A Promising Economy for Growth

Act Now to Ride the Wave of Soaring Corporate Profits

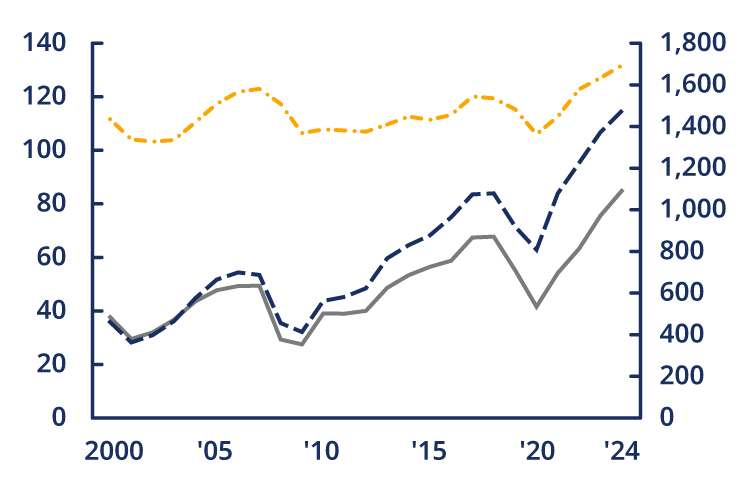

Corporate profits in Japan soared in 2024, with both the manufacturing and non-manufacturing sectors seeing record growth. Ordinary profit is at the highest level ever recorded, highlighting the increasing stability and resilience of the Japanese economy. There’s never been a better time to bring your business to Japan.

Trends in Ordinary Profit Across All Sectors and Industries (Unit:Trillion yen)

*Dashed line (blue): ordinary profit, dashed line (yellow): sales revenue, solid line: operating profit

*Ordinary profit and operating profit refer to the left axis scale, while sales revenue refers to the right axis scale.

Source: Created by JETRO based on Ministry of Finance "Quarterly Business Statics Report"

Japan’s Market Stability Means You Can Invest with Confidence

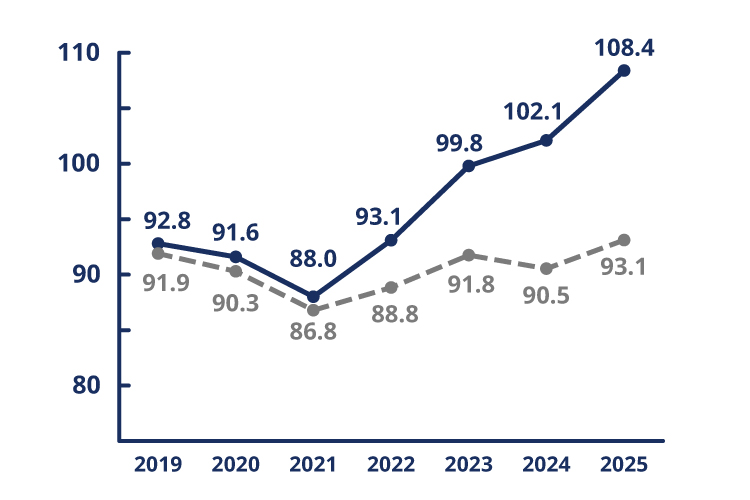

In FY2023 capital investment by Japanese companies exceeded 100 trillion yen, reaching a historic high and showing just how firmly investors were reassured by the swift recovery from the pandemic. Right now, with increased investment in infrastructure ushering in higher productivity and economic growth, the business environment in Japan could hardly be more desirable from the viewpoint of an overseas companies.

Corporate Capital Investment (Unit:Trillion yen)

*Solid line: nominal capital investment, dashed line: real capital investment

Source: Created by JETRO based on Department of National Accounts, Economic and Social Research Institute, Cabinet Office "Quarterly Estimates of GDP: April - June 2025 (The Second Preliminary)"

A Society Ready to Attract Top Talent with Rising Wages

In 2025 labor-management negotiations, Japan’s major companies agreed on an average wage increase of 5.39%. The wages have risen for two consecutive years, which brings Japan closer to global standards and enhances its ability to attract highly-skilled talent. Hiring top-quality personnel in Japan could significantly speed up the growth of your business, giving you a competitive edge in Japan’s thriving economy.

Source: Japan Business Federation "Spring 2025 Labor-Management Negotiations: Compromised Results by Major Industry (Weighted Average)"

The Drive for Carbon Neutrality by 2050 Is Expanding Business Opportunities Across Sectors

In its mission to achieve carbon neutrality by 2050, Japan is focusing on 14 key sectors, including energy, transportation, manufacturing, and household/office-related industries. For businesses entering the Japanese market, this is creating growth opportunities too good to miss.

Source: Ministry of Economy, Trade and Industry "Green Growth Strategy Through Achieving Carbon Neutrality in 2050"

We provide a flowchart outlining the basic steps involved in establishing a base in Japan. You can also find a detailed explanation of each step, cost estimation, an overview of the laws, regulations and procedures related to setting up business, and more.

The pamphlet “Laws & Regulations” is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan.

PDF “Reasons to Choose Japan”

The “Reasons to Choose Japan” is also available in PDF.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices