JETRO Global Connection -Accelerate Innovation with Japan-

Interview

How SMTB hopes to build regional startup ecosystems across Japan

(Japan)

Feb 26, 2024

Universities have, for centuries, been hubs for learning and innovation. In recent decades, they’ve also played a key role in the development of startups and technology hubs, creating pipelines between researchers, students and venture capital. The most famous example is the strong connection between Stanford University and Silicon Valley, with many of the region’s largest tech companies tracing their roots to products, designs, or capital from Palo Alto.

In Japan, the link between academia, businesses and startups is not yet strong, but that is starting to change. At the forefront of creating a new model is one of Japanese well-established and largest institutional investors, Sumitomo Mitsui Trust Bank (SMTB), where a project led by Kengo Noguchi![]() ,Deputy Chairman of the bank, is aiming to develop regional ecosystems centered around Japanese Universities, starting in Tohoku.

,Deputy Chairman of the bank, is aiming to develop regional ecosystems centered around Japanese Universities, starting in Tohoku.

We spoke with Mr. Noguchi to learn more about SMTB’s strategy, approach and future plans.

(Photo provided by Sumitomo Mitsui Trust Bank)

Can you please share a bit about your involvement around SMTB’s efforts to build regional startup ecosystems?

When you start something new, it's quite challenging to have people sympathize internally as well as externally. Back in 2017, when I was the managing executive officer of the division in charge of this effort, I was leading on trying to change and shift the direction of how we engaged with university communities.

While we were trying to embark on collaboration with these universities, we did not know, for example, how they operated, what their organizational structure looked like, what the process was for them to decide whether to embark on a business or not, or how their IP or patents were being managed. Therefore, we visited many universities, met with many people at different levels, and had quite a few interviews and hearing sessions.

I took risks myself, such as becoming a visiting professor, to better understand what professors or researchers at the universities were thinking and what they were ultimately hoping to accomplish. As the division head, I took the initiative to show others what could be possible, and then I thought they would be interested in following. That's how I was able to gain more sympathy internally at SMTB as well.

Can you tell us about the recent launch of the Tohoku University Co-creation Initiative and why it is meaningful?

It took well over six years until this joint venture was established. So it was not something that was built all of a sudden. It was step by step, building this up from 2017.

The purpose of the academic world is to engage in research and development activities independently, and then try to conduct as much research as possible. On the other hand, the industry side is focused on boosting their earnings by introducing new products or engaging in marketing activities. If they have direct dialogue, it often does not go well.

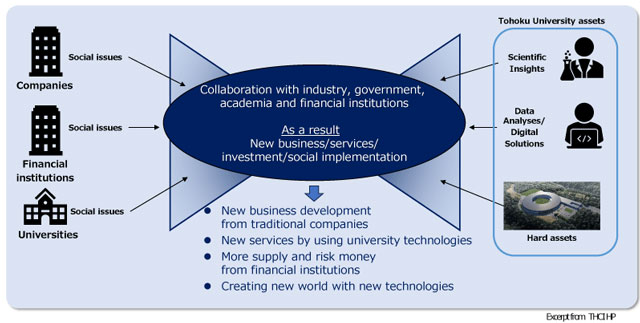

So, one reason why we established the Tohoku University Co-creation Initiative (THCI) is that we understood that we needed to be the translators or interpreters for both sides.

We made a direct equity investment into THCI to take on some risk ourselves rather than just being consultants. We wanted to create a success story as an example so that we could share it when we asked others to come on board. We wanted to be the frontrunner in creating that example.

(Image provided by Sumitomo Mitsui Trust Bank)

Is this a big shift for a large and well-established bank like SMTB? How do you work with startups that come out of THCI?

I think traditionally, Japanese financial institutions did not proactively create markets or try to generate added value. We were very passive.

When we decided that we wanted to embark on creating markets ourselves, we thought that there would be a big affinity for us to actually try to support the engagement, or bridge, between corporations and startups. Startups struggle in the startup phase, and we thought it would be beneficial for us to connect with large cap companies, and then they would have a higher probability of overcoming what is often, I think, a very difficult phase.

We are not just involved in offering some banking services, such as lending. We also have corporate pension fund schemes that we offer to them, advise them on corporate governance, and support their social benefits and welfare activities.

We noticed that these initiatives are connected to SMTB’s social and environmental goals. How do you think this model can provide high-value-added solutions to various social issues?

A main reason we try to support startups is that they may be able to help solve societal issues.

I am very confident and convinced that social issues can be solved if this collaboration between the academic and the industrial sides can materialize. To make a better society, you need breakthrough technology, and this technology is often, I think, coming out of universities.

A challenge for us going forward is determining exactly what type of added value we were able to achieve. Therefore, I think we need to come up with a very easy-to-understand and clear structure for us to actually evaluate the progress towards solving social issues.

What are SMTB’s goals for THCI the next 5–10 years, and how would you like to see these regional ecosystems evolve?

The joint venture company that we have established with Tohoku University is taking a sort of middle-ground approach between the industry and academic sides. But it does not necessarily mean that this will be the same for all universities, because each university will have a different situation, conditions, or way of engaging.

For example, with money, sometimes it will be angel investors that are most suitable. Other times, it could be the local government, the city, or the prefecture with public funds. There will be occasions where we ourselves will be making an equity investment or offering some debt.

I think THCI is a vehicle that is required in this current era. However, ten years down the line, I do not foresee THCI playing a major role. I'm hoping to see a society where university professors, as well as students and the corporate side, understand the importance of trying to commercialize technology in order to generate added value. If they are able to understand that, they would be able to do so without the presence of THCI.

I hope that society will progress and that we are just offering that trigger.

- Profile of Kengo Noguchi, Deputy Chairman of Sumitomo Mitsui Trust Bank

- After serving as a relationship manager for a wide range of industries including major general trading companies, manufacturing, and service industries, Kengo was responsible for structured finance and credit investment operations. In addition, Kengo has held experiences such as an executive of a VC fund management company, an investment committee member of a private equity fund, and a member of an advisory committee, achieving results in corporate growth support operations. In collaboration with Tohoku University, he established THCI, which aims for co-creation with startups while utilizing the seed technology that the university possesses, and he is serving as a director.

- Report by:

- WATANABE,Keita, Startup Support Division, JETRO

-

US<>Japan VC Playbook: Bridging U.S. and Japanese Startup Ecosystems

February 2026

-

Overview of Japanese Startup Investment for US Venture Capitalists

May 2025

-

TBM, a Japanese Unicorn, is taking its environmentally conscious materials and solutions global

April 2025

-

Algal Bio’s Plan to Scale-up Microalgae Solutions for Food, Health, Climate, and more

March 2025

-

From Complexity to Clarity: How Veritus Helps Professors and Research Labs Innovate 5X Faster

February 2025

-

Biodata bank: Innovating Heat Risk Solutions for a Warming World

February 2025

-

Thermalytica’s Improved, Nano-scale Insulation Technology Could Change the World

January 2025

-

Techstars Tokyo Demo Day shows how Japan is Making Strides Towards Becoming a Global Startup Hub

December 2024