The Japanese government is working together with private corporations to invest in digitalization. A wide range of foreign companies are also entering the Japanese market, attracted by the size of the market and Japan's advanced infrastructure. With the strong support from the government for digitalization, the overall market size is continuing to grow.

Digital Technology

Attractive Markets

- (1) AI: Increasing Public and Private Investment

- (2) Cybersecurity: Remarkable Overseas Presence in the Japanese Market

- (3) Virtual Space (Metaverse): Business Opportunities in Societal Implementation

- (4) Web3.0: An Improving Business Environment

- (5) Fintech: The Significant Roles of Foreign Companies

(1) AI: Increasing Public and Private Investment

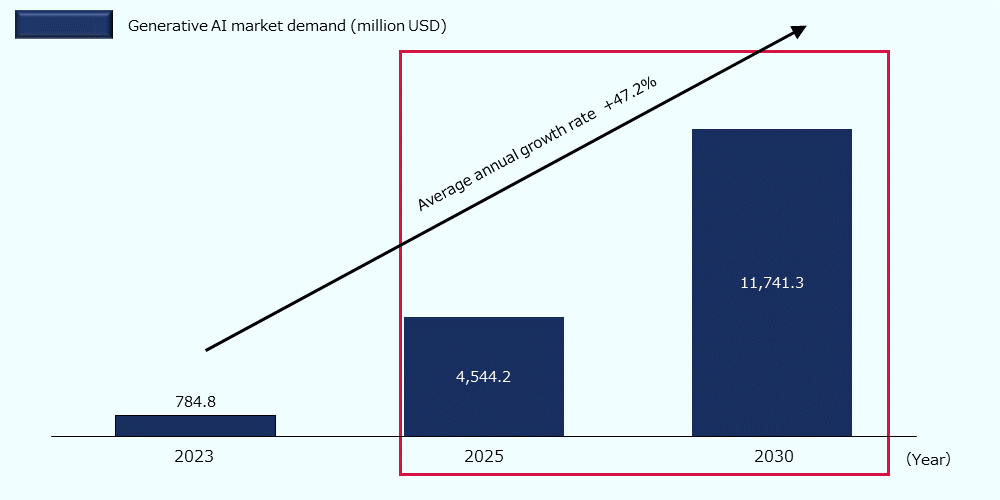

The Japanese AI market is expanding as AI services grow rapidly and the government increases AI related expenditure. Generative AI is gaining more attention. Domestic demand is expected to grow rapidly from 780 million USD* (118.8 billion JPY) in 2023 to 11.74 billion USD* (1,777.4 billion JPY) in 2030, with an average annual growth rate of 47.2% (Figure 5).

Figure 5: Demand forecast in Japan's generative AI market (FY 2023-30)

Source: Created by JETRO based on data from Japan Electronics and Information Technology Industries Association (JEITA) 29

The Japanese government is also enacting policies in the AI sector. The government's budget for AI in 2023 was 750 million USD* (113.8 billion JPY), with the budget increasing year by year, and efforts are being made to promote AI usage, research and development of foundation models, and risk management.30 In addition to enhancing competitiveness in the AI sector, the government is working vigorously to establish a stable supply of foundational cloud services in Japan in light of recent uncertainties.31

The versatility of generative AI has resulted in a rise in both domestic investment and the number of foreign companies entering the market. Examples of foreign companies entering the market include OpenAI (U.S.), a developer of large-scale language models (LLM), which established its first Asian base32 and NVIDIA (U.S.), which specializes in GPUs (semiconductor chips needed for image and video rendering) and established a development base.33

Major Japanese companies are partnering with overseas companies to promote and develop AI services – Japanese companies with financial resources and expertise on Japan's unique landscape are partnering with foreign companies with technological capabilities, to develop various services. For example, Fujitsu and Cohere (Canada) have teamed up to develop a Japanese-language LLM.34 Another example is the collaboration between SG Holdings, Sagawa Express, Sumitomo Corporation and the robot AI developer Dexterity (U.S) for the demonstration of AI-equipped loading robots.35

As seen above, foreign companies are starting to enter the Japanese market for AI-related development and demonstrations. Additionally, with widespread adoption of AI in various fields, including support for business operations, product development, and creative activities, the demand for related software and hardware products is expected to grow. In the service and manufacturing industries, there are still several operations that rely on human labor, and foreign companies with advanced digital technologies will have abundant opportunities for collaboration.

(2) Cybersecurity: Remarkable Overseas Presence in the Japanese Market

Cyberspace is becoming increasingly public, interconnected and interrelated, with personal and corporate information and human interactions starting to shift to the cloud.36 However, the ever-increasing competition between companies and countries with regards to the economy, military, and technology is forcing the Japanese government to take measures against cyber-attacks that can have a significant impact on companies' production activities and national security.

Japan has always prioritized cybersecurity and is relatively advanced when it comes to initiatives related to cybersecurity. The International Telecommunication Union's (ITU) 2020 Global Cybersecurity Index, which evaluates countries' cybersecurity related efforts, ranked Japan 7th overall and 3rd in Asia among 193 countries worldwide.37 The domestic cybersecurity market is also expanding year by year. It reached 9.66 billion USD* (1,462.8 billion JPY) in 2022 and is expected to grow at an annual rate of 8-9% over the next few years. In addition, companies expanding into Japan are responding to the various developments in cybersecurity in recent years, such as the spread of the concept of Zero Trust (performing security checks for anyone trying to access information assets, whether from inside or outside the network), the spread of multi-device services such as IoT, the expansion of cloud services due to remote work, the emergence of generative AI, and daily updates to security guidelines and legal revisions.38

Foreign-affiliated companies with diverse cybersecurity solutions and technologies are developing their own products and services in partnership with Japanese companies in a variety of industries (Figure 6).

As mentioned earlier, the expanding security needs, the need to respond to possible new threats, and regulatory reforms in line with these needs, are expected to fuel the demand in the cybersecurity market. In addition, the government has allocated 1.406 billion USD* (212.8 billion JPY) in its FY 2024 budget for cybersecurity, aiming to strengthen security at each ministry and agency. Initiatives are being taken to improve security nationwide, and business opportunities in this field are expected to increase in the future.39

Figure 6: Successful cases of security-related foreign companies entering Japan and collaborating with local companies

| Foreign Companies | Overview |

|---|---|

|

Stealien (Korea) |

|

|

Robust Intelligence (U.S.) |

|

|

Axonius (U.S.) |

|

|

Cato Networks (Israel) |

|

|

Allot (Israel) |

|

(3) Virtual Space (Metaverse): Business Opportunities in Societal Implementation

The domestic market for virtual space (metaverse) is expected to exceed 19.82 billion USD* (3 trillion JPY) by FY 2028,41 and the number of users is expected to reach approximately 17.5 million by 2030.42 It is a promising market with the potential to leverage Japan's strength in abundant IP content and the formation of a creator economy. In Japan, leading companies in the gaming industry, including Sony and Nintendo, drive the gaming hardware market, and several startups that develop platforms and content, are entering the market. In addition, platforms operated by foreign companies such as The Sandbox and Fortnite are being used by several domestic companies and local governments for public relations purposes. An increasing number of companies and organizations are focusing on platforms operated by foreign companies with a large global userbase, using it for self-promotion and attracting tourism.

Digital twins, which recreate the real world in a virtual space based on data collected from the real world, are being considered for a wide range of applications, including design, simulation, and monitoring. The government collects and measures data such as topography and buildings in each city, mainly for urban development and disaster prevention, and converts it into 3D models and open data.43 Meanwhile, the private sector has begun to utilize the system mainly for process optimization in the manufacturing industry. There are also examples of applications in fields such as building 3D models of products to identify unpredictable defects in the manufacturing process, and modeling human movement and posture to help set indicators that consider the work environment and mental load. In addition to the increasing utilization in the manufacturing industry, the potential of virtual spaces in other industries is being recognized, such as banking and financial services, driven by expectations for technology transfer and operational efficiency improvements. However, while companies are collecting data through multiple devices when using digital twins, many are facing challenges in developing and implementing integrated platforms for data aggregation and execution planning software that optimize data linkage. Therefore, there is a growing need for collaboration with foreign companies that have strengths in these areas, as well as securing talent capable of system development.44

The introduction and application of metaverse is also attracting attention in terms of public relations for products and services, as well as risk prevention, including disaster prevention and defect detection. To create an attractive business and investment environment, the government is considering forming a common understanding with other countries, ensuring interoperability, and developing guidelines for businesses.45 Aligning system design and environmental improvements with global standards is likely to support the entry of foreign companies into the Japanese market.

(4) Web3.0: An Improving Business Environment

Following Web 1.0, which made the transmission and reception of information possible, and Web 2.0, which made progress in the aggregation of information, including big data, Web 3.0 now uses blockchain technology to process information in an autonomous and decentralized manner. This has improved information security and has helped create new services which use crypto assets and non-fungible tokens (NFTs), and bring about changes in consumer activities and asset formation (token economy).46

Government initiatives for Web 3.0 include undertaking cross-border projects and creating flexible regulations that facilitate innovation.47 While Japan was one of the first countries to introduce regulations on crypto assets, it is also taking steps to ensure that those regulations do not become a hindrance to innovation. These steps include providing tax benefits, such as a system that exempts long-term ownership of crypto assets by corporations from taxation based on certain requirements48, and promoting Web 3.0-related startup investment by allowing crypto assets to be acquired and held by Investment Limited Partnerships (LPS)49.

The government's positive attitude towards Web 3.0 is contributing to an increase in the number of foreign blockchain startups entering the Japanese market in recent years. Japanese companies and institutions are developing services in collaboration with foreign-affiliated companies that possess highly specialized technologies and can flexibly respond to changes in Japan's regulatory environment and market conditions. Examples include dApp Technology (Canada) establishing its Japanese subsidiary,50 and the strategic alliance between Fujitsu and SettleMint (Belgium).51 Such opportunities for business collaboration are predicted to increase in the future.

(5) Fintech: The Significant Roles of Foreign Companies

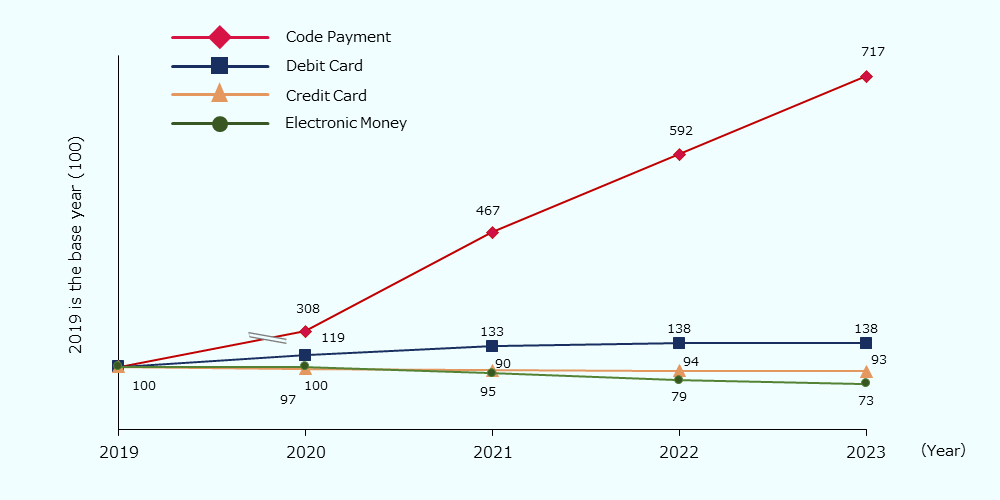

Digitalization in Japan's financial sector has significant growth potential, and the market is forecast to continue growing. Japan has a strong preference for using physical cash for payments due to the country's public safety, well-developed cash infrastructure system, and high credit card transaction fees.52 Therefore, the cashless payment ratio in 2023 was merely 39.3%. However, the rate of cashless payments is on the rise, and payment methods are becoming more diversified. Especially after the COVID-19 pandemic, the use of code payments has increased significantly (Figure 7).

Figure 7: Changes in the proportion of different payment methods within total cashless payment amounts in Japan (%, with 2019 as the base year)

Source: Created by JETRO based on data from the METI53

At present, the use of cloud services by financial institutions is mainly for operations that are not related to customer information or transaction operations. Future focus will likely shift towards implementing cloud solutions for core systems, such as accounting systems. In the process of adoption, challenges such as expanding availability and cost have been raised.54 There is a demand for products and services that can broadly address the specific needs of financial institutions and improve the efficiency of system implementation, maintenance, and operation.

FinTech adoption is also spreading among small and medium-sized enterprises (SMEs). With the introduction of the Invoice System (a system which allows the buyer to deduct purchase tax if the seller accurately records the applicable tax rates and consumption tax amounts on the receipt) in 2023, the government has established subsidies for the introduction of accounting and transaction software and hardware for SMEs and small businesses.55 Given that integration with the national electronic tax filing and payment system (e-Tax) is possible56, the use of cloud-based accounting software is projected to increase.57

The government is encouraging the use of FinTech as described above and actively supporting the entry of FinTech businesses into the Japanese market. The Financial Services Agency (FSA) established an innovation promotion office in 2022 to set up a support desk for FinTech-related regulations and to support the creation of innovative business opportunities. For foreign companies, it also set up a contact point for opening offices and organized business matching events.58

With the expansion of the FinTech market, recent years have seen the entry of foreign companies into this market, especially those related to remittances and payments. PayPal (U.S.), a major payment service provider, acquired the Japanese startup Paidy, which provides a payment platform allowing online shopping to be completed via convenience store payments and bank transfers. Japan's e-commerce (B2C) market size, which is approximately 92.48 billion USD* (14 trillion JPY)59, along with Paidy's unique payment services and its large number of accounts and affiliated merchants, are considered the key factors behind the acquisition.60 Additionally, the FinTech startup Wise (U.K.) offers a service that enables international money transfers at exceptionally low fees. In Japan, there is no upper limit on the transaction amount for international money transfers, but it generally incurs fees of over 7%. Wise, which charges only one-tenth of that fee, entered the market likely due to the significant demand potential.61

As mentioned above, there are examples of market entry through partnerships with businesses already operating in Japan or by offering services with advantages that are difficult for domestic companies to provide. With government support, an open environment for FinTech companies is being fostered.

-

*

Calculated based on the Bank of Japan exchange rate of 1 USD for 151.38 JPY (as of April 1, 2024)

References

- Japan Electronics and Information Technology Industries Association (JEITA). JEITA Announces Global Demand Forecast for Generated AI (JP).

- Cabinet Office. AI-Related Budget in FY 2024 Budget Request (JP), p. 2.

- Ministry of Economy, Trade and Industry (METI). Approval of Plans for Ensuring a Stable Supply of Cloud Programs under the Economic Security Promotion Act.

- OpenAI Japan. Introducing OpenAI Japan.

- NVIDIA. NVIDIA to Help Elevate Japan's Sovereign AI Efforts Through Generative AI Infrastructure Build-Out.

- JETRO. Canadian generative AI startup Cohere signs strategic partnership with Fujitsu (JP).

- Sagawa Express. Becoming the first industry to solve Labor Shortages through AI-equipped loading robots (JP).

- National center of Incident readiness and Strategy for Cybersecurity (NISC). Japan's Cybersecurity Strategy 2021 (Overview), p. 1.

- International Telecommunication Union (ITU). Global Cybersecurity Index 2020, pp. 25, 29.

- Japan Network Security Association (JNSA). Japanese Information Security Market: 2023 Survey Report (JP), pp. 8, 11.

- NISC. Government cybersecurity budget (JP), p. 1.

- Press releases from the respective companies

Stealien. [Korean Cybersecurity Firm Challenging the World] (12) Stealien (KR).

Robust Intelligence. Robust Intelligence Teams Up with Tokio Marine to Help Japanese Companies Use AI.

Macnica. Visualizes and analyzes information from multiple tools to support appropriate security measures.

Cato Networks. Cato Networks, a leading vendor of the SASE platform, established a Japanese subsidiary to accelerate its penetration into the domestic market, establishing two PoP connection bases in Tokyo and Osaka to respond to the growing demand for cloud services, strengthen marketing and channel development (JP).

Allot. Japanese Broadband Provider Asahi Net Launches Allot Traffic Management Solution. - Nomura Research Institute (NRI). Transformation of ICT and media markets through digitalization (JP), p. 20.

- Ministry of Internal Affairs and Communications (MIC). Study Group on Realizing a Safe and Secure Metaverse (1st meeting) "Secretariat Material" (JP), pp. 4, 66.

- MIC. "Digital Twin," 2023 WHITE PAPER Information and Communications in Japan (JP),Chapter 1, Section 2.

- JETRO. Impact of changes in GVC [Metaverse Digital Twin (industrial applications)] (JP), p. 16.

- MIC. Study Group on Utilization of Metaverse in the Web 3 Era: Report Outline (draft) (JP), pp. 22-24.

- METI. Approach to Improving Web3.0 Business Environment (JP), p. 11.

- See Note 46, p. 40.

- METI. (3-5) Revision of Taxation on Year-End Fair Value Valuation of Crypto-Assets Held by Third Parties (JP).

- Ministry of Economy, Trade and Industry (METI). Cabinet Decision on the Bill for Partially Amending the Act on Strengthening Industrial Competitiveness and Other Acts to Create New Business and Encourage Investment in Industries.

- JETRO. dApp, a Blockchain System Developer from Canada, Establishes Japanese Subsidiary.

- Fujitsu. Fujitsu and SettleMint embark on global strategic agreement to accelerate enterprise blockchain technology.

- METI. Discussion by Study Group on the Future Direction of Cashless Payment Summarized, p. 24.

- METI. 2023 Ratio of Cashless Payment Among the Total Amount Paid by Consumers Calculated.

- Bank of Japan. Current Utilization and Challenges of Cloud Services in Financial Institutions (JP), pp. 2-7.

- TOPPAN Inc. (The organization for Small & Medium Enterprises and Regional Innovation, JAPAN and The Small and Medium Enterprise Agency). "Invoice quota (invoice-enabled type)," IT Introduction Subsidy 2024.

- National Tax Agency. "Frequently asked questions about e-Tax software (Web version)", National Tax Electronic Filing and Payment System(e-Tax) (JP).

- Ministry of Internal Affairs and Communications (MIC). Results of the Communications Usage Trends Survey of 2023 (JP), p. 6.

- Financial Services Agency (FSA). FSA’s Efforts to Promote Innovation (JP).

- Ministry of Economy, Trade and Industry (METI). Results of FY2022 E-Commerce Market Survey Compiled, p. 5.

- PayPal. PayPal to Acquire Paidy.

- Wise. WISE GRANTED TYPE 1 FUNDS TRANSFER SERVICE PROVIDER LICENCE IN JAPAN, READIES FOR NEXT PHASE OF GROWTH.

-

Overview

Japan's Digital Transformation Market Shows Solid Growth, Presenting Increased Growth Opportunities for Foreign-affiliated Companies

-

Government Initiatives

Implementing Wide-range Support, from Incentivizing the Development of Leading-edge Technologies to Promotion of Digital Transformation

The Japanese government envisions "Society5.0" as its goal - a society which aims to solve social issues through cutting-edge technology. In order to achieve such a society, it is providing multifaceted support, including revisions of existing regulations, cross-border and industrial data linkage, offering incentives for digital technology, and the attraction of overseas companies and talent.

Digital Technology Report

You can download the whole report on the webpage free of charge. Please simply fill out the form below to get information on promising industries in the Japanese market. Download now and use the information for your success in business.

-

- Business Expanding

- Biotechnology & Life Science

- Digital & AI

- 対日投資_産業(英)

- Korea

The medical AI startup AITRICS has established an office in Tokyo, Japan

-

- Business Expanding

- Digital & AI

- Yokohama city

- Vietnam

SOLAZU Holding, which offers data utilization, AI implementation, and business optimization solutions through its AI development support workflow, has established a Japanese subsidiary in Yokohama City, Kanagawa

-

- Business Expanding

- Digital & AI

- Hong Kong

Mercury Technology Solution Company Limited, a software development and digital consulting firm, has established an office in Chiyoda-ku, Tokyo

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices