A Foundation of Trust and Stability for Investment

Japan Has the World’s Attention, Make It Your Next Investment Destination

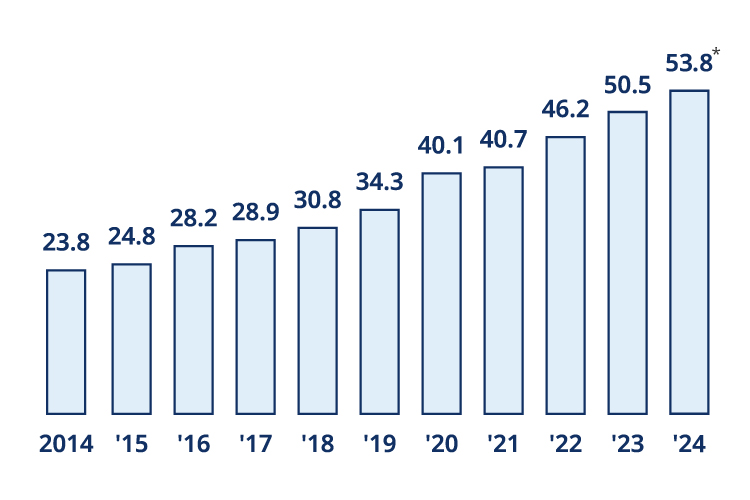

Japan continues to attract a healthy flow of inward foreign direct investment (FDI). Increasing investment attests to the trust and confidence inspired by the Japanese market and points to its stability as an investment destination. For overseas businesses, Japan offers a unique investment opportunity to achieve long-term success.

Trends in FDI Stock in Japan (Unit:Trillion yen)

Source: Created by JETRO based on JETRO "JETRO Invest Japan Report 2024" and MOF"International Investment Position of Japan"

*The data is a preliminary figure.

On the FDI Confidence Index, Japan Ranks 1st in Asia

Japan ranks first in Asia and fourth worldwide in the Foreign Direct Investment Confidence Index.

This rating reflects the stability and growth potential of the Japanese economy, as well as low investment risk.

Japan is a country you can invest in with peace of mind and trust.

| Rank | Country and Region | Score |

|---|---|---|

| 1 | Japan | 2.02 |

| 2 | China (including Hong Kong) | 1.97 |

| 3 | South Korea | 1.75 |

| 4 | Singapore | 1.73 |

| 5 | Taiwan | 1.54 |

-

Source:

Created by JETRO based on data from Kearney "2025 Kearney Foreign Direct Investment Confidence Index(R)"

Japan Leads the G20 in Political Stability and Governance

Among the G20 nations, Japan ranks 1st in both political stability and government effectiveness, and 2nd in rule of law. This is an environment where businesses can operate with confidence and trust and thrive over the long term.

| Rank | Country and Region | Score |

|---|---|---|

| 1 | Japan | 1.63 |

| 2 | Australia | 1.59 |

| 3 | Canada | 1.52 |

| 4 | Korea | 1.40 |

| 5 | United States | 1.22 |

| Rank | Country and Region | Score |

|---|---|---|

| 1 | Japan | 0.95 |

| 2 | Australia | 0.92 |

| 3 | Canada | 0.82 |

| 4 | Korea | 0.61 |

| 5 | Germany | 0.59 |

| Rank | Country and Region | Score |

|---|---|---|

| 1 | Germany | 1.55 |

| 2 | Japan | 1.54 |

| 3 | Australia | 1.52 |

| 4 | Canada | 1.47 |

| 5 | United Kingdom | 1.40 |

-

Source:

©World Bank "World Development Indicators Database" Creative Commons License (Attribution 4.0 International)

We provide a flowchart outlining the basic steps involved in establishing a base in Japan. You can also find a detailed explanation of each step, cost estimation, an overview of the laws, regulations and procedures related to setting up business, and more.

The pamphlet “Laws & Regulations” is available in PDF, and outlines basic information about laws, regulations and procedures related to setting up a business in Japan.

PDF “Reasons to Choose Japan”

The “Reasons to Choose Japan” is also available in PDF.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices