JETRO Global Connection -Accelerate Innovation with Japan-

Report

Startup Ecosystems Pop Up Across Japan

(Japan)

April 15, 2021

*This article was originally published in Japanese. All information in this article is as of November 26, 2019.

While Tokyo has long been the largest startup ecosystem in Japan, ecosystems are gradually being built around the country under the initiatives of local governments. This report outlines the current status of startup ecosystem in each region and introduces support measures in major cities.

Tokyo has by far the largest startup ecosystem in Japan

According to entrepedia’s Japan Startup Finance Report, which compiles trends in startup fundraising and startup investment in Japan, the total amount raised by startups in Japan was 387.8 billion JPY in 2018 (see table below). Looking at the breakdown, Tokyo-based startups have raised 300.3 billion JPY, accounting for 77% of the total, followed by Kanagawa, Osaka, and Aichi prefectures, all of which are metropolitan areas.

| City | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Average Annual Growth Rate (2009-2018) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Tokyo | 54 | 46.4 | 62.2 | 52.1 | 64 | 116.1 | 138.3 | 181.5 | 242.7 | 300.3 | 21.0% |

| Kanagawa | 5.9 | 6 | 2.9 | 2 | 3.8 | 4.1 | 2.1 | 10.8 | 16.7 | 16.9 | 12.4% |

| Osaka | 3.1 | 1.9 | 4 | 1.5 | 4 | 5.6 | 8.3 | 6.2 | 7.6 | 12.1 | 16.3% |

| Aichi | 0.5 | 1.8 | 0.5 | 0.3 | 0.3 | 0.9 | 1.5 | 3.1 | 8.7 | 7.9 | 35.9% |

| Fukuoka | 0.8 | 0.8 | 1.1 | 0.7 | 1.3 | 2.3 | 3.8 | 4.1 | 12.6 | 7.5 | 28.2% |

| Kyoto | 0.7 | 1.7 | 0.5 | 2.5 | 2.9 | 2.7 | 7.6 | 4.4 | 8.2 | 7.5 | 30.1% |

| Yamagata | 0.4 | 0.1 | 0.5 | 0 | 0.8 | 3.6 | 13 | 0.4 | 2.2 | 6.8 | 37.0% |

| Chiba | 1.1 | 1.1 | 0.5 | 0.3 | 0.8 | 0.4 | 0.8 | 1.5 | 1.6 | 3.9 | 15.1% |

| Hokkaido | 0.3 | 0.6 | 0.7 | 0.3 | 0.1 | 0.3 | 1.2 | 2.4 | 1.1 | 3.4 | 31.0% |

| Tochigi | — | — | — | — | — | 0 | 0.1 | 0.2 | 0 | 2.3 | — |

| Other | 6.9 | 9.4 | 8.5 | 4.7 | 4.8 | 5.8 | 9.4 | 11.5 | 15.4 | 19.2 | 12.0% |

| Total | 73.7 | 69.8 | 81.4 | 64.4 | 82.8 | 141.8 | 186.1 | 226.1 | 316.8 | 387.8 | 20.3% |

Source: Created based on Japan Startup Finance Reports produced by entrepedia

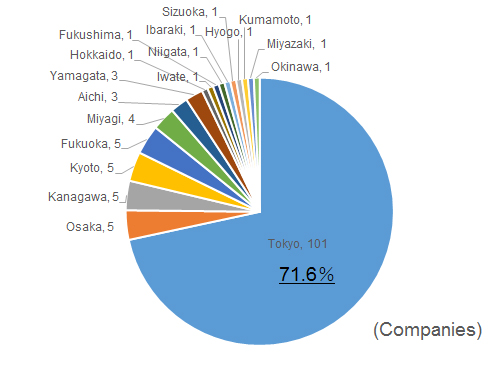

Looking at the headquarters locations of 141 companies selected for startup support and training project J-Startup![]() by the Ministry of Economy, Trade and Industry (METI), JETRO, and the New Energy and Industrial Technology Development Organization (NEDO), 101 startups are based in Tokyo, accounting for 71.6%. Kanagawa, Kyoto, Osaka, and Fukuoka each has five startups with Miyagi having four and Aichi and Yamagata each having three (see Figure 1). As most of leading startups are headquartered in Tokyo, incubating startups in local regions is urgent.

by the Ministry of Economy, Trade and Industry (METI), JETRO, and the New Energy and Industrial Technology Development Organization (NEDO), 101 startups are based in Tokyo, accounting for 71.6%. Kanagawa, Kyoto, Osaka, and Fukuoka each has five startups with Miyagi having four and Aichi and Yamagata each having three (see Figure 1). As most of leading startups are headquartered in Tokyo, incubating startups in local regions is urgent.

Figure 1: Headquarters locations of 141 companies in J-Startup project

Source: Created based on JETRO’s materials

Local ecosystems developed through initiatives by local governments

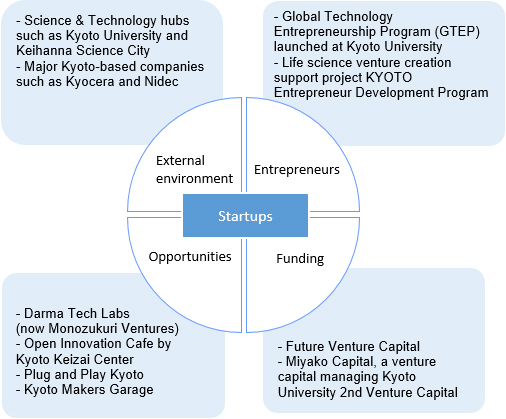

Looking at changes in the amount of fundraising in detail, it reveals that major cities’ average annual growth rates between 2009 and 2018 are higher than the total average. In these cities, local governments and affiliated organizations have played leading roles in launching initiatives and projects (see Figure 2). In Kyoto Prefecture, for example, the Kyoto Keizai Center was opened in March 2019 by the Kyoto Chamber of Commerce and Industry and 50 other supporting organizations. There is high expectation for the life sciences field, a major area of cutting-edge research, as well as the areas that take advantage of the “Kyoto” brand. Funding support has also increased, as seen in the launch of the” Kyoto City Startup Support Fund “by Kyoto-based Future Venture Capital in collaboration with Kyoto City and Japan Finance Corporation.

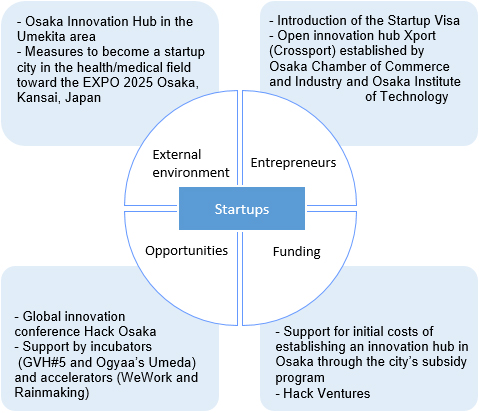

In Osaka City, the Osaka Innovation Hub has opened to host innovation pitches and business matching events. Entrepreneur development programs by the city and Osaka Prefecture have been unified to provide continuous support for startups. Furthermore, Osaka Prefecture and Osaka City, together with their business communities, launched a preparatory organization in July with the aim of becoming one of the Startup Cities*1, which will be selected by the Cabinet Office in 2020. If designated as a city, it will receive intensive support from the Government, including loosening of regulations and inviting entrepreneurs and investors to the city.

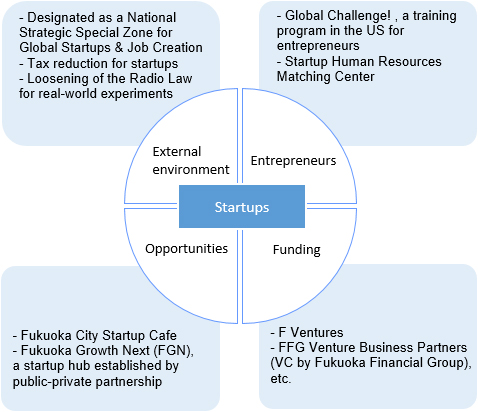

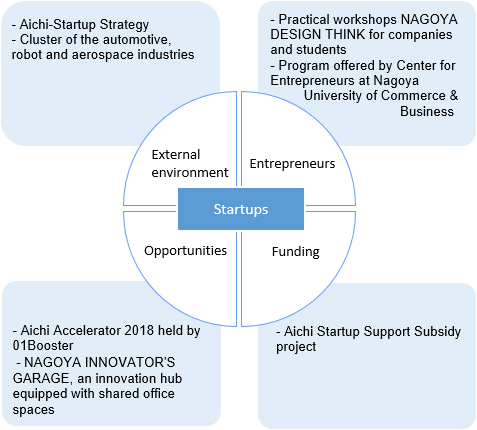

Figure 2: Features of startup ecosystems in major cities

Kyoto

Osaka

Fukuoka

Aichi

Note: Regarding the classification of (1) External environment, (2) Entrepreneurs, (3) Funding, and (4) Opportunities, see Figure 1 in the report entitled “Is Japan's Ecosystem Established? - How Does Japan's Strengths and Weaknesses Compare to Other Major Countries?”(in Japanese) It includes city policies.

Source: Created from local government websites and a column on p. 75 of the Global Trade and Investment Report.

In addition to the Kansai region, ecosystems with distinctive characteristics are also being developed in other regions. Fukuoka City is one of the municipalities that have begun providing support for entrepreneurs ahead of other cities. The city announced the “Startup City Fukuoka” declaration in 2012 and has been focusing on creating networks at startup cafes and developing environments for real-world experiments. The city has been actively working on attracting foreign entrepreneurs since it was designated as a National Strategic Special Zone for Global Startups & Job Creation in 2014, where foreign entrepreneurs can apply for a Startup Visa*2. Furthermore, in 2019, the city opened Fukuoka Growth Next, a startup hub established through a public-private partnership, in a former elementary school to provide support according to each startup’s level of development. It is a one-stop-shop for starting up business that provides support, advice, and opportunities to build networks among entrepreneurs, investors, and companies.

Aichi Prefecture formulated Aichi-Startup Strategy in 2018 with the aim of responding to changes in the industrial structures of its main industries such as automotive, robot, and aerospace industries while technological innovations such as Artificial Intelligence and the Internet of Things are advancing. The prefecture aims to create an innovation ecosystem by drawing on its strengths in manufacturing. In order to create new industries and develop human resources, the prefecture has also signed an agreement on startup ecosystem with Nagoya University, Nagoya Institute of Technology, Toyohashi University of Technology, and the Kurimoto Educational Institute, which runs Nagoya University of Commerce & Business.

All these cities have startup support measures developed from the perspective of ecosystem participants. In Osaka and Fukuoka, entrepreneurs can easily access support agencies and programs as well as necessary information through a single point of contact without being bothered by the different levels of administrative divisions. In Kyoto and Aichi, measures such as utilization of university research seeds through industry-academia collaboration, and entrepreneurship development programs are prominent. In addition to developing young entrepreneurs, mechanisms for technology commercialization are being developed in cooperation with companies by establishing innovation hubs at universities. George Goda, cofounder of 01Booster, a Tokyo-based accelerator that invests in local startups, points out the importance of wide-area cooperation and considers that providing support and opportunities for horizontal expansion is essential. He works on changing the attitude of supporters, who tend to stick to the benefits of their own local community, to focus on promising startups’ successes in wider business areas [from the interview article, "Wide Area Cooperation Changes Local Startup Ecosystems" by Open Innovation Japan (January 2019)].

Foreign-affiliated companies participate in supporting local startups

Local governments and universities are not the only ones that fuel startup ecosystems across Japan. In recent years, foreign-affiliated companies, especially leading accelerators, have been actively participating in ecosystems throughout Japan. Plug and Play, a global accelerator from Silicon Valley, has opened its second location in Kyoto after opening its first in Tokyo, and San Francisco-based venture capital firm 500 Startups is running an accelerator program in Kobe. In addition, WeWork, a leading coworking space provider with locations in Tokyo, Yokohama, Nagoya, Osaka, Kobe, and Fukuoka, and Venture Café from Boston that hosts startup events in its Cafés in Yamagata, Tokyo, and Kobe are playing a major role in forming local startup communities.

Local governments often expect startups to stay local. True success, however, requires going global. With the ecosystem in each region being increasingly enhanced by the participation of foreign-affiliated companies, many startups who used to be active only in Japan now have opportunities to enter the international arena.

*1:

At a meeting of the Integrated Innovation Strategy Promotion Council held in June 2019, the Cabinet Office decided to designate a couple of cities as “Startup Cities” by the end of 2020 and to provide them with intensive support that includes loosening of regulations and inviting entrepreneurs and investors to the cities. The Office will strengthen its support to local governments that are active in supporting startups.

*2:

The Startup Visa scheme allows a foreign entrepreneur who receives entrepreneurial support from a local government to enter and stay in Japan for up to one year based on the Foreign Entrepreneurship Promotion Project (authorized by METI). As of August 2019, prefectures of Fukuoka, Aichi, Gifu, and Mie as well as cities of Kobe and Osaka have been allowed to use the scheme and are working to attract foreign entrepreneurs.

- Report by:

- IOKI Tomoko, International Economy Division, Overseas Research Department, JETRO

-

US<>Japan VC Playbook: Bridging U.S. and Japanese Startup Ecosystems

February 2026

-

Overview of Japanese Startup Investment for US Venture Capitalists

May 2025

-

TBM, a Japanese Unicorn, is taking its environmentally conscious materials and solutions global

April 2025

-

Algal Bio’s Plan to Scale-up Microalgae Solutions for Food, Health, Climate, and more

March 2025

-

From Complexity to Clarity: How Veritus Helps Professors and Research Labs Innovate 5X Faster

February 2025

-

Biodata bank: Innovating Heat Risk Solutions for a Warming World

February 2025

-

Thermalytica’s Improved, Nano-scale Insulation Technology Could Change the World

January 2025

-

Techstars Tokyo Demo Day shows how Japan is Making Strides Towards Becoming a Global Startup Hub

December 2024