JETRO Invest Japan Report 2023

Chapter3. Recent Government Measures Section10. Startup Development Five-year Plan

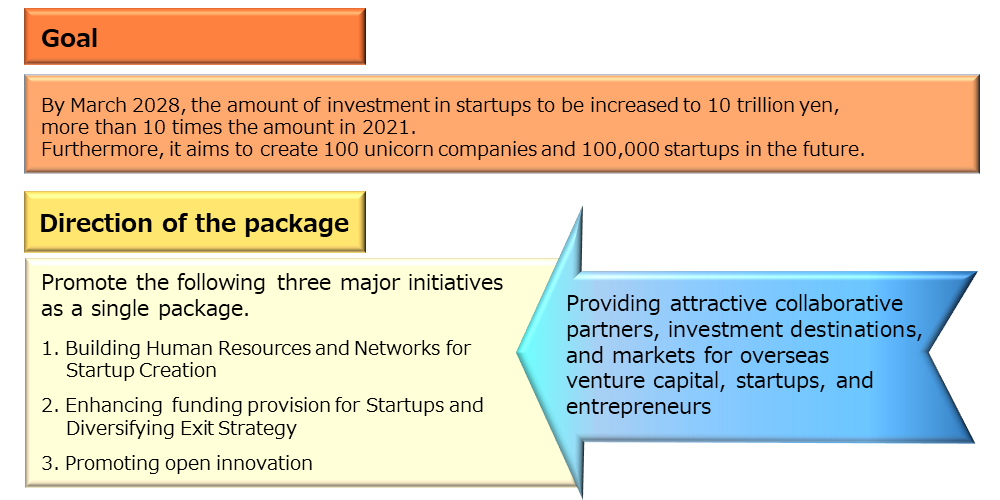

The Japanese government announced the Startup Development Five-year Plan in November 2022. The plan aims to create an ecosystem that nurtures startups in Japan by accelerating the launch of startups and promoting open innovation among large established companies.

(1) Building Human Resources and Networks for Startup Creation

-

Expansion and horizontal development of support projects by mentors

Top runners from industry and academia will act as mentors to identify talented individuals and provide guidance on projects, with the aim of expanding the number of students from 70 per year (in 2022) to 500 per year by March 2028. -

"One University One Exit" movement

Encouraging university startups, it aims to launch 50 startups from one research university and finally achieve one successful exit. -

Support for the creation of startups at universities, elementary, junior high, and high school students

The Government will support more than 5,000 commercialization cases of university-originated research results over 5 years, mainly in startup ecosystem cities, with the participation of overseas accelerators and venture capitals. To support this, a new fund of 100 billion yen for five years will be created. -

Global Startup Campus Concept

By attracting top overseas universities and inviting outstanding researchers, "Global Startup Campus", that combines international joint research and incubation functions in deep tech fields will be created through public and private funds. Through the collaboration with domestic and overseas companies, domestic companies will improve the ability to create innovations. -

Promotion of attraction of overseas entrepreneurs and investors

The startup visas (Projects for Encouraging Foreign Entrepreneurs to Start Business) will be expanded. The visa verification has been limited to the government-approved municipalities, but this will be expanded to include government-approved private organizations such as venture capital firms and accelerators, and the maximum period of stay will be extended. In addition, the grant of status of residence will be facilitated so that overseas investors can be active in Japan. Also, procedures for opening bank accounts will be facilitated

(2) Enhancing Funding provision for Startups and Diversifying Exit Strategies

-

Reinforcement of SMRJ(Organization for Small & Medium Enterprises and Regional Innovation, JAPAN) to invest in venture capitals

Strengthen the investment function with 20 billion yen with a view to limited liability investment in domestic and overseas venture capital. Support for the development of domestic venture capital, exploring possibility of the introduction of an investment quota limited to venture capital managed by young capitalists, and reviewing the maximum amount of the debt guarantee system for deep tech startups -

Reinforcement of the investment function of JIC(Japan Investment Corporation)

Launch a new fund that will almost double the size of the previous investment (120 billion yen over the past four years starting in 2022). -

Reinforcement of support measures for R&D startups by NEDO

Establish a new fund of 100 billion yen (20 billion yen per year) for five years, which is three times the size of the fund in 2022. Expand the subsidy ceiling, scope of support menus, etc. -

Improvement of environment to attract overseas investors and venture capital firms

Promote the introduction of fair value valuation (mark-to-market) for unlisted shares held by the funds instead of valuation at acquisition cost. Eliminate the upper limit on overseas investment ratio of Limited Partnerships for Investment (LPS).

(3) Promoting open innovation

-

Tax measures to promote open innovation

Open innovation taxation will be applied to acquisition of existing issued shares, limited to those that contribute to the growth of startups. Promote M&As as an exit strategy, which lead startups to achieve significant growth under the umbrella of operating companies. In addition, preferential measures for R&D taxation in case of collaboration with startups will be expanded. -

Study for the further acceleration of organizational restructure

In order to encourage large enterprises to realize the potential of their business resources (human resources, technology, etc.), tax exemption is to be introduced in case where a company retains a part of its equity in a spin-off company. -

Expansion of voluntary application of International Financial Reporting Standards (IFRS) to facilitate M&A

Promote voluntary application of IFRS, that does not amortize goodwill.

Source: Prepared from materials published by the Cabinet Secretariat

JETRO Invest Japan Report 2023

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

[Column 1]

-

[Column 2]

-

[Column 3]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

Section7.

-

Section8.

-

Section9.

-

Section10.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices