May 2023

Digital Health on the Rise as Japan’s Healthcare System Gets Hi-Tech Makeover

April 2023

(From left) Anand Iyer, Chief Analytics Officer of Welldoc and Naoyuki Kanda, business producer at Astellas Pharma

Imagine what it’s like to have type 2 diabetes. Your cells don’t respond normally to the insulin that your body produces to hold your blood sugar levels in check. Letting your blood sugar spike is a bad idea because it raises your chances of debilitating, long-term health problems like heart disease, kidney disease and vision loss, and allowing it to go too low could increase the risk of a possible coma. Maintaining your blood sugar within a target range involves a complex calculation of medications, exercise, and meals and snacks. You must maintain a strict diet and keep track of everything you eat, like serving sizes as well as carbohydrate and salt intake.

This rigorous regimen is the daily reality for more than 10 million people with diabetes in Japan. It can be all-consuming. It could also one day be more easily managed with technology known as digital health.

Digital health is one of the frontiers of healthcare innovation in Japan. It encompasses a broad category of hardware and software that puts new digital solutions at the center of how patients and doctors are working together to prevent, treat and manage diseases and health problems––and not just for diabetes. Companies are now racing to develop software for medical purposes and products specifically designed to treat or manage diseases (also known as digital therapeutics). They are testing their ideas just like they would with any experimental drug or medical device––with the same clinical trials verifying safety and efficacy, and the same rigorous scientific committee reviews. Globally, the digital therapeutics market![]() topped 3.4 billion dollars in 2021, and by 2026 it’s expected to more than triple to 13.1 billion dollars.

topped 3.4 billion dollars in 2021, and by 2026 it’s expected to more than triple to 13.1 billion dollars.

In Japan, where medical costs totaled 44.2 trillion yen (329 billion dollars) in fiscal 2021, digital health is being hailed as one of the medical system’s most drastic makeovers since the introduction of universal healthcare in 1961. The broader technology rollout is comprehensive, ranging from the digitization of patients’ health records to wider use of artificial intelligence and cloud-based doctor-patient services.

Driven by Demographics

One of the factors behind the Japanese government’s![]() (360KB) rush for a hi-tech upgrade of its healthcare system: Japanese government’s the country’s swelling ranks of elderly people

(360KB) rush for a hi-tech upgrade of its healthcare system: Japanese government’s the country’s swelling ranks of elderly people![]() (800KB) . Already, approximately 29 per cent of Japan’s population of 125 million is at least 65 years old. Nearly a decade ago, Japan became the world’s first super-aged society––one in four of its citizens was 65 or older. The country’s low birthrate and long average lifespan ensure that the trend will continue. By 2040, 35 per cent of the country’s population is expected to be 65 or older––including more than 300,000 centenarians.

(800KB) . Already, approximately 29 per cent of Japan’s population of 125 million is at least 65 years old. Nearly a decade ago, Japan became the world’s first super-aged society––one in four of its citizens was 65 or older. The country’s low birthrate and long average lifespan ensure that the trend will continue. By 2040, 35 per cent of the country’s population is expected to be 65 or older––including more than 300,000 centenarians.

As the costs of chronic diseases surge, digital solutions will likely play a bigger role. In the not-so-distant future, doctors’ digital records will be automatically updated when patients check their blood pressure or take their medications, and patients will keep track of and get doctor-prescribed reminders about meals, exercise, and medications on smartphone apps. The improvements to efficiency could also have a positive knock-on effect in related fields such as elderly care and sports and health management.

Advancing Regulatory Approvals of Digital Therapeutics in Japan

Since revising the Pharmaceutical Act in 2014, the Government of Japan has been moving swiftly to upgrade its healthcare system with digital therapeutics. CureApp, a startup company pioneering digital therapeutics in Japan, received Japan's first regulatory approval in 2020 for its "CureApp SC" nicotine addiction treatment app, followed by the world’s first regulatory approval for hypertension in 2022 for its "CureApp HT" high-blood-pressure-management app.

With its large and growing elderly population, high-speed wireless connectivity and state-of-the-art medical technologies, Japan is poised to become a major market for digital health. “Entering one of the world’s largest and most tech-savvy healthcare markets where regulators are promoting digital health to tackle the burden of chronic diseases––and as a first step in expanding in the Asia-Pacific region––had a lot of appeal,” said Anand Iyer, Chief Analytics Officer of US digital health company Welldoc.

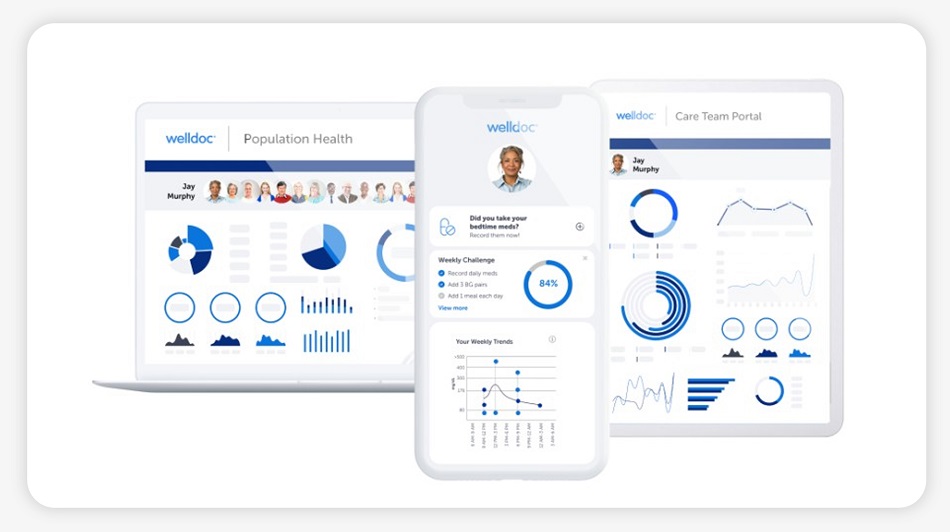

In Japan, Welldoc has been collaborating with Japan’s leading pharmaceutical company Astellas Pharma since 2019. They are planning a clinical trial for Welldoc’s BlueStar®️ product, a digital health app for diabetes patients. (The US Food and Drug Administration approved BlueStar for both of healthcare providers and diabetes patients—for adults with type 2 diabetes and in 2010, and for type 1 diabetes in 2019.) In the US, BlueStar syncs with blood glucose meters, scales to measure weight, home-use blood pressure machines, fitness trackers, smartphones, and tablets. As someone with type 2 diabetes, Iyer lives through the difficulties of “moment-to-moment” decisions. “My biggest challenge is what I eat,” he said.

BlueStar is designed to give diabetes patients like Iyer a tool to make better decisions about food, medications, sleep, and exercise and to manage blood sugar levels. “As it pertains to digital health solutions, there is a concern that technology will replace the need for doctors. But in fact, it’s exactly the opposite,” says Iyer. “The intent of Welldoc is utilizing our technology to strengthen connections and decision-making between the individual, their doctors and their broader care team.”

Because BlueStar compiles data from various devices, it can let doctors continually assess their patients’ health in real time and tailor treatments to individual needs. “It’s getting the patient to a better place faster,” Iyer said.

Digital Empowerment

Other companies from overseas have begun to tie up with Japanese firms to explore the digital health market in Japan. U.S. healthcare technology provider TriNetX has tapped Japan’s major trading company Mitsui & Co. for support in signing up research hospitals and other institutions that can use its collaborative, global research technology platform and real-world clinical database to design safer clinical trials for testing new drugs and devices. US medical tech specialist Akili is collaborating with a large Japanese pharma company Shionogi to commercialize mobile games that can help children deal with attention deficit hyperactivity disorder (ADHD).

Meanwhile, new online tools that empower doctors and reduce the need for frequent clinic visits could be on the way soon. Japanese health-tech startup MICIN is working with British pharma giant GSK on online medical exams for asthma patients and has teamed up with British-Swedish pharma giant AstraZeneca to develop personalized treatment timelines for lung cancer patients.

“In terms of demographics, there’s a good foundation for digital therapeutics in Japan to become as prevalent as that in the US,” says Naoyuki Kanda, business producer at Astellas Pharma. “When you look at specific disease areas and applications, digital therapeutics are advancing quite a bit. Two digital therapeutics are already receiving public reimbursement in Japan. When you consider all these factors, there’s big potential for the Japanese digital therapeutics market.”

KEY TAKEAWAYS

- Japan’s medical costs totaled 44.2 trillion yen (329 billion dollars) in fiscal 2021.

- The Japanese healthcare system’s digital reboot marks the most drastic transformation since the rollout of universal healthcare system in 1961.

- Globally, annual revenues in the digital therapeutics market are expected to more than triple to 13.1 billion dollars by 2026, from 3.4 billion dollars in 2021.

Learn More

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices