JETRO Invest Japan Report 2018 (Summary)4. Perception of the Business Environment in Japan among Foreign-affiliated Companies

Greatest appeal lies in the Japanese market, with high profitability also seen as a major selling point

- A questionnaire was sent out to approximately 1,700 companies, with a focus on foreign-affiliated companies supported by JETRO in their entry into the Japanese market. 266 companies responded. (Survey period : from May to June, 2018)

Attractiveness of doing business in Japan

Attractiveness of doing business in Japan Rank Answer Votes 1st Votes 2nd Votes 3rd Points 1 Japanese market 158 20 20 534 2 Existence of suitable partners, (companies, universities, etc.) with outstanding technology or products 25 50 29 204 3 Stability of country and society 16 43 60 194 4 High quality of R&D 19 38 15 148 4 Existence of renown global companies 24 26 24 148 6 Infrastructure (traffic, logistics, ICT, energy, etc.) 4 39 30 120 7 Potential for securing talented human resources 4 14 19 59 8 Well-maintained living environment 4 7 23 49 9 Japan’s location (e.g. position as a gateway to Asia, advantage as a base for regional headquarters, etc.) 3 12 14 47 9 Expected increase in demand and sales toward the 2020 Tokyo Olympics 3 9 20 47 11 Well-structured legislation regarding intellectual property 2 6 5 23 NA Other 4 2 7 23 - Even though Japan’s market scale is predicted to shrink in the future, a considerable number of foreign-affiliated companies see “Mid-and long-term growth potential of the business field” and ”Opportunities for innovation due to Japan’s status as a frontrunner in addressing global challenges” as particularly appealing about the Japanese market.

What is particularly appealing to you about the Japanese market? (top 2 options)

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

- Over 70% of the companies perceive Japan as a highly profitable market.

How do you evaluate the Japanese market in terms of profitability?

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

High level of business confidence among foreign-affiliated companies and a positive outlook on the future

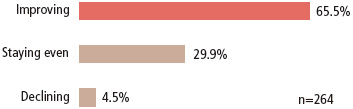

- Foreign-affiliated companies are positive about economic prospects.

Outlook of the business conditions in Japan (over the next one or two year)

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

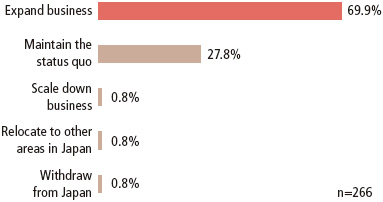

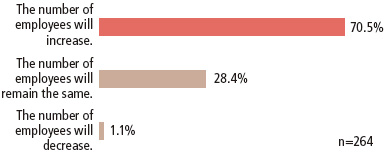

70% of foreign-affiliated companies plan to expand their business operations and employment

Investment plans within the next 5 years

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

Projected number of employees in Japan

(within the next 5 years)

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

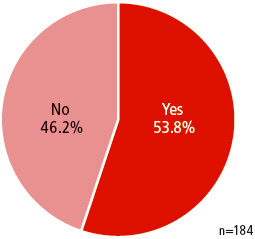

- Over 50% of foreign affiliated companies who plan to expand their business in Japan within the next five years expressed an interest in M&A deals with Japanese companies.

Are you interested in secondary investment through M&A with a Japanese company?

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

Focus on Japan’s SMEs as partners for open innovation

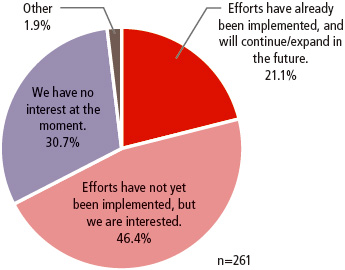

- Around 70% of the foreign-affiliated companies showed interest in open innovation with Japanese companies and universities.

Please tell us about your efforts regarding open innovation with Japanese companies/universities, etc.

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

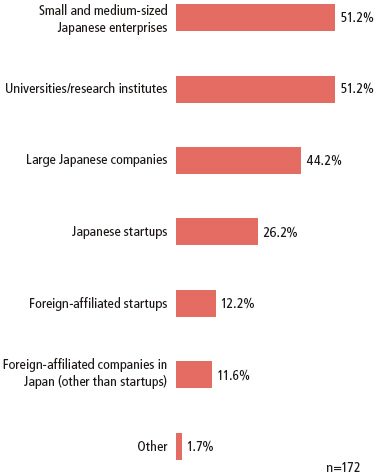

- They are more interested in Japan’s SMEs and universities/research institutes as partners.

Please select the kinds of partners you are interested in (multiple answers)

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

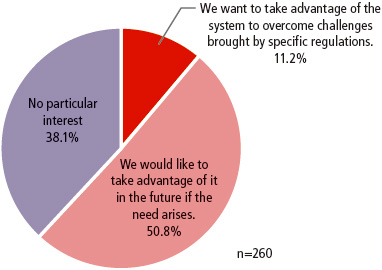

- Over 60% of the companies expressed an interest in using the “Regulatory Sandbox” system.

Please tell us about your interest in the "Regulatory Sandbox" system

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

The biggest obstacle to doing business in Japan is difficulty in finding human resources

Obstacles to doing business in Japan (select each from 1st to 3rd position)

| Rank | Answer | Votes 1st | Votes 2nd | Votes 3rd | Points |

|---|---|---|---|---|---|

| 1 | Difficulty in finding human resources | 87 | 35 | 37 | 368 |

| 2 | Difficulty in communicating in non-Japanese languages | 54 | 69 | 31 | 331 |

| 3 | High business costs | 41 | 45 | 63 | 276 |

| 4 | Complicated administrative procedures | 36 | 40 | 39 | 227 |

| 5 | Rigid regulations | 24 | 32 | 31 | 167 |

| 6 | Difficulty in finding business partners | 11 | 25 | 15 | 98 |

| 7 | Immigration control system | 7 | 6 | 9 | 42 |

| 8 | Difficulty in financing | 0 | 7 | 12 | 26 |

| 9 | Difficulty in living conditions for foreigners | 0 | 2 | 11 | 15 |

| NA | other | 6 | 5 | 18 | 46 |

- Particularly troublesome issues are “Lack of human resources with foreign language ability” and “Difficulty in finding experts.”

Regarding securing human resources, what difficulties in particular have you encountered? (top 2 options)

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

- By category of job, “Engineering” is most difficult to fill.

Regarding securing human resources, which categories of jobs are most difficult to fill? (multiple answers)

[Source] JETRO “Survey on Japan’s Investment Climate 2018”

- In regard to “Complicated administrative procedures,” many companies pointed to the “Excessive amount of required documents,” “Lack of English translation” and “Excessive amount of time required to complete procedures,” especially with “Tax matters,” “Labor matters” and “Matters related to status of residence (visas)”.

Administrative procedures felt to be in need of most improvement and specific issues currently experienced by companies

| Administrative procedures that need improvement the most | Issues necessary to be improved the most | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Excessive points of contact(lack of consolidation) | Excessive amount of required documents | Inconvenience caused by the lack of online procedures | Lack of English translation | Excessive amount of time required to complete procedures | High cost of applications and procedures | Other | Unselected | Total | |

| Company registration | 3 | 5 | 0 | 8 | 5 | 1 | 1 | 2 | 25 |

| Tax matters | 6 | 15 | 6 | 19 | 6 | 5 | 0 | 0 | 57 |

| Social insurance | 1 | 5 | 6 | 6 | 5 | 2 | 1 | 0 | 26 |

| Labor matters | 6 | 14 | 3 | 7 | 14 | 1 | 7 | 0 | 52 |

| Matters related to status of residence (visas) | 0 | 6 | 8 | 6 | 23 | 1 | 2 | 0 | 46 |

| Intellectual property | 0 | 1 | 2 | 3 | 0 | 0 | 0 | 0 | 6 |

| Trade | 1 | 4 | 0 | 2 | 4 | 2 | 0 | 1 | 14 |

| Other | 1 | 2 | 2 | 5 | 4 | 0 | 14 | 1 | 29 |

| Unselected | 0 | 0 | 0 | 2 | 1 | 0 | 0 | 8 | 11 |

| Total | 18 | 52 | 27 | 58 | 62 | 12 | 25 | 12 | 266 |

2018

-

1. Recent Situation of Inward FDI in Japan

(1.7MB)

(1.7MB)

-

2. Toward Improvement of Business Environment

(469KB)

(469KB)

-

3. Trend in Inward FDI in Japan – Foreign Investment Contributing to the Emergence of Innovation

(1.6MB)

(1.6MB)

-

4. Perception of the Business Environment in Japan among Foreign-affiliated Companies

(440KB)

(440KB)

-

5. JETRO Efforts to Promote Investment in Japan

(3.5MB)

(3.5MB)

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices