This article series will provide useful insights into the changing investment and innovation environment, and new business opportunities in Japan.

Reference

1. International Comparisons of Dismissal Regulations

OECD regularly conducts comparative research on dismissal regulations in its member countries and analyses and ranks them by the strictness of dismissal regulations. According to 2019 research, Japan ranked 13th in terms of the least strict dismissal regulations among the 37 OECD member countries. The least strict countries included the US, Switzerland, Canada, etc., while Czech, Israel, and Portugal were among the strictest nations. The UK was 6th, Germany 16th, France 24th, and Sweden 27th, as a country with low strictness.

While the effective criteria for dismissal supported by the court are stringent in Japan, Japan has simple procedures and a short notice period for dismissal. These, coupled with the absence of a legalized monetary resolution system, were the reasons for Japan's higher ranking (or being less strict) compared with many continental European countries.

2. Labor unions

In Japan, the right of its labor unions to carry out their activities is guaranteed by law. Employers cannot employ a person on the condition that he/she does not join a union, and cannot cause any disadvantage to an employee because he/she is a union member. Furthermore, no company may refuse its labor union’s request for collective negotiations without due cause.

According to a survey by the Ministry of Health, Labour and Welfare, the unionization rate of Japan’s unions as of June 2022 was estimated to be 16.5%, a slight decrease from the previous year. By company size (private sector only), 39.6% of the workers at companies with 1,000 or more employees are unionized, 10.5% at companies with between 100 and 999 employees, and 0.8% at companies with less than 100 employees.

3. Coverage of temporary workers by labor law

The term "Temporary worker" refers to a worker that enters into a labor contract with a temporary staffing agency (the company that temporarily places the worker), and who, under the orders of the agency, reports for work at a client company of that agency (i.e., a company that enters into a temporary worker placement contract with the agency, and then accepts temporary placement of the worker), and who performs duties under the orders of the client company.

Labor laws such as the Labor Standards Act, the Industrial Safety and Health Act, and the Equal Employment Opportunity Act apply to temporary workers. Companies that accept placement of temporary workers bear the responsibility of complying with the provisions of the Labor Standards Act pertaining to working hours, breaks and days off; those companies may have temporary workers work overtime within the scope allowed by the Labor Standards Act provided they enter into a labor agreement regarding workers' overtime with the agency that places the temporary worker. In this case, the temporary staffing agency bears the responsibility to pay increased rate of wages.

It is the temporary staffing agency's responsibility to ensure temporary workers' annual paid leave, and to supply the client company with a replacement worker if necessary while the original temporary worker is on annual paid leave. Furthermore, it is the temporary staffing agency rather than the client company that must take out labor insurance (Workers' Accident Compensation Insurance and Employment Insurance) and social insurance (Employees' Pension Insurance and Health Insurance) for the temporary worker and pay the appropriate premiums.

If a client company accepts illegal supply of temporary workers (exceeding period limitations, disguised contract, unauthorized supply service, etc.), a direct employment relationship is deemed to have been established between the client company and the temporary workers at the time of accepting such supply of temporary workers.

4. Consultation with specialists on human resource management

Labor and social security attorneys are human resource management experts with special nationally administered qualifications. As well as payroll accounting, they perform a range of services at companies' request, including:

-

(1)

Carrying out labor and social insurance-related procedures and other administrative work as a proxy for companies when hiring staff.

-

(2)

Consulting services in relation to safety and hygiene, as well as labor management (including drawing up work rules, planning and redesigning wage structures, as well as settling employment problems).

-

(3)

Mediation in individual employment disputes.

-

(4)

Consulting and handling of claims regarding pensions.

-

(5)

Other employment-related tasks.

(Performance of services covered by (1) and (3) by persons other than labor and social security attorneys in private practice, certified social insurance labor and social security attorney corporations, or attorneys is prohibited by law.)

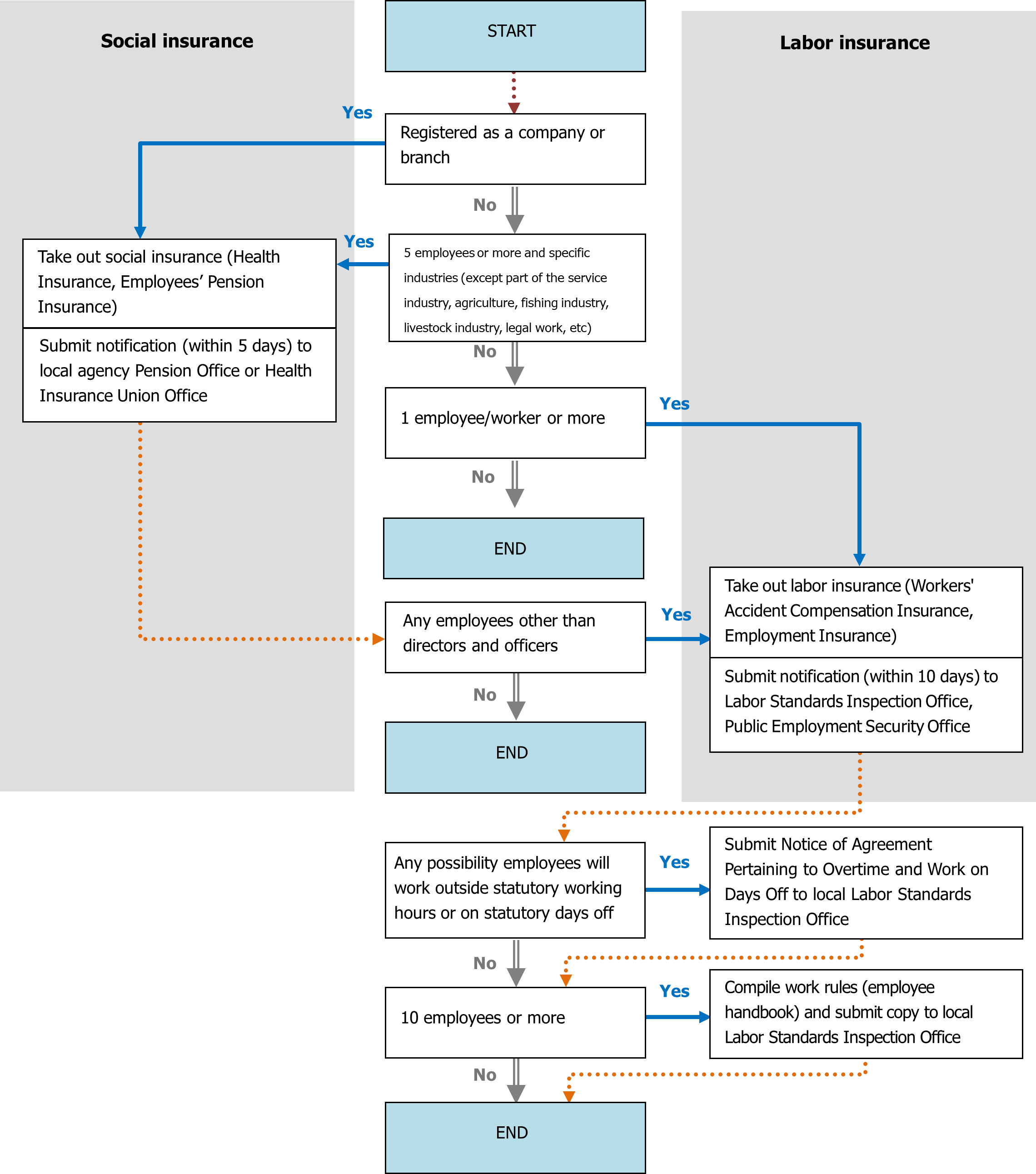

Social and labor insurances procedures when setting up a company or hiring staff/workers

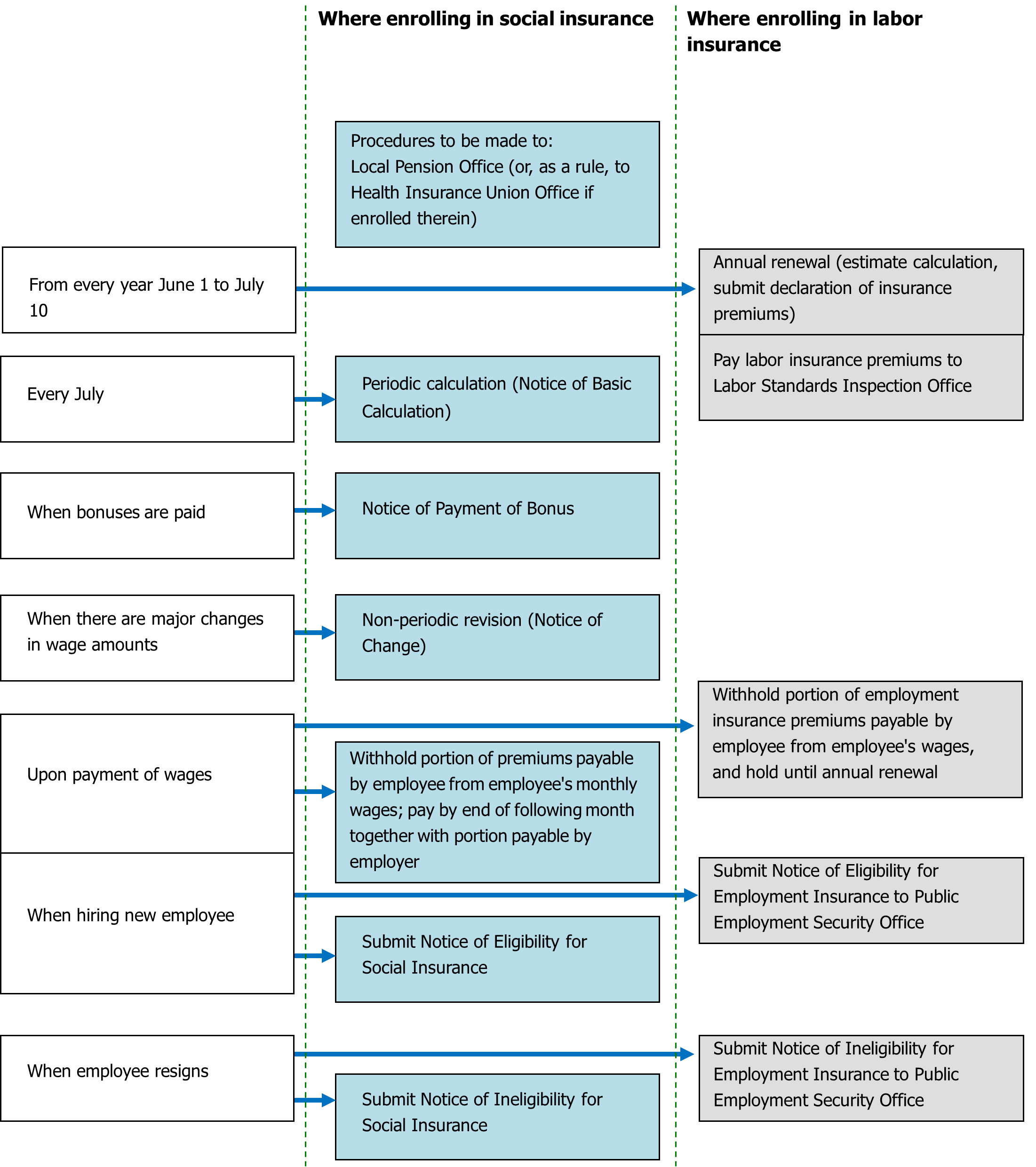

Annual procedures

Writer :

SATOSHI NAGAURA, Labor and Social Security Attorney, Nagaura Personnel Management Office

Editor / Publisher :

Promotion Division, Innovation Department, JETRO

Table of Contents

-

4.1

-

4.2

-

4.3

-

4.4

-

4.5

-

4.6

-

4.7

-

4.8

-

4.9

(Reference)

(Flowchart)

Laws and Regulations on Setting Up Business in Japan Pamphlet

The pamphlet "Laws & Regulations" is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan. It is available in 8 languages (Japanese, English, German, French, Chinese (Simplified), Chinese (Traditional), Korean and Vietnamese).

You can download via the "Request Form" button below.

Section4: Documents businesses are required to submit to authorities

| Section | Documents | Where documents are listed within the URL | The competent authorities and relevant web pages |

|---|---|---|---|

| 4-3 |

Notice of Employment |

See the pdf below |

Ministry of Health, Labour and Welfare |

| 4-3 | Employment Agreement |

Ministry of Health, Labour and Welfare |

|

| 4-5 | Notification of Agreement on Overtime work Working on Holidays |

Ministry of Health, Labour and Welfare |

|

| 4-6 |

The Model Rules of Employment |

See "The Model Rules of Employment" |

Ministry of Health, Labour and Welfare |

| 4-9 | Notification of Acquisition of Employment Insurance Qualification |

Ministry of Health, Labour and Welfare |

|

| 4-9 |

Application to Enroll in Employees' Health Insurance / Employees' Pension Insurance |

See "Application form" |

Japan Pension Services |

| 4-9 | Labor insurance Estimated insurance premiums / Increased estimated insurance premiums / Final insurance premiums Declaration |

Ministry of Health, Labour and Welfare |

|

| 4-9 |

Basic amount for calculation of monthly remuneration of person insured Health insurance and Employees' pension insurance Insurance Application to enroll in Employees' Pension Insurance for insured persons aged 70 and older |

Japan Pension Services |

|

| 4-9 |

Report of Dependents (change) |

See "Report form" under "Coverage of Your Dependents" section. |

Japan Pension Services |

| 4-9 | Notification of the Establishment of a Labor Insurance Relationship |

Ministry of Health, Labour and Welfare |

|

| 4-9 | Notice of establishment of the business place to which employment insurance is applied |

Ministry of Health, Labour and Welfare |

|

| 4-9 |

Application for Workplace Coverage |

See "Application form" |

Japan Pension Services |

| 4-9 |

Declaration of Tax Exemption for Salaried Employees (Change) |

Select the desired format from the formats below |

National Tax Agency |

| 4-10 | Income Tax Withholding Certificate |

National Tax Agency |

Materials listed as ‘Reference’ contain samples of documents regarding registration, visa, taxation, personnel and labor matters that are necessary when a foreign company establishes a corporation or other entity in Japan. These documents are not published by competent authorities and therefore are not official. For those who are going through the official procedures, please obtain the latest official documents from the competent authorities and related bodies or consult a person who specializes in advising on such information and procedures.

The information contained in this documents should be used at the reader’s independent discretion. While JETRO makes every effort to ensure the accuracy of the information it provides, no responsibility is accepted by JETRO for any loss or damage incurred as a result of actions based on the information provided in these documents or provided by the external links listed on these pages.

JETRO supports your business in Japan

We provide consistent one-stop service for establishing a base or expanding business in Japan. See the details of support services that JETRO provides when setting up business in Japan.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices