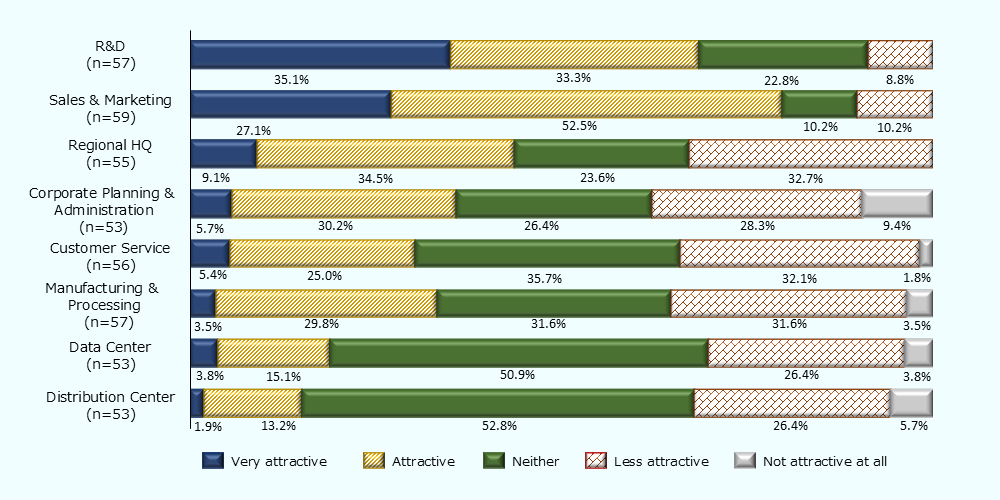

Business in Japan highly rated as "R&D" base and "Sales and Marketing" base

In this section, we look at the assessment of Japan's business environment from the perspective of global companies outside Japan, based on the survey results on the impact of structural changes in global value chains (GVCs) , which implemented to 62 companies, mentioned in Chapter 1, Section 3.

In terms of the attractiveness of setting bases in Japan by business function, global companies tend to rate "R&D" base and "sales and marketing" base particularly highly. As an R&D base, about 35% of the companies surveyed responded that Japan is "very attractive", and about 33% responded it is "attractive". Also, as a sales and marketing base, about 27% responded that Japan is "very attractive", and about 53% responded that it is "attractive".

-

Note 1:

The sum does not necessarily equal 100% due to rounding to one decimal place.

-

Note 2:

"n" is the number of companies that assessed for each business function. "n" does not equal 62 because some companies left the field blank. Companies that selected at least one option were considered valid.

-

Source:

Results of JETRO's survey on the impact of structural changes in global value chains (GVCs)

Column: Japan as a highly regarded R&D center

In the 2020s, Japan is being re-evaluated as an investment destination due to increased awareness of geopolitical risks and economic security in the wake of the COVID-19 pandemic and Russia's invasion of Ukraine. In particular, with the focus on research and development (R&D) and the establishment of new facilities, foreign-affiliated companies are becoming more active in conducting joint research with nearby universities and research institutions.

The Japanese subsidiary of the Bosch Group, a German precision equipment manufacturer, announced in February 2022 that it will make a large-scale investment to build a new R&D facility in Yokohama and relocate its headquarters functions there. The new R&D facility will introduce cutting-edge testing equipment and other features to strengthen R&D capabilities in order to keep up with trends in automotive development. The new headquarters began operations in May 2024, and in September 2024, the company held an event to celebrate the completion of the Tsuzuki Ward Cultural Center (nicknamed "Bosch Hall") , the company's first public-private partnership project, and other facilities. The company aims to contribute to regional revitalization by integrating its sites with local facilities. Through this initiative, the company consolidated its eight sites across Japan and moved approximately 2,000 people there, and it will strengthen its cross-divisional development structure and promote the shaping of the future of mobility with the new R&D center as its core.

As for the semiconductor industry, which has been attracting attention in recent years, a major semiconductor manufacturer Samsung Electronics Co., Ltd. announced in December 2023 to establish a new cutting-edge R&D center for next-generation semiconductor packaging technology in Yokohama. The press release from Yokohama City quoted the CEO of Samsung Electronics praising the investment environment in Japan, saying "Yokohama is one of the best places to work with industry, universities and research institutes since it has a large number of packaging-related companies, as well as excellent universities and human resources."

In June 2022, TSMC, a major Taiwanese semiconductor contract manufacturer, opened the "TSMC Japan 3DIC R&D Center" in the "Tsukuba Center of the National Institute of Advanced Industrial Science and Technology (AIST)" in Tsukuba City, Ibaraki Prefecture. It is said to be TSMC's first overseas R&D center with clean room facilities.

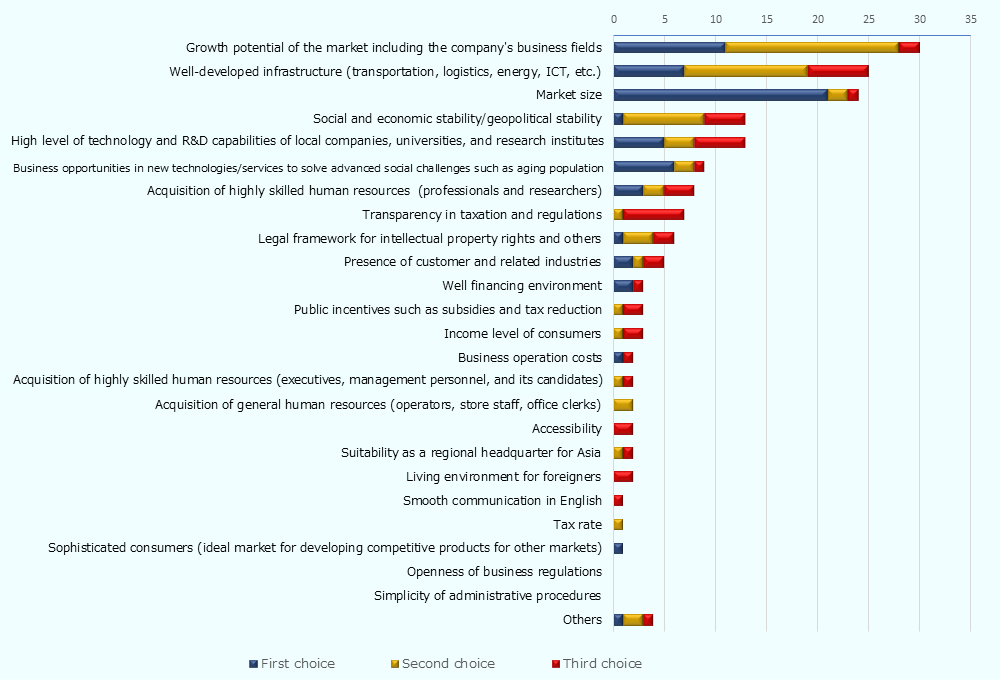

Strengths of the Japanese business environment is "growth potential of the market including the company's business fields," "well-developed infrastructure," and "market size"

Regarding the strengths of Japan‘s business environment compared to other countries, the most frequently selected by surveyed companies were "growth potential of the market including the company's business fields," "well-developed infrastructure," and "market size." Looking at the breakdown, when asked to select up to three of the top choices, about 30% of the companies (21 out of 62 respondent companies) chose "market size" as their first choice.

-

Note1:

:Companies that selected at least one option were considered valid.

-

Note2:

Because of the format of selecting up to three choices, the numbers of responses after the second choice may not be equal.

-

Source:

Results of JETRO's survey on the impact of structural changes in global value chains (GVCs)

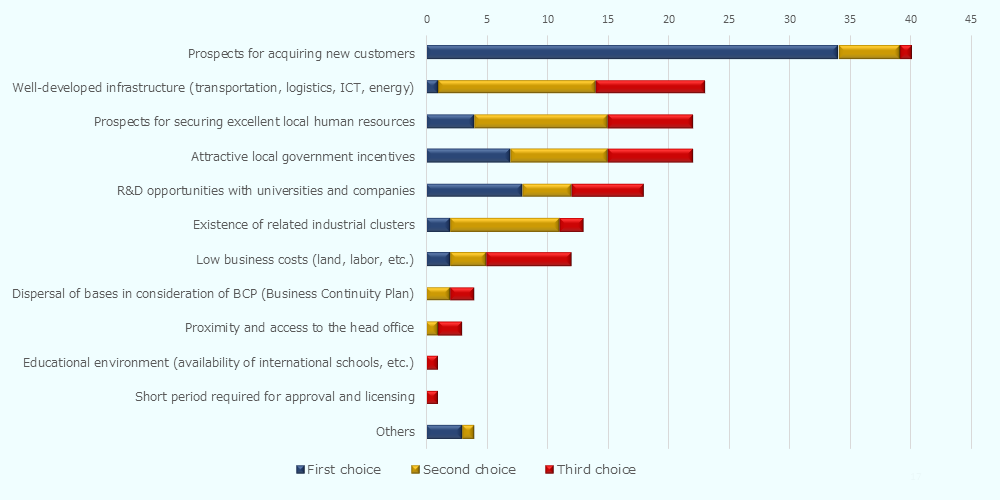

Global companies place the greatest importance on the "prospects for acquiring new customers" when expanding their operations in Japan

According to the survey, the most important factor for global companies when expanding into Japan or strengthening existing bases was the "prospects for acquiring new customers" (selected by 40 of the 61 respondent companies). It was followed by "well-developed infrastructure" (23 companies) in terms of the total number in the selection, but when focusing on the first choice instead of the total number in the selection, it is clear that a certain number of companies place importance on the "R&D opportunities with universities and companies" and "attractive local government incentives."

-

Note1:

Companies that selected at least one option were considered valid.

-

Note2:

Because of the format of selecting up to three choices, the number of responses after the second choice may not be equal.

-

Note3:

n=61 because one company did not respond.

-

Source:

Results of JETRO's survey on the impact of structural changes in global value chains (GVCs)

| Important Factors as Selection Criteria When Deciding to Locate | Free Comment |

|---|---|

| Prospects for acquiring new customers |

|

| Well-developed infrastructure (Transportation, logistics, ICT, energy) |

|

| Prospects for securing excellent local human resources |

|

| Attractive local government incentives |

|

| R&D opportunities with universities and companies |

|

| Existence of related industrial clusters |

|

| Low business costs (land, labor, etc.) |

|

| Others |

|

-

Source:

Results of JETRO's survey on the impact of structural changes in global value chains (GVCs)

JETRO Invest Japan Report 2024

-

Section1.

-

Section2.

-

Section3.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

[Column]

-

[Column]

-

Section5.

-

[Column]

-

Section6.

-

[Column]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

Laws and Regulations on Setting Up Business in Japan Pamphlet

The pamphlet "Laws & Regulations" is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan. It is available in 8 languages (Japanese, English, German, French, Chinese (Simplified), Chinese (Traditional), Korean and Vietnamese).

You can download via the "Request Form" button below.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices