Meet Japanese Companies with Quality

A System People Can Bank On Doreming IP

Website: Doreming![]()

Category: IT

Doreming’s pro-rata payroll system enables salaries to be used to pay for goods as soon as people work, reducing dependence on payday loans

Doreming offers an innovative service that provides businesses with a solid HR platform and enables workers to receive pro-rata payments, easing cash flow problems for those who find themselves trapped by limited salaries and payday loans, particularly in developing countries.

Even as the number of people with a bank account rises globally, there are still people living in poverty who cannot wait for payday, and end up taking out loans against their paychecks. “These loans can be very risky, and have high interest rates that can actually cast people into poverty spirals,” explains Hiromitsu Kuwahara, CEO of Doreming Co., Ltd., a Fukuoka Prefecture-based FinTech company.

Pro-Rata Payment System

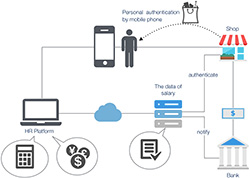

Aiming to help workers avoid expensive loans or payday advances, Doreming’s system allows people to receive pro-rata payments based on their accrued take-home value – the amount employees have worked minus taxes. When people need money before payday, they can use their phones to see what funds are available for the amount of work they’ve done. They can then use those funds for shopping, with stores receiving payment from the employer’s bank account – a patented system.

Importantly, the service is free for workers. “Similar to how credit card payments work, we earn our revenue through transaction fees charged to retailers when an item is purchased,” Kuwahara explains, noting that Doreming is looking to revenue-share with other financial institutions based on this service.

Doreming Co., Ltd. CEO Hiromitsu Kuwahara.

HR Platform & Beyond

The calculation of pro-rata salary requires a precise and reliable real-time HR platform – and Doreming provides this as well. In 2015, the company was spun-off from Kizunajapan Co., Ltd., which has developed and managed HR platforms in Japan for over 20 years. Doreming has drawn on this knowhow to offer a patent-pending, Cloud-based system for tracking employee attendance, performance and payroll data. Workers can even benefit from special incentives with features that enable increased pay rates by task.

Kuwahara sees potential in the platform far beyond payment and HR. “We can offer employees a record of their employment when they want to change companies,” he says. “Workers being able to show their employment history can help show stable employment and reliability when they apply for loans.” Moreover, Doreming lets employees rate their employers, aiding workers searching for reliable businesses.

Employees working on development of the Doreming HR platform.

Aiming for India, Africa, China & Southeast Asia

Doreming’s payroll system goes live in November 2016. “In five years’ time we hope to reach 400 million workers,” Kuwahara says. To fulfil this goal, Doreming is looking to help workers by partnering with government agencies, payment providers, banks and telecommunications companies. The company is building momentum overseas, actively participating in JETRO programs in Silicon Valley and Singapore, and reaching out in the U.K. as well.

Through technology, Doreming may help bring financial stability – and peace of mind – to millions around the world.

Based on interview in September 2016

CEO Kuwahara (third from left) with his multinational staff in Fukuoka.

*In October 2016, Doreming became the first Japanese company to be named in Fintech 100, a report by KPMG and H2 Ventures that examines global companies leveraging technology and driving disruption in the financial services industry. The report names the Leading 50 FinTech

Website: Doreming![]()