JETRO Invest Japan Report 2023

Chapter2. Trends in Inward FDI in Japan Section 4. Trends in Greenfield Investment in Japan

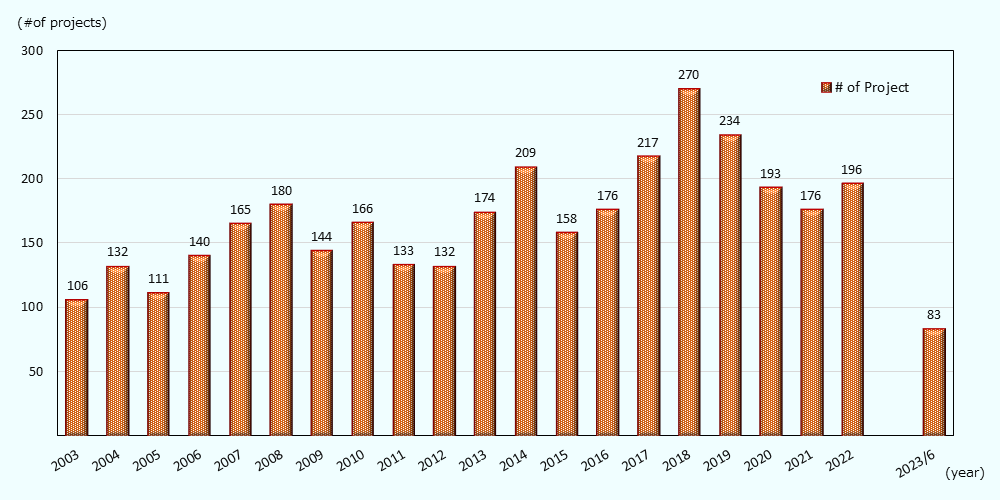

1. Number of projects

The number of greenfield investments in Japan in 2022 (based on date of publication) increased 11.4% from the previous year to 196, the first increase in four years.

Through the second quarter of 2023, the number of cases is 83, maintaining the same pace as in the previous year (Chart 2-11).

Source: "fDi Markets"(Financial Times)(as of Oct. 20, 2023)

2. Top 5 Countries and Regions / Top 5 Sectors

Looking at greenfield investments in Japan in 2022 by investor country/region, the U.S. was the largest with 57 investments, up 5.6% from the previous year. France, which was the second largest, saw a significant increase in the number of investments with 17 cases, up 240.0% compared to five cases in the previous year. The U.K., the third largest, maintained the same ranking as the previous year, despite an 11.1% decrease year-on-year. Germany, on the other hand, had 11 cases, down 45.0% from the previous year (Chart 2-12).

By sector, Software & IT services accounted for the largest number of cases at 70, up 32.1% year-on-year. This was followed by business services with 30 cases, up 76.5% year-on-year, and these sectors accounted for the majority of the total. In addition, the number of cases for communication was 14, down 30.0% year-on-year (Chart 2-13).

| Ranking | Country/ Region | # of Projects | Growth rate(YoY) | Share |

|---|---|---|---|---|

| 1 | United States | 57 | 5.6 | 29.1 |

| 2 | France | 17 | 240.0 | 8.7 |

| 3 | United Kingdom | 16 | -11.1 | 8.2 |

| 4 | Germany | 11 | -45.0 | 5.6 |

| 5 | Singapore | 10 | -23.1 | 5.1 |

| 5 | Australia | 10 | 150.0 | 5.1 |

| — | Total | 196 | 11.4 | 100.0 |

| Ranking | Country/ Region | # of Projects | Growth rate(YoY) | Share |

|---|---|---|---|---|

| 1 | Software & IT services | 70 | 32.1 | 35.7 |

| 2 | Business services | 30 | 76.5 | 15.3 |

| 3 | Financial services | 14 | 40.0 | 7.1 |

| 4 | Communications | 14 | -30.0 | 7.1 |

| 5 | Industrial equipment | 13 | 0.0 | 6.6 |

| — | Total | 196 | 11.4 | 100.0 |

3. Major Greenfield Investment Projects from January 2022 to June 2023

Looking at greenfield investment projects in Japan during the above period, there were cases such as an investment by U.S. semiconductor manufacturer Micron to upgrade production facilities and an investment in a fulfillment center (logistics base) by Amazon Japan, a subsidiary of U.S. Amazon. By sector, investment projects in the renewable energy field continued to show a presence (Chart 2-14).

| Company | Country/Region | Sector | Destination (Prefecture) | Outline | Date (Based on announcement/ press release) |

|---|---|---|---|---|---|

| Micron Technology | U.S. | Semiconductors | Hiroshima | Micron Technology, a leading U.S. semiconductor memory company announced plans to invest up to 500 billion yen over the next several years in1γ (gamma) generation technology at its Hiroshima Plant (Higashi-Hiroshima City, Hiroshima Prefecture) . | May 2023 |

| Octopus Energy Group | U.K. |

Renewable energy |

Tokyo, Others |

Octopus Energy is developing its renewable energy business in partnership with Tokyo Gas and currently has approximately 200,000 retail customers. In addition to a £600 million investment in solar and wind power, the company also announced plans to invest another £300 million to advance technological innovation and position Tokyo as a retail hub. | May 2023 |

| Fidelity Investments | U.S. | Real estate | Chiba | Fidelity Investments announced that its subsidiary, Colt Data Centre Services, a global provider of hyperscale data center solutions for large enterprises, has begun construction of its fourth major data center in Inzai City, Chiba Prefecture, in a joint venture with Mitsui & Co. | April 2023 |

| Amazon Japan | U.S. | Consumer goods | Hyogo | In March 2022, it announced the opening of the Amazon Amagasaki Fulfillment Center (FC) in Amagasaki City, Hyogo Prefecture. It is the largest FC of the company in western Japan, expecting to create more than 2,000 jobs in Amagasaki and surrounding areas. | March 2022 |

| Total Energies | France |

Renewable energy |

Tokyo | The French leading energy company established a joint venture with ENEOS (50% stake each) in June 2022, which will implement a project to support self-consumption of solar power generation for corporations in Japan, India, Thailand, Viet Nam, and other Asian countries. In Japan, the company proposes introduction of solar power generation facilities, and implements the management of the facilities, aiming to develop more than 300MW of power generation capacity over the next five years. | April 2022 |

| Mitsubishi Estate・Simon | U.S. | Real estate | Saitama | The company, a joint venture of the U.S. real estate developer Simon Property Group and Mitsubishi Estate, developed an outlet mall in Fukaya City, Saitama Prefecture, opening in October 2022. | October 2022 |

| GLP | Singapore |

Renewable Energy |

Tokyo and the Kansai region | In February 2022, the Japanese subsidiary of Singapore-based logistics facility developer GLP announced its full-scale entry into the data-center business. In the Tokyo metropolitan area and the Kansai region, the company acquired suitable land totaling approximately 600MW, with construction starting sequentially in 2023 and completing sequentially in 2024. The company plans to invest 1 trillion yen or more in the future, aiming for supply capacity of 900 MW by around 2027-2028 at the latest. | February 2022 |

| U.S. | Communications | Chiba | In October 2022, the company announced a plan to invest a total of 100 billion yen in Japan's network infrastructure through 2024, and said that the initiative was launched in 2021, and it would open Google's first data center in Japan in Inzai City, Chiba Prefecture. The opening ceremony was held in April 2023. | October 2022 | |

| Advanced Nano Products | Korea | Electronic components | Aichi | The Korean EV battery material manufacturer established a Japanese subsidiary in July. Its production is implemented in Tahara-cho, Aichi Prefecture. | July 2022 |

| Pattern Energy Group | U.S. |

Renewable energy |

Hokkaido | In September 2022, Green Power Investment (GPI), a Japanese subsidiary of Pattern Energy, an American renewable energy equipment developer, announced the conclusion of a financing contract for its constructing Ishikari Bay offshore wind power generation project with a capacity of 112MW, accelerating the construction. Subsequently, in May 2023, NTT Anode Energy and JERA announced that they would acquire GPI by the end of 2023. | September 2022 |

| Copenhagen Infrastructure Partners | Denmark |

Renewable energy |

Aomori | The Danish green energy investment company announced in July 2022 that it had established a joint venture with Tokyu Land for offshore wind power generation project in the Sea of Japan off the coast of Aomori Prefecture (the south side). | July 2022 |

| Gestamp Hot Stamping Japan | Spain | Transportation equipment | Mie | In May 2022, Gestamp Hot Stamping Japan, a Japanese subsidiary of a Spanish automotive stamping components manufacturer, announced the expansion of its new plant building to meet growing demand for components, with operations scheduled to commence in June 2023. | May 2022 |

| Equinix | U.S. | Communications | Tokyo | In November 2022, the U.S. data center company announced the establishment of a new data center, its 15th location in Tokyo. The initial investment is 115 million dollars, and the opening is scheduled to be in the second half of 2024. | November 2022 |

JETRO Invest Japan Report 2023

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

[Column 1]

-

[Column 2]

-

[Column 3]

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

Section7.

-

Section8.

-

Section9.

-

Section10.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices