In Japan, where people have secure access to quality healthcare, the national healthcare expenses and the elderly population are at record highs. Additionally, the market is expected to grow further, driven by the increasing adoption of digital and AI-based technologies and the promotion of innovation by the government.

Life Science

Attractive Markets

- (1)Pharmaceuticals: Foreign Companies Active in the Steadily Growing Market

- (2)Medical Devices: Expanding Demand in the Market Estimated as the World’s Fourth Largest

- (3)Regenerative Medicine: Practical Application Promoted Through Institutional Development

- (4)Digital Health: Advancing Collaboration Across a Wide Range of Areas

- (5)Nursing Care: Continuous growth expected with an aging population

(1) Pharmaceuticals: Foreign Companies Active in the Steadily Growing Market

In addition to its size, the Japanese pharmaceutical market is characterised by the significant role played by foreign companies. The focus on follow-on products and Contract Manufacturing Organization (CMO)/ Contract Development and Manufacturing Organization (CDMO) is also high, and foreign companies can be expected to enter the biopharmaceutical market, which is likely to lead the market in the future.

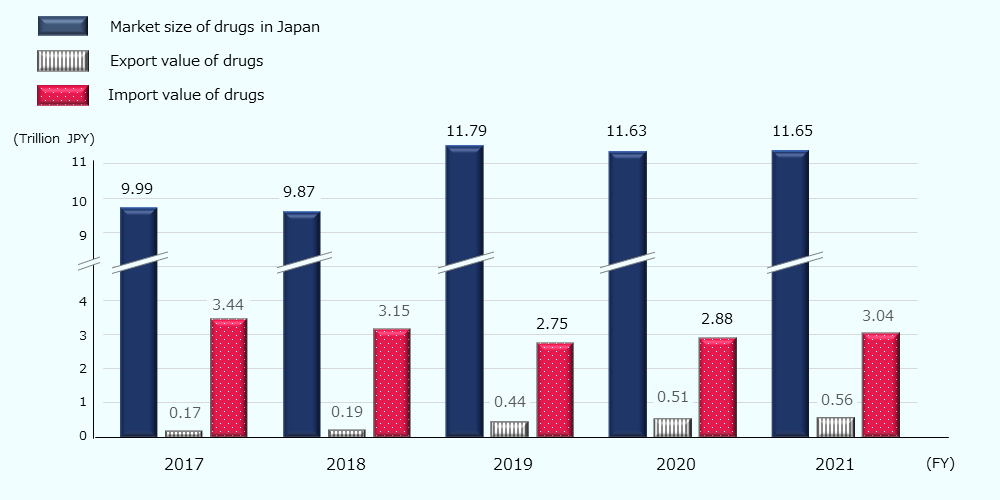

In 2021, the domestic pharmaceutical market (the size of drugs expected to be consumed in Japan) is estimated to be about 78 billion USD * (about 11.7 trillion JPY). The market size is on an increasing trend, driven by an increase in domestic production value (Figure 8).

Figure 8: Trends in market size and export and import value of drugs (Japan)

Source: Created by JETRO based on Statistics of Production by Pharmaceutical Industry by MHLW 42

In addition, foreign companies have a large presence in the domestic pharmaceutical market and several foreign companies, including AstraZeneca (U.K., 4th), MSD (U.S., 5th), and Pfizer (U.S., 10th), were among the top 20 pharmaceutical companies in terms of sales (at the distributor level) in FY 202243 ,and 76% of the top 70 pharmaceuticals sold in Japan are manufactured by foreign companies.44

In this market, biopharmaceuticals are attracting attention as one of the industries that will drive the domestic market in the future. The Cabinet Office aims to increase the domestic market size of the biopharmaceutical and regenerative medicine industry from about 10 billion USD* (1.5 trillion JPY) in 2020 to more than about 22 billion USD* (3.3 trillion JPY) in 2030, focusing on expanding the bio-related market.45

However, about 90% of antibody drugs sold in Japan are manufactured overseas, and the country is highly dependent on overseas production sites. The reasons for the low domestic manufacturing rate are the lack of human resources capable of setting up biopharmaceutical manufacturing processes and the low number of biopharmaceuticals developed by Japanese pharmaceutical companies.46 Therefore, collaboration with foreign companies to solve the shortage of human resources and the entry of foreign pharmaceutical companies that can develop biopharmaceuticals in Japan are expected.

The government, which is promoting the marketing of generic drugs, is also working to promote the use of biosimilars for biopharmaceuticals. In collaboration with various entities including medical professionals and insurers, it aims to increase the number of ingredients replaced by biosimilars by at least 80% (on a volume basis) to at least 60% (on an ingredient basis) of the total number of ingredients by the end of FY 2029. Increased replacement with biosimilars will enable the provision of biopharmaceuticals with efficacy and safety at lower prices, which is expected to reduce patient burden and improve healthcare insurance financing.47 Some products are manufactured by foreign companies such as Sanofi (France), Pfizer (U.S), and Viatoris (U.S), and their entry into the market is expected to increase in the future.48

In addition, because biopharmaceuticals require technologies and know-how that differ from those of conventional pharmaceuticals and development costs are high, the horizontal division of labor in which manufacturing and development are outsourced to Contract Manufacturing Organization (CMO)/ Contract Development and Manufacturing Organization (CDMO) is advancing internationally.49 In Japan, businesses are expanding into various biomodalities, including increased investment in antibody production facilities and new entrants from different industries.

Business alliances and acquisitions with foreign companies have also been increasing in the Contract Development and Manufacturing Organization (CDMO) business of the biotechnology field, and the recent trends include Fujifilm's acquisition of Atara Biotherapeutics (U.S.) to enter the CDMO business of cell therapy50, AGC's (Japan) acquisition of Novartis (Switzerland) to expand the CDMO business of gene therapy51, and Asahi Kasei's (Japan) acquisition of Bionova Scientific (U.S.) to enter the CDMO business of antibody therapy.53

(2) Medical Devices: Expanding Demand in the Market Estimated as the World’s Fourth Largest

The medical device market in Japan, one of the largest in the world, is expected to continue to grow. Additionally, due to the high percentage of imports and the fact that some companies support domestic sales to foreign manufacturers, it seems easy for foreign companies to enter the Japanese medical device market. In 2021,the domestic medical device market (the size of medical devices consumed in Japan) is estimated to be about 28.7 billion USD* (4.3 trillion JPY) (Figure 954 and is estimated to have the fourth market size after U.S, China and Germany by 2024.55

Figure 9: Trends in market size and export and import value of medical devices (Japan)

Source: Created by JETRO based on Statistics of Production by Pharmaceutical Industry by MHLW 52

The shipment value of medical devices is expected to expand at a CAGR of 1.8% from 2023 to 2027. It is estimated that the demand for medical devices, especially consumables, such as products related to cardiology and orthopedic surgery, will increase due to the elderly population.56

While the market size is large, in 2021 medical device imports amounted to about 18 billion USD * (about 2.7 trillion JPY) and imports account for more than 60% of the market.57 While Japan possesses strengths in diagnostic equipment, many medical devices are imported, so it can be assumed that there are many situations where treatments are carried out using medical devices manufactured overseas.58

Amid such situations, there are examples of collaboration among companies aiming to support overseas medical device manufacturers' entry into Japan.

Recent examples include the business alliance between Century Medical, a subsidiary of ITOCHU Corporation, and A2 Healthcare Corp. (both in Japan) which aims to provide medical device manufacturers, including overseas manufacturers, with comprehensive support for medical device sales, from market research to regulatory application and domestic sales in Japan59,and the business alliance between ECLEVAR MEDTECH (France), a contract research organization and Micron (Japan), to strengthen support for overseas medical device manufacturers' expansion into Japan and Japanese medical device manufacturers' expansion into overseas markets.60 Both companies provide consistent marketing support for medical devices to overseas manufacturers, from market research in Japan to regulatory application and domestic sales.

(3) Regenerative Medicine: Practical Application Promoted Through Institutional Development

The domestic regenerative medicine market is expected to grow rapidly due to institutional development and policy support. The commercialization of regenerative medicine products and partnerships between Japanese and foreign companies in the Contract Development and Manufacturing Organization (CDMO) business can also be seen.

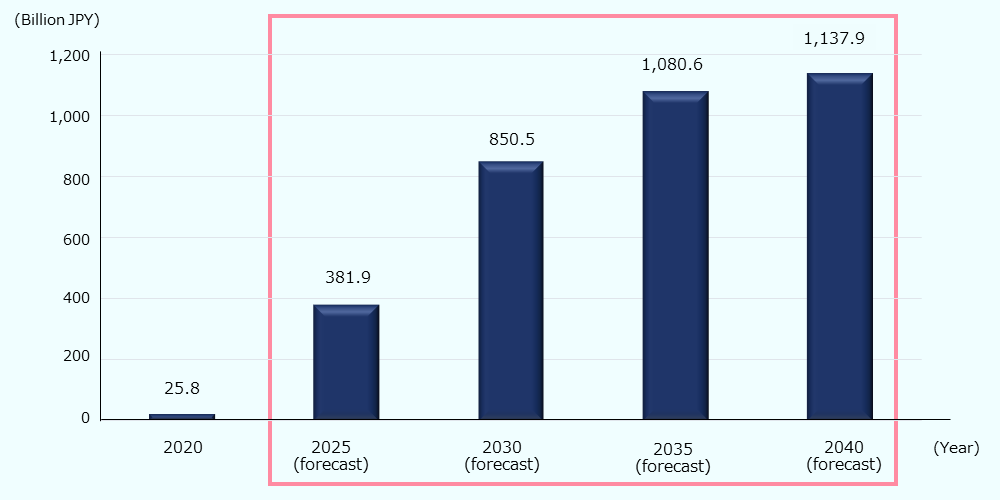

Regenerative/cellular medicine and gene therapy are expected to be new treatment options and drug discovery tools in clinical practice, and the global market size is expected to rapidly expand the size to 18.7 times in 20 years from 2020 to 2040.61

As the global market expands, the Japanese government is promoting the practical application and social implementation of regenerative/cellular medicine and gene therapy. Based on the success of creating human iPS cells by Professor Shinya Yamanaka of Kyoto University, who won the Nobel Prize in 2012, comprehensive support from basic research to the practical application has been provided through the AMED, including about 0.73 billion USD* (110 billion JPY) over 10 years (under the jurisdiction of the Ministry of Education, Culture, Sports, Science and Technology) and the world's first clinical research has also been initiated.62 he budget has been requested for regenerative/cellular medicine and gene therapy projects for FY 2024 as well.63

The government is promoting the industrialization of regenerative/cellular medicine and gene therapy, as well as the development of related technologies (Advanced drug discovery support tool base technology, high gene therapy manufacturing technology, human cell processing product manufacturing base technologies)64, and the market is expected to expand rapidly in Japan, which has a well-developed foundation in this field. In particular, it is estimated that treatments for cancer, central nervous system, and eye diseases will drive market expansion, and based on pipeline estimates, the domestic market is expected to reach about 2.5 billion USD* (about 380 billion JPY) by 2025 and about 7.6 billion USD* (about 1.14 trillion JPY) by 2040 (Figure 10).65 Based on the number of papers published in this area, METI estimates that the Japanese market will worth about 6.7 billion USD* (about 1 trillion JPY) in 2040.66

Figure 10: Regenerative medicine and gene therapy market (Japan)

Source: Created by JETRO based on data by AMED 67

As of April 2023, 19 products have been approved as regenerative medicine products (commercialization) by the Pharmaceuticals and Medical Devices Agency (PMDA). Manufacturers and distributors holding regulatory approval include several foreign companies, such as Bristol Myers Squibb (U.S), Novartis Pharmaceuticals Corporation (Switzerland), and Janssen Pharmaceutical (Belgium)68 , indicating that foreign pharmaceutical companies are increasingly entering the market. In addition, Teijin (Japan) and Resilience US, Inc. (U.S.) recently formed a business alliance to mutually support the overseas expansion of Contract Development and Manufacturing Organization (CDMO) business in the regenerative medicine field69, and it is expected that the presence of foreign companies in the same area will increase.

(4) Digital Health: Advancing Collaboration Across a Wide Range of Areas

The rapidly advancing digital technology is also causing a paradigm shift in the healthcare industry. Unlike conventional company-led and treatment-oriented services, services are being developed based on the individual patient's characteristics, covering a wide range of subjects, including pre-symptomatic health maintenance, disease prevention, diagnosis and treatment, prevention from severe illness, and nursing care. 70

Representative areas of digital health include SaMD, Digital Therapeutics (DTx), AI-based drug discovery, electronic prescriptions, AI analysis of medical images, online medical care, and personal health record (PHR) for health maintenance and treatment advancement. The digital healthcare industry, which is likely to be introduced in various fields, is expected to boom.71 Recently, there has been an increasing focus on medical big data and RWD and its use for new drug development, marketing, and insurance product development has also advanced.

The domestic digital health market is expected to expand exponentially due to private sector R&D and government support. The market size in 2022, which was 13.12 billion USD, is expected to grow at a CAGR of approximately 20% and reach 53.1 billion USD by 2030. 72

One of the areas in this field that is attracting particular interest is SaMD. It is expected to be effective in addressing issues in the medical field and improving healthy life expectancy, and active efforts are underway to promote its practical application. In 2023, the MHLW and the METI have formulated guidelines on regulatory approval and marketing methods for SaMDs to the general public, and it is expected that their market introduction will accelerate. The guidelines also implement new measures such as support for Japanese SaMD developers to improve their business environment overseas, which will increase opportunities for collaboration between Japanese and foreign companies.73 In FY 2021, the domestic shipment value of SaMD was about 22.66 million USD* (3.4 billion JPY)74, and considering the market value of medical devices is not much today, further development is expected with the launch of a variety of SaMD products that will address social issues, such as reduced medical and nursing care expenses and reform in the working style of medical professionals.

Furthermore, in response to COVID-19, online medical care and telemedicine have been introduced. Following the revision of the guidelines in 2023, the requirements for online medical care for an initial consultation, identification process, and pre-consultation for diagnosis have been clearly defined, improving convenience.75 In addition, with the establishment of the electronic prescription delivery system in 202376,the further development of telemedicine as one of the market elements in the rapidly developing digital health sector is attracting attention. the use of telemedicine is expected to increase in hospitals and clinics, home healthcare, patient monitoring, etc., due to government policies, elderly population, a shortage of healthcare professionals, and technological advancement, and as a result, the telemedicine market in Japan is expected to expand from about 3.78 billion USD in 2022 to about 14.89 billion USD in 2030.77

Among the various areas of discussion, there are many examples of foreign companies collaborating and entering the digital health field. In the DTx field, Canary Speech, Inc. (U.S), a developer of technology that analyzes diseases and human conditions by speech, has started research and development of an algorithm to support dementia diagnosis using digital devices with electronic component manufacturer SMK (Japan) and the National Cerebral and Cardiovascular Center (Japan).78 In the telemedicine field, Philips (Netherlands), a foreign medical device manufacturer, is introducing Japan's first telemedicine system using IoT, which is expected to solve problems in medical fields where specialists are insufficient.79 In the field of medical data, such as RWD, a collaboration between Japanese companies and foreign companies is advancing, For example, Real World Data (Japan) and Aetion Inc. (U.S.) are promoting the use of data for drug discovery80, and National Cancer Center Hospital East (Japan) and Flatiron Health (U.S.) are jointly researching to build a real-world database of patients with gastrointestinal cancer.81 About the introduction of ICT in medical fields, Perspectum (U.K), which develops AI diagnostic imaging systems, and Clairvo Technologies, a 100% Marubeni subsidiary (Japan) are developing software to support the diagnosis of non-alcoholic fatty liver disease and hepatitis through a business alliance.82

(5) Nursing Care Services

It is expected that the nursing care market will continue to grow due to the increase in long-term care expenditures as the elderly population increases. Furthermore, various businesses are being developed along with the use of technology in the field of nursing care.

It is estimated that the percentage of the elderly population aged 65 and above will exceed 30% by 2030. 83 Therefore, a large amount of budget has been allocated to support the lives of the elderly, and efforts are being made to enhance nursing service, manage the nursing care insurance system, and revitalize the market for the elderly.84

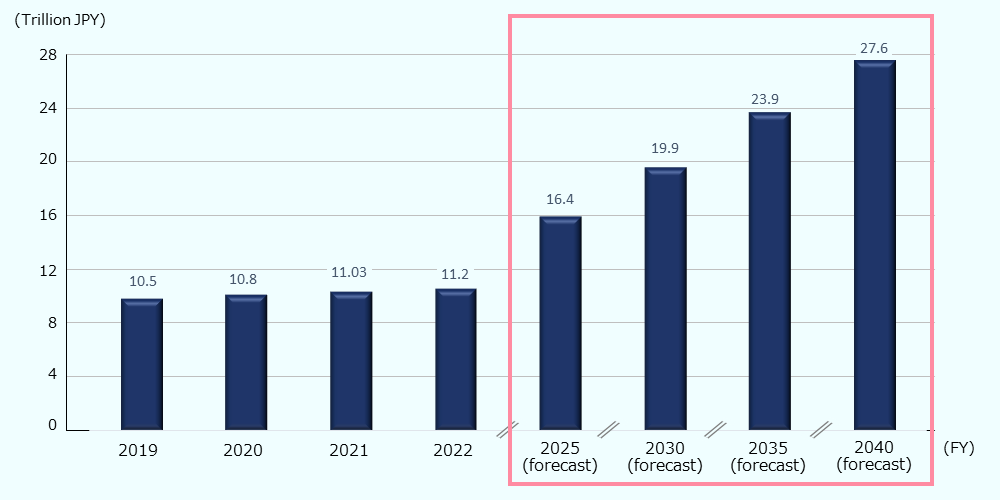

Along with the aging of the population, the long-term care expenditures (the total cost including preventive care services, in-home nursing care, and institutional nursing care) have been increasing annually, and it amounted to about 74.6 billion USD* (11.2 trillion JPY) in FY 2022.85 As per the forecast based on the Insured long-term care service plans, long-term care expenditures in FY 2040 will be about 183.9 billion USD* (27.6 trillion JPY), or 3.5% of GDP (Figure 11).86 The Japanese nursing care market is expected to expand further, driven by the aging of the population and government support.

Figure 11: Trends and forecasts of long-term care expenditures in Japan

Source: Created by JETRO based on data by the MHLW 87

In addition, the entry examples of foreign companies into the domestic nursing care market show that new services are being created as digitalization progresses. Those include a business alliance between Homage (Singapore), a foreign company engaged in the matching business for human resources for nursing care and Infocom (Japan) for developing an IT-based human resources business for the nursing care field88, a collaboration between DeNA, Allm, Sompo Light Voltex (all Japanese companies) and TytoCare Ltd. (Israel), a foreign company engaged in the medical ICT business, for developing medical support equipment in the field of nursing care89, and the entry of Voxela (U.S), a technology company providing nursing care management services using AI, into the Japanese market.90 It is expected that opportunities for foreign companies to expand into the growing Japanese nursing care market will continue to grow.

-

*

Calculated based on the Bank of Japan exchange rate of 1 USD for 151.38 JPY (as of April 1, 2024)

References

- MHLW. Statistics of Production by Pharmaceutical Industry for FY2021 (JP), Table 1, 24, 28.

- IQVIA. IQVIA Pharmaceutical Market Statistics: Sales Data Period: 2022 April–2023 March (JP), p. 2.

- OPIR. Seeing the Pharmaceutical Industry Nationality of the Company Creating the Top Products in Pharmaceutical Sales in the Japanese Market (JP), p. 2.

- Office of Healthcare Policy, Cabinet Office. Market Domain (6) Roadmap: Market Domain Name: Biopharmaceuticals, Regenerative Medicine, Cell Therapy, and Gene Therapy-Related Industries (JP), p. 2.

- METI. Strengthening Bio-CMO/CDMO (JP), pp. 3, 5, 11.

- MHLW. Promoting the use of generic drugs and biosimilars (JP).

- Japan Biosimilar Association. Biosimilars approved in Japan [updated February 8, 2024] (JP).

- METI. Strengthening Bio-CMO/CDMO (JP), pp. 3, 5, 11.

- Fujifilm. Official website.

- AGC. Official website.

- MHLW. Statistics of Production by Pharmaceutical Industry for FY 2021 (JP), Table 32, 37, 41.

- Asahi Kasei. Official website.

- See Note 52.

- Statista. "Global Comparison," Medical Devices – Worldwide.

- Industry Research Department, Mizuho Bank. Medical Device Industry Trends (JP), p. 4.

- See Note 52, Table 41.

- METI. Second Medical Device and Healthcare Development Council Meeting: Document Submitted by the METI (JP), p. 2.

- A2 Healthcare. Official website (JP).

- ECLEVAR MEDTECH. Official website.

- METI. Development Project for Infrastructure Technologies Aimed at the Industrialization of Regenerative Medicine and Gene Therapy: Interim Evaluation/Completion Evaluation Supplementary Explanatory Material (JP), p. 19.

- Council for the Development of Regenerative/Cellular Medicine and Gene Therapy, Cabinet Office. Future initiatives in the field of regenerative/cellular medicine and gene therapy (JP), pp. 3-4.

- Cabinet Office. Points of R&D Budget in Medical Sector in FY 2024 (JP).

- See Note 61, p. 3.

- AMED (prepared on contract by Arthur D. Little Japan). Market Research Project for Regenerative Medicine and Gene Therapy in FY 2019: Final Report (JP), pp. 118-119.

- See Note 61, p. 19.

- AMED (prepared on contract by Arthur D. Little Japan). Market Research Project for Regenerative Medicine and Gene Therapy in FY 2019: Final Report (JP), pp. 118-119.

- Prime Minister's Office of Japan. Approved Regenerative Medicine Products (as of April 1, 2023) (JP).

- Teijin. Official website.

- Nomura Research Institute. Digital Health Heading into an Expansion Phase (JP).

- See Note 70.

- insights10. "Summary Report," Japan Digital Health Market Analysis.

- MHLW and METI. Practical Application Promotion Package Strategy 2: Promoting Practical Application and International Development of SaMD (JP), pp. 3-4.

- MHLW. Statistics of Production by Pharmaceutical Industry for FY 2021 (JP), Table 33.

- MHLW. Summary of Guidelines for the Appropriate Implementation of Online Medical Treatment, pp. 1-4.

- MHLW. Overview of Law Partially Amending Law on Securing Quality, Efficacy, and Safety of Pharmaceuticals and Medical Devices (JP).

- insights10. Japan Telemedicine Market Analysis: Report Summary.

- SMK. Official website.

- JETRO. Official website.

- Real World Data. Official website.

- Flatiron. Official website.

- Marubeni. Official website.

- Cabinet Office. "Status of the Ageing Population," White Paper on Ageing Society 2023, Chapter 1 (JP), p. 3.

- Cabinet Office. "Reference: Budget Related to Measures for Ageing Society," White Paper on Ageing Society 2023 (JP).

- MHLW. Summary Report of Statistics of Long-term Care Benefit Expenditures in FY 2022 (JP), p. 7.

- MHLW. Future Prospects for Nursing Care Expenditure (JP).

- See Note 85 and MHLW. Summary Report of Statistics of Long-term Care Benefit Expenditures in FY 2022 (JP), p. 7.

- Infocom. Official website.

- DeNa. Official website (JP).

- Voxela. Official website.

-

Overview

The Life Sciences Sector of Japan Is Expected to Expand Due to the Elderly Population, the Promotion of Innovation, and the Introduction of Digital Technologies

-

Government Initiatives

Promoting Innovation Through Data Utilization, Early Drug Approvals, and Support for Pharmaceutical Startups

In this report, we focus on the following five government initiatives in the life science industry:

-

(1)

Utilizing data and AI in medical, nursing care, and healthcare

-

(2)

Early approval of pharmaceuticals and medical devices

-

(3)

Promoting new drug discovery

-

(4)

Supporting pharmaceutical startups

-

(5)

Supporting the entry of foreign companies in regions

-

Life Science Report

You can download the whole report on the webpage free of charge. Please simply fill out the form below to get information on promising industries in the Japanese market. Download now and use the information for your success in business.

-

- Business Expanding

- Biotechnology & Life Science

- USA

Cellares, an integrated development and manufacturing organization specializing in clinical and industrial-scale cell therapy manufacturing, plans to establish a smart factory in Kashiwa, Japan

-

- Business Expanding

- Biotechnology & Life Science

- Korea

AIRS Medical, a Korean startup who develops an AI-based MRI image reconstruction software that reduces scanning time and improves image quality at the same time, enters the Japanese market

-

- Business Expanding

- Biotechnology & Life Science

- Korea

Doctornow, a company that develops and operates a platform for online doctor consultations, establishes an office in Tokyo

E-mail newsletter subscription

Our E-mail newsletter introduces the latest investment environment information and the trends of foreign companies supported by JETRO. It includes information about seminars by local governments, incentives, examples of setting up business in Japan, topics of deregulation, and introduction of industries.

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices