JETRO Invest Japan Report 2022

Chapter1. FDI Trends in the World and Japan Section2. Trends in Inward FDI to Japan

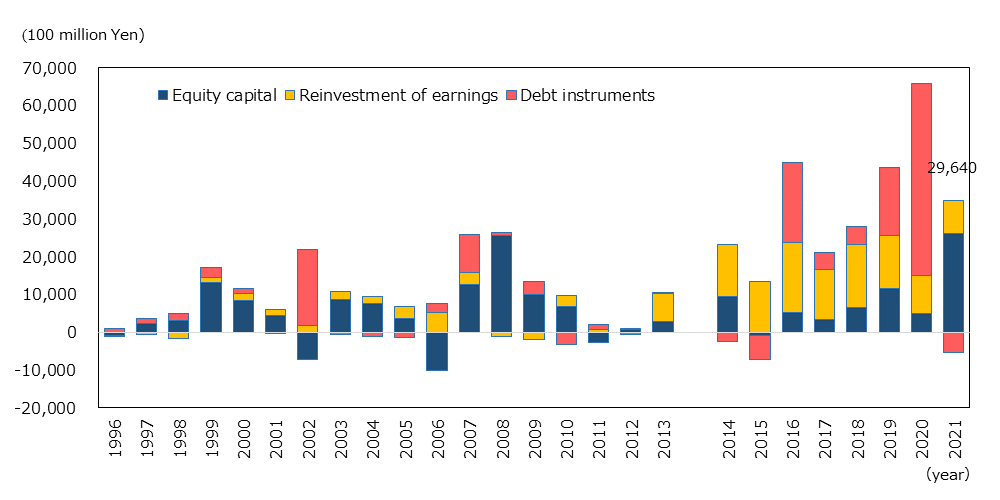

1. Flow

On the other hand, according to the "Balance of Payments" (asset and liability principle) of the Ministry of Finance and Bank of Japan, FDI flow to Japan in 2021 decreased significantly by 55.0% year-on-year to 3.0 trillion yen (Chart 1-2). Looking at this by type of capital, equity capital increased 425.0% year-on-year to 2.6 trillion yen, reinvestment of earnings fell 14.3% to 0.9 trillion yen, while debt instruments, which represent the lending and borrowing of funds between enterprises in capital ties, turned negative at -0.5 billion yen from 5.1 trillion yen in the previous year. Equity capital, which represents the trend of new investments and capital increases in Japan, increased significantly and reached a record high, a turnaround from 2020, when the economy and society were affected by the global COVID-19 crisis.

Note: The figures before 2013 are calculated based upon a different principle.

Source: “Balance of Payments” (Bank of Japan (BoJ); Ministry of Finance (MoF))

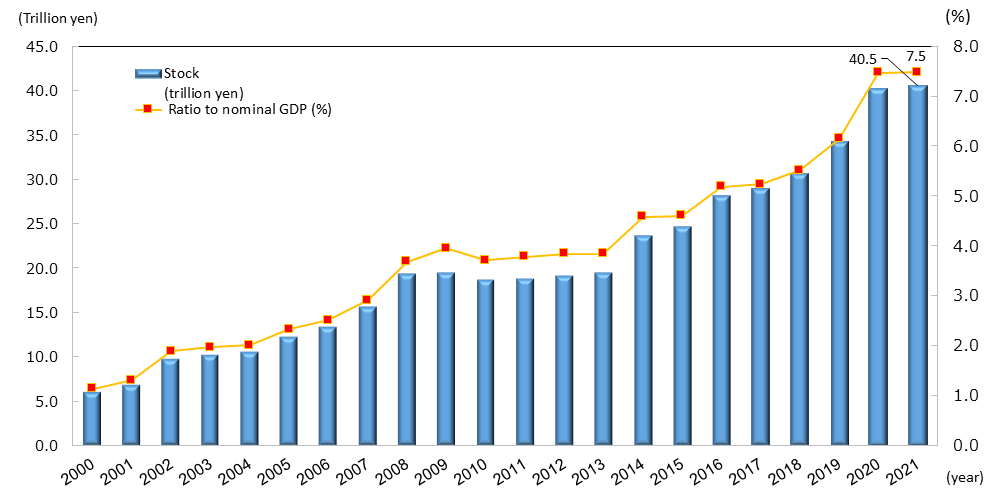

2. Stock

At the end of 2021, the FDI stock in Japan (asset liability principle) was 40.5 trillion yen, remaining at the highest level, albeit with only a slight increase of 0.8% over the previous year (Chart 1-3). The ratio against GDP was 7.5%.

By type of capital, equity capital increased 13.8% year-on-year to 21.3 trillion yen, debt instruments decreased 13.4% to 11.9 trillion yen, and reinvestment of earnings fell 5.7% to 7.3 trillion yen. Reflecting the flow of debt instruments turning negative and the significant increase in equity capital mentioned earlier, the share of debt instruments in the stock declined to 29.4% at the end of 2021 from 34.2% at the end of 2020, while the equity capital increased to 52.7% from 46.6%.

Source: "International Investment Position of Japan" (MoF, BoJ), "National Accounts of Japan" (Japan Cabinet Office)

JETRO Invest Japan Report 2022

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

[COLUMN]

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices