The Japanese government envisions "Society5.0" as its goal - a society which aims to solve social issues through cutting-edge technology. In order to achieve such a society, it is providing multifaceted support, including revisions of existing regulations, cross-border and industrial data linkage, offering incentives for digital technology, and the attraction of overseas companies and talent.

Digital Technology

Overview

Japan's Digital Transformation Market Shows Solid Growth, Presenting Increased Growth Opportunities for Foreign-affiliated Companies

(1) Japan as a Leading Country in Large-scale Investments in Digitalization

In the International Institute for Management Development's (IMD) Digital Competitiveness Ranking (2023) covering 64 countries, Japan ranks 8th overall in the Asia-Pacific region. Notably, Japan held top positions worldwide in the E-Participation (1st) and Wireless broadband (2nd) indices, demonstrating its global leadership in digital infrastructure.1 Similarly, in the Portulans Institute's Network Readiness Index (2023), which covers 134 countries and regions, Japan ranks 13th globally and 3rd in Asia. Japan excels in areas such as Access to Technology (5th) and Online Information Sharing by Government Agencies, including local authorities (2nd). Additionally, Japan's high willingness to invest in the research and development (R&D) of new technologies is notable, with strong positions in R&D Investment (2nd), R&D Expenditure (4th), and Investment in Emerging Technologies (9th).2 It is evident that Japan has made comparatively more large-scale investments in digitalization and R&D than other countries, led by large private companies with financial power and influence, as well as by the government.

(2) Continuous Growth is Expected in Digital Market

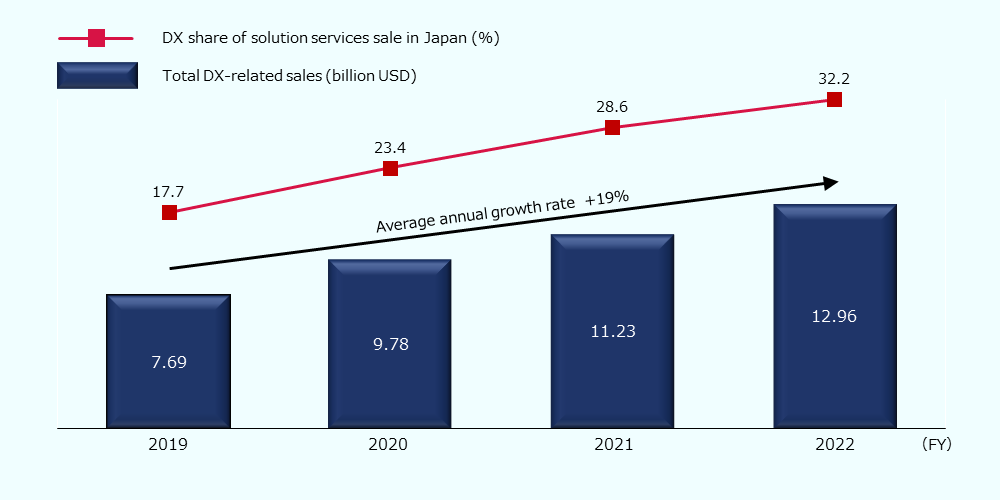

The market size for digital transformation-related solution services in Japan grew from 7.69 billion USD* (1,163.4 billion JPY) in 2019 to 12.96 billion USD* (1,961.9 billion JPY) in 2022, recording a steady annual growth rate of 19% (Figure 1).

Figure 1: Digital transformation-related solution services market size in Japan

Source: Created by JETRO based on data from the Information-technology Promotion Agency, Japan (IPA) 3

In addition, the digital transformation market is expected to see steady long-term growth due to the government's support for digitalization initiatives, including the realization of Society 5.0 and the new taxation system for promoting digital transformation investment (as detailed in section 2. Government Initiatives)

(3) Company-wide Digital Transformation Driven by Large Corporations

With the solid growth of the domestic digital transformation market, Japanese companies are advancing digitalization across different fields. In addition to streamlining existing operations, such as digitizing physical data, digital transformation is beginning to be recognized for its diverse benefits, including the creation of new products and services and the transformation of company-wide processes leading to fundamental management reforms.4。

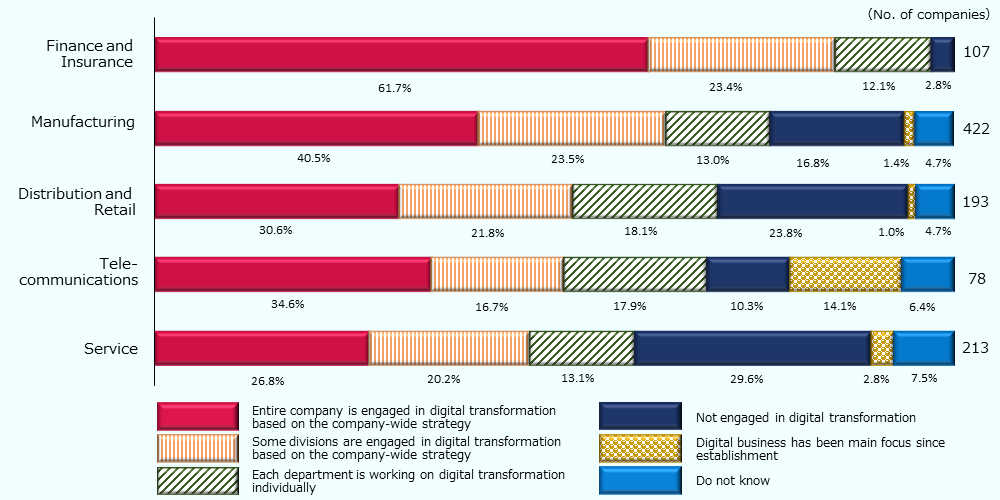

On the other hand, there is variation in the level of digital transformation achieved among industries. According to survey results, the proportion of companies engaged in digital transformation is highest in the Finance and Insurance industry at 85.1%, followed by the Manufacturing, and Distribution and Retail industries. In contrast, the Service industry tended to have fewer companies involved in digital transformation (Figure 2).

Figure 2: Companies engaged in digital transformation based on company-wide strategy (by industry)

Source: Created by JETRO based on data from IPA5

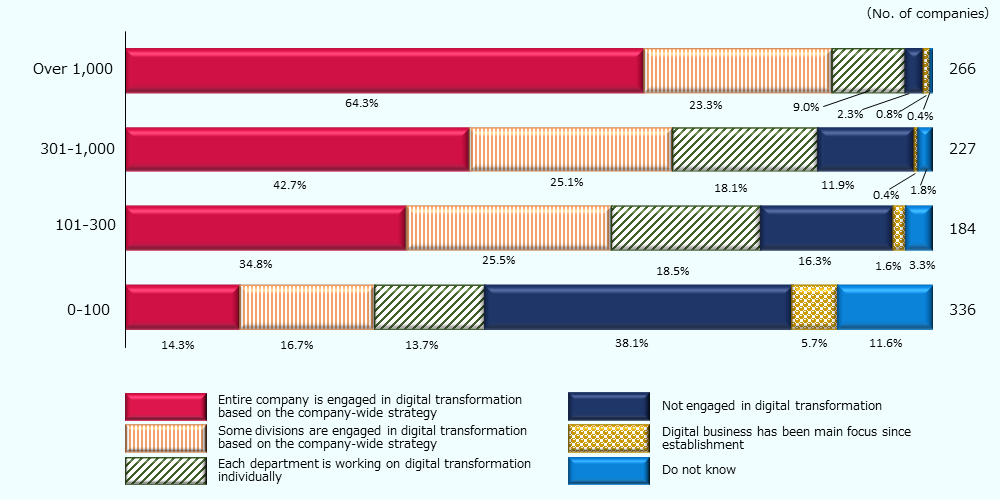

Furthermore, nearly 90% of large companies with over 1,000 employees are engaged in digital transformation, whereas only about 30% of companies with 100 employees or fewer are involved, indicating a significant gap (Figure 3). Many small and medium-sized enterprises (SMEs) cite the lack of strategic planning and oversight personnel, as well as insufficient personnel to facilitate on-site digital transformation, as reasons for the slow progress in digital transformation initiatives. Companies with 100 employees or fewer frequently report a lack of knowledge and information necessary for digital transformation, highlighting significant concerns regarding expertise and skills.

Figure 3: Companies engaged in digital transformation based on company-wide strategy (by number of employees)

Source: Created by JETRO based on data from IPA6

As compared to other countries, Japanese companies tend to cite a lack of personnel and lack of knowledge and literacy in digital technology as barriers to digital transformation.7 Securing and developing talent, as well as reskilling existing employees, are key challenges.

In response to this situation, the government has begun implementing multifaceted support aimed at improving the nation's digital capabilities. This includes promoting further investment in companies that are advancing digitalization and digital transformation through innovation-driven policies, as well as supporting companies that are making efforts to attract and develop talent (as detailed in section 2. Government Initiatives).

(4) Japan's Market Size as a Key Point of Attraction for Foreign-affiliated Companies

According to a survey of foreign-affiliated companies in Japan, the Japanese market is considered attractive due to its market size, social and economic stability, and robust infrastructure. In addition, foreign-affiliated ICT companies tended to value the size of the Japanese market at a higher rate (68.5%), than those in the finance and insurance industry (68.1%) and academic research, professional and technical services (51.4%). The same respondents also favorably rated the concentration of related clients and industries in Japan, the quality of infrastructure, and the medium- to long-term growth potential of the ICT industry in Japan, indicating that they value opportunities for collaboration and the well-developed business foundations in Japan.8。

Furthermore, many foreign-affiliated companies highlighted the importance of advancing digital transformation as a key theme for both their operations and Japanese society in the aftermath of the COVID-19 pandemic. A similar trend is observed among Japan's domestic companies as well. According to a survey, 24% of Japanese companies reported that the COVID-19 pandemic led them to expanding the segments that they are digitalizing, increasing the budgets allocated towards digital transformation, and improving their digital transformation systems.9 Despite the challenges, the digital transformation market is set to expand in the future due to an increase in the number of companies involved and government support measures (as detailed in section 2. Government Initiatives).

In addition to market size, social and economic stability, and well-developed infrastructure, the wave of digitalization following the COVID-19 pandemic could further incentivize foreign-affiliated companies specializing in digital transformation, to invest in the Japanese market. In fact, in recent years, various emerging digital markets in Japan have seen the entry of numerous foreign companies, ranging from startups to large enterprises (as detailed in section 3. Attractive Markets).

-

*

Calculated based on the Bank of Japan exchange rate of 1 USD for 151.38 JPY (as of April 1, 2024)

References

- International Institute for Management Development (IMD). "PEER GROUPS RANKINGS: ASIA – PACIFIC," "TECHNOLOGY: Wireless broadband," "FUTURE READINESS: E-Participation," Digital Trends-Overall-Japan.

- Portulans Institute. "Network Readiness Index 2023(PDF)," Analysis Benchmarking the Future of the Network Economy.

- Japan Electronics and Information Technology Industries Association (JEITA). Solution Services Market Size (2019-2020) (JP), p. 2.

JEITA. 2021-2022 Solution and Services Market Size by Application, JEITA (JP), p. 2. - Information-technology Promotion Agency, Japan (IPA). Digital Transformation Trend 2024 (JP), p. 9.

- IPA. Digital Transformation Trend 2024 (JP), pp. 2, 3.

- See Note 5, pp. 2, 4.

- Ministry of Internal Affairs and Communications (MIC). Survey Research on R&D on the Latest Information and Communications Technologies and the Trends of Use of Digital (JP), p. 243.

- JETRO. Summary of the Results of Survey on Business Operations of Foreign-affiliated Companies in Japan, 2023 (JP), p. 20.

- Japan Electronics and Information Technology Industries Association (JEITA). Results of Survey on DX in Japanese and US Companies, JEITA (JP), p. 5.

-

Government Initiatives

Implementing Wide-range Support, from Incentivizing the Development of Leading-edge Technologies to Promotion of Digital Transformation

-

Attractive Markets

In This Report, We Focus on the Following Five Attractive Markets in the Digital Industry

-

(1)

AI: Increasing public and private investment

-

(2)

Cybersecurity: Remarkable overseas presence in the Japanese market

-

(3)

Virtual Space (Metaverse): Business opportunities in societal implementation

-

(4)

Web3.0: An improving business environment

-

(5)

FinTech: The significant roles of foreign companies

-

Digital Technology Report

You can download the whole report on the webpage free of charge. Please simply fill out the form below to get information on promising industries in the Japanese market. Download now and use the information for your success in business.

-

- Business Expanding

- Biotechnology & Life Science

- Digital & AI

- 対日投資_産業(英)

- Korea

The medical AI startup AITRICS has established an office in Tokyo, Japan

-

- Business Expanding

- Digital & AI

- Yokohama city

- Vietnam

SOLAZU Holding, which offers data utilization, AI implementation, and business optimization solutions through its AI development support workflow, has established a Japanese subsidiary in Yokohama City, Kanagawa

-

- Business Expanding

- Digital & AI

- Hong Kong

Mercury Technology Solution Company Limited, a software development and digital consulting firm, has established an office in Chiyoda-ku, Tokyo

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices