JETRO Invest Japan Report 2023

Chapter2. Trends in Inward FDI in JapanSection 5.Trends in Inbound M&A in Japan

1. Number of M&A Deals : Top 5 Countries and Regions

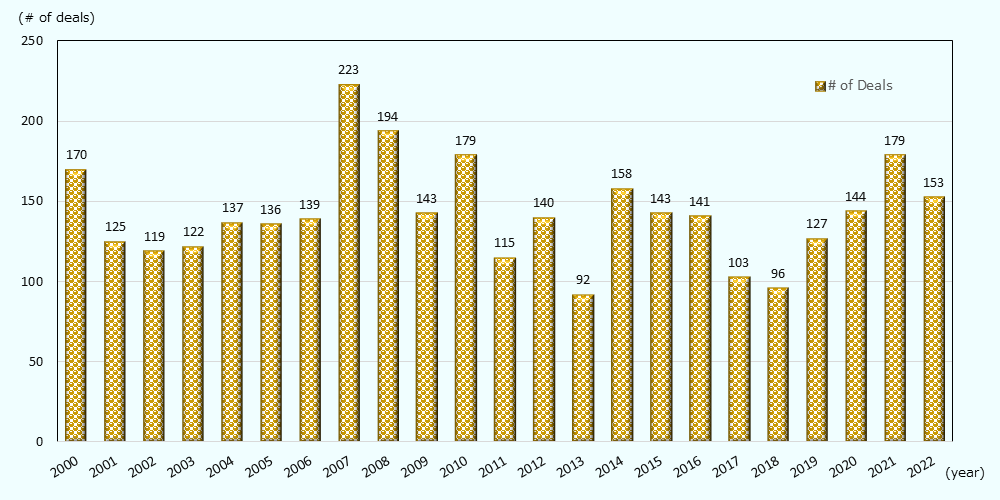

In 2022, the number of cross-border M&A deals in Japan (hereafter, inbound M&A deals) was 153 (on a completion date basis), down 14.5% from the previous year (Chart 2-15). The number of inbound M&A deals increased by double digits for three consecutive years from 2019 to 2021, but turned downward in 2022.

Looking at the number of inbound M&A deals in 2022 by investor country and region, the U.S. was the largest with 52 deals (34.0% of the total), followed by Hong Kong (19 deals, 12.4% of the total) and China (16 deals, 10.5% of the total). Singapore, which ranked second with 20 deals in 2021, had 8 deals (60.0% decrease year-on-year) (Chart 2-16).

Source: "Workspace"(Refinitiv)(as of Oct. 20, 2023)

| Ranking | Country/ Region | # of Projects |

# of Projects Growth rate(YoY) |

# of Projects Share |

|---|---|---|---|---|

| 1 | United States | 52 | -11.9 | 34.0 |

| 2 | Hong Kong | 19 | 137.5 | 12.4 |

| 3 | China | 16 | 0.0 | 10.5 |

| 4 | South Korea | 13 | -35.0 | 8.5 |

| 5 | Singapore | 8 | -60.0 | 5.2 |

| — | Total | 153 | -14.5 | 100.0 |

2. Major Inbound M&A Deals in Japan from January 2022 to June 2023

Major inbound M&A deals in the above period include the tender offer for Hitachi Transport System by HTSK (a special purpose company of the U.S. investment fund KKR), tender offer for Hitachi Metals by BCJ-52 (a special purpose company led by U.S. investment fund Bain Capital), tender offer for NIPPO Co. by Roadmap Holdings (a special purpose company established by Goldman Sachs and ENEOS) (Chart 2-17).

| Completion | Target Company | Target Company :Sector | Acquiring Company | Acquiring Company: Country / Region | Acquiring Company:Sector | Outline | Value (Million US$) |

|---|---|---|---|---|---|---|---|

| February 2023 | Hitachi Transport System | Transportation, logistics, and infrastructure | HTSK(KKR) | U.S. | Other finance | U.S. investment firm KKR acquired Hitachi Transport System for about 670 billion yen through a special-purpose company HTSK and others (March 2023). Hitachi Transport System changed its name to LOGISTEED. (April 1, 2023) and formed a strategic partnership with Hitachi, formerly the parent company of Hitachi Transport System, to promote the bulk logistics contracting business. | 5,985 |

| December 2022 | Hitachi Metals | Metals and mining | BCJ-52(Bain Capital) | U.S. | Other finance | BCJ-52, led by investment fund Bain Capital, purchased Hitachi Metals' shares. The company is no longer Hitachi's consolidated subsidiary, and aims to strengthen its competitiveness and recover profitability under Bain Capital and others. | 4,000 |

| April 2023 | Evident | Health/medical equipment and materials | BCJ-66(Bain Capital) | U.S. | Other finance | Olympus transferred all shares of its wholly owned subsidiary Evident, which is involved in the scientific business such as biological microscopes and industrial endoscopes, to a BCJ-66 led by investment fund Bain Capital. Evident will take over the scientific business, which has different business characteristics from the medical field, and the two companies each will establish a management structure suited to their respective characteristics. | 3,110 |

| April 2022 | Mitsubishi-UBS Realty | Asset management and investment advisory | 76(KKR) | U.S. | Asset Management and investment advisory | In March 2022, U.S. investment firm KKR agreed to acquire, through its subsidiary, all outstanding shares of Mitsubishi-UBS Realty, held by Mitsubishi and UBS Asset Management for 230 billion yen. Mitsubishi-UBS Realty is a real estate management company with assets under management of approximately 1.7 trillion yen (US$15 billion). | 1,937 |

| March 2022 | NIPPO | Transportation, logistics and infrastructure |

Roadmap Holdings (Goldman Sachs, ENEOS) |

U.S. | Other finance | A tender offer by Roadmap Holdings, a special-purpose company formed by Goldman Sachs Group and ENEOS, NIPPO's parent company. ENEOS has been reviewing the ideal form of NIPPO, a listed subsidiary, from the perspective of improving the corporate value of the entire group and capital efficiency, and has decided to dissolve the parent-subsidiary listing and aim to optimize NIPPO management. | 1,865 |

| March 2023 | Prince Hotel | Real estate | Reco Pine | Singapore | Other finance | As part of efforts to strengthen the financial and business structure of the Seibu Holdings Group, Prince Hotel, a consolidated company of the Group, transferred 26 assets including hotels it owns, to Singaporean corporation Reco Pine. The transfer price of the asset is 123.7 billion yen. | 906 |

| August 2022 | Toshiba Carrier | Machinery | Global Comfort Solutions | U.S. | Other finance | U.S. air-conditioning equipment manufacturer Carrier acquired, through its subsidiary, Toshiba's 55% stake in Toshiba Carrier, a joint venture with Toshiba, which is also in the air-conditioning business, for approximately 100 billion yen. Toshiba's shareholding ratio became 5%. | 901 |

| September 2022 | Huis Ten Bosch | Leisure and entertainment | PAG HTB Holdings | Hong Kong | Other finance | PAG, one of the largest asset-management companies in Asia, acquired all shares of Huis Ten Bosch owned by HIS for 66.66 billion yen, and it also acquired shares held by Kyushu Electric Power and others, making Huis Ten Bosch a wholly owned subsidiary of PAG. The total purchase price is about 100 billion yen. | 481 |

| January 2023 | KITO | Machinery |

Lifting Holdings BidCo (KKR) |

U.S. | Professional services | A tender offer by a company established by U.S. investment firm KKR and others. It enhances corporate value through synergies from the management integration of KITO, a leading manufacturer of material handling equipment (hoists and cranes), and Crosby Group (U.S.), a leading provider of lifting and rigging solutions. The planned purchase price based on the data of announcement is 56.5 billion yen. | 479 |

| August 2022 | Trend Micro | Software & Internet services | Valueact Capital Partners | U.S. | Alternative financial investment | U.S. investment firm Valueact Capital invested about 83.4 billion yen to acquire a stake in Trend Micro, taking its ownership to 8.73%. One of its objectives is to provide advice to the management team. | 431 |

| February 2022 | SNK | Software | Electronic Gaming Development | Saudi Arabia | Other finance | MiSK Foundation, a Saudi youth development support organization established by Saudi Arabia's Deputy Crown Prince Mohammed bin Salman, acquired Japanese game developer SNK, through its subsidiary, for about 51.2 billion yen, raising its stake from 33.3% to 96.18%. It aims to strengthen the entertainment sector. | 415 |

| March 2022 | Blackstone's property portfolios | Housing | M&G Asia Property Fund | U.K. | Other finance | It acquired 30 residential properties or 1,575 units in Tokyo, Osaka, and Nagoya for 49.2 billion yen. | 415 |

| March 2022 | SENQCIA | Machinery | Lone Star Funds | U.S. | Alternative financial investment | U.S. investment firm Carlyle transferred all of its shares in building materials manufacturer SENQCIA to Loan Star Funds, another U.S. investment fund. | 411 |

| December 2022 | ALBERT | IT consulting | Accenture | Ireland | Professional services | Consulting firm Accenture acquired ALBERT, a big data analytics company, and made it a wholly owned subsidiary, strengthening services utilizing data and artificial intelligence (AI). | 272 |

JETRO Invest Japan Report 2023

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

[Column 1]

-

[Column 2]

-

[Column 3]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

Section7.

-

Section8.

-

Section9.

-

Section10.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices