-

(1)

Utilizing data and AI in medical, nursing care, and healthcare

-

(2)

Early approval of pharmaceuticals and medical devices

-

(3)

Promoting new drug discovery

-

(4)

Supporting pharmaceutical startups

-

(5)

Supporting the entry of foreign companies in regions

Life Science

Overview

The Life Sciences Sector of Japan Is Expected to Expand Due to the Elderly Population, the Promotion of Innovation, and the Introduction of Digital Technologies

The life sciences market in Japan, including the pharmaceutical/medical device market, is expected to grow driven by social conditions and policy trends, including increased medical expenses due to the elderly population and government initiatives to support business development.

Japan's population is aging rapidly and as per statistics by the Ministry of Internal Affairs and Communications (MIC), as of 2023, the number of people aged 65 or above has risen to about 36 million, and it is expected to reach about 40 million by 2040. (Figure 1) In 2023, approximately 29% of the total population is 65 or older, and 16% is 75 or older, the highest in the world.1

Figure 1: Trends in the elderly population and its share

Source: Created by JETRO based on data by the Statistics Bureau, MIC 2

While the increase in the elderly population is a social challenge faced by the entire world, it also have a positive impact on the life sciences market in Japan. Japan is one of the most generous countries among the OECD countries in terms of healthcare provision by the government, with one of the world's lowest healthcare burdens on its citizens and world-class levels of healthcare satisfaction3,and it has an environment in which citizens can actively access high-quality medical care. The increase in the aged population is considered to be directly linked to an increase in medical expenditure because elderly people at higher risk of developing diseases can rely on medical care without worry.

In FY 2022, estimated medical expenses were about 306.5 billion USD* (46 trillion JPY), an increase of about 4% over the previous year, and the proportion of expenditure by people aged 75 and over accounts for around 40% of the total.4 This indicates the impact of the increasing elderly population on healthcare expenditure.

In addition to the increase in the elderly population, the government's encouragement of innovation is one of the various factors that support the Japanese pharmaceutical market. Examples of innovations that support drug development by companies in Japan and overseas include the promotion of an additional allowance to promote the creation of new drugs and the eliminate the off-label uses of drug to maintain drug prices for new drugs, the adoption of real-world data, (RWD, data generated by routine clinical practice, etc.) to expedite drug review, and the establishment of an emergency drug approval system5 (see “2. Government Initiatives” for more details). Under special drug and emergency drug approval, COVID-19 vaccines and therapeutics are also subject to approval, leading to the start of the distribution of vaccines and treatments developed by foreign companies. 6

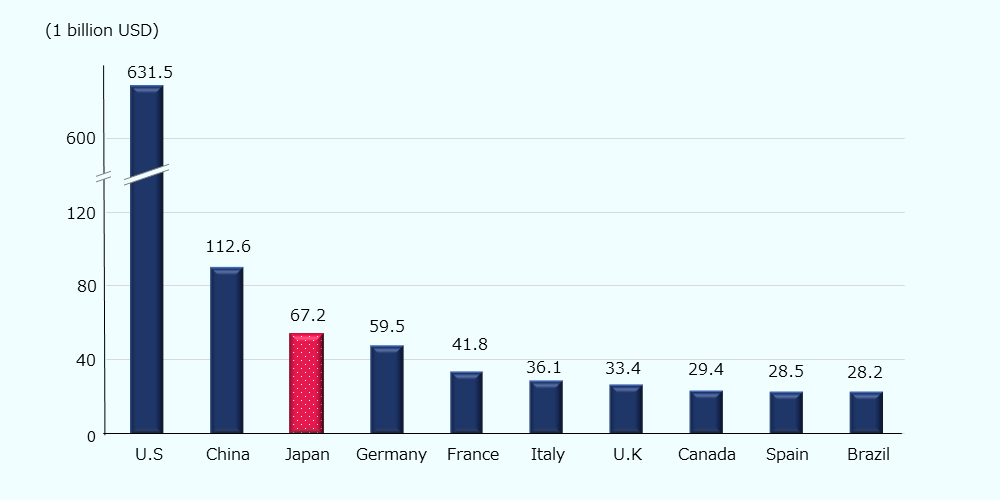

Figure 2: Prescription drug market size in 2022 (top 10 countries)

Source: Created by JETRO based on data by IQVIA7

As of November 2022, 53 products related to the COVID-19 virus (therapeutic drugs, vaccines, medical devices, and over-the-counter drugs) were approved in Japan, (out of which 15 products were approved in 2022)8.

In the life sciences sector, the pharmaceutical market, the medical device market, and the digital health market are expected to continue to expand. The pharmaceutical and medical device markets are particularly large, and the total market size in 2021 is estimated to be about 106.7 billion USD * (16 trillion JPY).9 (see "3. Attractive Markets" for more details)

The Japanese pharmaceutical market is the third largest in the world after the U.S. and China (Figure 2)10 and the sales figures are expected to remain the same from 2022 to 2027.11 Furthermore, it has been found that the per capita use of pharmaceutical is as high as that of Western Europe, indicating its high need in Japan. 12

In addition, the medical device sector is expected to grow continuously. The global market for medical device technology (including in vitro diagnostic medical devices, diagnostic imaging, and diabetes treatment devices) is estimated to grow at a CAGR of 3% over 10 years from 2022 to 2032, while the Japanese market for medical device technology is expected to grow at 5.5%. 13

Further development in the life sciences sector is expected as digitalization and the introduction of technologies using AI are accelerating.

It is expected that by 2024, Japan's digital health market (health system using information and communication technology) will be the fourth largest market in the world after China, the U.S., and India.14 The life science analytics (analytical technology in the field of life sciences) market is expected to expand at a CAGR of 12.3% between 2022-2032, and the market size in Japan will reach 3.2 billion USD by 2032.15 Not only technological development but also active encouragement and deregulation by the government is one of the factors driving digitalization in the life sciences sector.

-

*

Calculated based on the Bank of Japan exchange rate of 1 USD for 151.38 JPY (as of April 1, 2024)

References

- Statistics Bureau, MIC. Press Material: Statistical Topics No.138: Statistics on the Elderly Population in Japan [on the occasion of "Respect for the Aged Day"] (JP), pp. 4-5.

- See Note 1, pp. 4-5.

- OECD. OECD Health at a Glance 2023 Country Note Japan, p. 2.

- Ministry of Health Labour and Welfare (MHLW). Trends in Medical Expenditure in FY 2022 (JP), p. 6.

- IQVIA. IQVIA MARKET PROGNOSIS 2023-2027 Japan, p. 8.

- MHLW. Approved drugs for the treatment of COVID-19 (as of April 1, 2023) (JP).

- Pharmaceuticals and Medical Devices Agency (PMDA). About Business Performance in FY 2022 and Future Initiatives (JP), p. 4.

- IQVIA. PHARMACEUTICAL TRENDS Top 10 Pharmaceutical Markets Worldwide, 2022.

- MHLW. Statistics of Production by Pharmaceutical Industry for FY 2021 (JP).

- See Note 8.

- IQVIA. IQVIA Quarterly Pharmaceutical Market Outlook, p. 4.

- IQVIA. Global Use of Medicines 2023 Outlook to 2027, p. 18.

- Fact.MR. "Market Summary," Medical Device Technologies Market.

- Statista. Digital Health - Japan.

- Future Market Insights. Life Science Analytics Market Outlook (2022 to 2032).

-

Government Initiatives

Promoting Innovation Through Data Utilization, Early Drug Approvals, and Support for Pharmaceutical Startups

-

Attractive Markets

The Five Attractive Markets in the Life Sciences Industry

-

(1)

Pharmaceuticals: Foreign companies active in the steadily growing market

-

(2)

Medical Devices: Expanding demand in the market estimated as the world’s fourth largest

-

(3)

Regenerative Medicine: Practical application promoted through institutional development

-

(4)

Digital Health: Advancing collaboration across a wide range of areas

-

(5)

Nursing Care: Continuous growth expected with an aging population

-

Life Science Report

You can download the whole report on the webpage free of charge. Please simply fill out the form below to get information on promising industries in the Japanese market. Download now and use the information for your success in business.

-

- Business Expanding

- Biotechnology & Life Science

- USA

BioLabs Global, a Provider of Life Science Incubation Facilities, Establishes an Office in Tokyo

-

- Business Expanding

- Biotechnology & Life Science

- Osaka city

- USA

Prodrome Sciences Establishes Japanese Subsidiary to Advance Global Health Initiatives Bridging Science and Community Care

-

- Business Expanding

- Biotechnology & Life Science

- Digital & AI

- 対日投資_産業(英)

- Korea

The medical AI startup AITRICS has established an office in Tokyo, Japan

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices