JETRO Invest Japan Report 2019 (Summary) 1. Recent Trend of Inward FDI in Japan

Inflow of more than 2 trillion yen for the second consecutive year, the second highest after 2016

- The inflow of 2018 inward FDI (balance of payments basis, net) is 2.9 trillion yen and the second largest only after 2016, among comparable years since 1996.

- By region, the net inflow from Europe is 804.9 billion yen (30.4% increase from 2017), 668.1 billion yen from North America (4.0% decrease) and 552.2 billion yen from Asia (11.9% decrease)

Changes in the flow (net) of inward FDI into Japan by country/region(Billion Yen)

| Country/region | 2016 | 2017 | 2018 |

2019 Jan-Aug (P) |

|---|---|---|---|---|

| Asia | 950 | 627 | 552 | 485 |

China China

|

-11 | 110 | 89 | 99 |

Hong Kong Hong Kong

|

161 | -38 | 86 | 131 |

Taiwan Taiwan

|

259 | 95 | 44 | 50 |

Korea Korea

|

67 | 127 | 216 | 52 |

ASEAN ASEAN

|

475 | 331 | 117 | 154 |

Singapore Singapore

|

404 | 359 | -33 | 80 |

Thailand Thailand

|

71 | -50 | 132 | 50 |

| North America | 751 | 696 | 668 | 631 |

US US

|

748 | 702 | 662 | 580 |

| Latin America | 171 | 313 | 478 | 355 |

| Oceania | 87 | 27 | 210 | 104 |

| Europe | 2,508 | 617 | 805 | 1,328 |

EU EU

|

2,411 | 457 | 737 | 1,268 |

| World | 4,492 | 2,296 | 2,859 | 2,981 |

Major inward M&A deals in Japan since 2018(-: no data is available)

|

Date (Completion) |

Target Company |

Target Company: Industry |

Acquirer |

Acquirer: Nationality |

Acquirer: Industry |

Value (Bil.Yen) |

|---|---|---|---|---|---|---|

| Jun. 2018 | Toshiba Memory | Electronics | Bain Capital(US), SK Hynix(Korea), and others | - | Investors Group | 2,000 |

| Apr. 2018 | Takata | Transportation Equipment | Joyson Electronics | China | Transportation Equipment | 175 |

| Mar. 2018 | ASATSU-DK | Advertising Agency | Bain Capital | US | Investment Firm | 152 |

| Apr. 2019 | Ci:z Holdings | Cosmetics | Johnson&Johnson | US | Healthcare | 150 |

| Mar. 2019 | Clarion | Electronics | Faurecia | France | Transportation Equipment | 141 |

| Jun. 2019 | Godiva(Asia Pacific) | Food | MBK Partners | Korea | Investment Firm | 111 |

| Jan. 2019 | 6 logistics facilities owned by ESR | Real Estate | Axa IM (France), and others | - | Investors Group | 109 |

| Mar. 2019 | Pioneer(1) | Electronics | Baring Private Equity Asia | Hong Kong | Investment Firm | 102 |

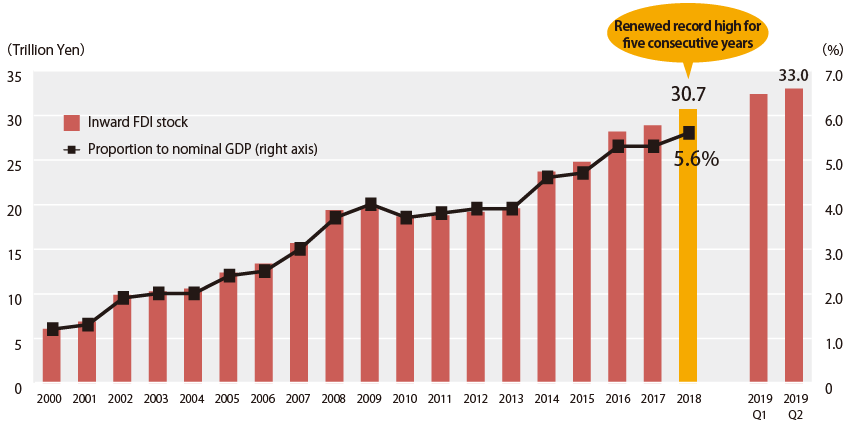

Inward FDI stock reaching 30-trillion-yen mark for the first time

- Inward FDI stock at the end of 2018 was 30.7 trillion yen. It marked a record high for five consecutive years and exceeded 30 trillion yen for the first time.

- By region, nearly a half of the stock, 49.5%, comes from Europe.

- By country, the stock of the US was 6.5 trillion yen and remained as the largest investor.

Inward FDI stock and its proportion to nominal GDP

Share of inward FDI stock in Japan by region

(as of end of 2018)

Inward FDI stock in Japan by country/region and by industry (as of end of 2018) Top 10 (By country/region)

| Rank | Country |

Stock (Billion yen) |

Share(%) |

|---|---|---|---|

| 1 | US | 6,529 | 21.3 |

| 2 | Netherlands | 4,625 | 15.1 |

| 3 | France | 3,761 | 12.2 |

| 4 | Singapore | 2,638 | 8.6 |

| 5 | UK | 2,606 | 8.5 |

| 6 | Cayman Isl. | 1,673 | 5.4 |

| 7 | Switzerland | 1,458 | 4.7 |

| 8 | Germany | 1,094 | 3.6 |

| 9 | HongKong | 1,012 | 3.3 |

| 10 | Luxembourg | 837 | 2.7 |

Finding business opportunities in addressing social issues unique to local regions and Japan through innovation

- Cases have been observed where foreign-affiliated companies find opportunities for research and development (R&D) or pilot projects of new technologies/services in unique social issues and characteristics and where they collaborate with local companies/organizations.

Regional social issues × Efforts of foreign-affiliated companies

| Place | Social issues | Foreign-affiliated companies | Characteristics | Efforts/business development |

|---|---|---|---|---|

|

Aizu-wakamatsu City, Fukushima Pref. |

|

Accenture, SAP Japan, Japan Microsoft, etc. |

Environment suitable for social business pilot projects (Combination of urban and depopulated areas) (Open data of its citizens) |

|

|

Sendai City, Miyagi Pref. |

|

Philips Japan, etc. |

Research and development in the field of healthcare |

|

Social issues in Japan × Efforts of foreign-affiliated startups

|

Foreign-affiliated company |

Business overview | Social issues | Cooperation partners |

Efforts/business development in Japan |

|---|---|---|---|---|

| Standard Cognition | Providing a payment software system, with which retail stores no longer need cash registers | Manpower shortage | PALTAC | Planning to start pilot projects to install the software at drugstores in Miyagi Prefecture |

| One Concern | Development of damage prediction system for natural disaster utilizing AI | Disaster prevention/disaster mitigation | Sompo Japan Nipponkoa Weathernews | Starting pilot projects of disaster prevention/disaster mitigation system utilizing AI in Kumamoto City. Planning to start trial operation of the damage prediction system of damages for floods and earthquakes from September 2019. |

| StreetScooter | Manufacturing of electric vehicle (EV) |

Work-style reform Manpower shortage Reduction of burdens on environment |

Yamato Transport | Jointly developed of first Japanese small EV truck for parcel delivery. Yamato Transport announced it would introduce 500 units of them during FY2019. |

| Wind Mobility | Providing service of shared electric scooters | Last one-mile between public transportation and a destination | Saitama Railway Corporation | Providing an electric scooter sharing service in Saitama City and Kawaguchi City. |

Diversification of the ways foreign-affiliated companies form ecosystems

- Some of foreign-affiliated companies forming startup ecosystems in Japan hold programs for startups making the best use of characteristics of individual regions as well as investment through establishing corporate venture capital (CVC).

Foreign-affiliated accelerators in Japan(-: no data is available)

| Foreign-affiliated company | Market to expand | Advantages of market | Characteristics of program |

|---|---|---|---|

|

Rainmaking Innovation |

Osaka City, Osaka Pref. |

Market size Low cost (compared with Tokyo) |

Holding "Startupbootcamp," a startup support program, in 21 cities around the world. The program sets up a specific industrial cluster for each host city and invites promising startups in the field from all over the world. The theme in Osaka is "Smart City & Living." |

| Plug and Play |

Kyoto City, Kyoto Pref. |

Startup environment with local universities at its core | Since entering Japan in 2017, assisted both domestic and overseas startups. Their program in Kyoto is to specialized in "Hard Tech/Healthcare." |

| ImpacTech | Tokyo | - | Providing support exclusively to startups tackling social issues using technologies. Supported projects include wireless electric car/robot charging service, online medical consulting service for parents with children, etc. |

Foreign-affiliated open innovation program/CVC by traditional companies

| Open innovation program/CVC | Investing foreign-affiliated companies | Efforts/investment |

|---|---|---|

|

G4A Tokyo Dealmaker CoLaborator Kobe |

Bayer Yakuhin |

|

| Philips HealthWorks | Philips |

|

| Samsung Venture Investment Corporation | Samsung Group |

|

| Cisco Innovation Hub | Cisco Systems |

|

| Google for Startups Campus | Alphabet |

|

| Japan Trailblazer Fund | Salesforce.com |

|

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices