-

(1)

Strengthening the supply chain through the promotion of digital transformation investment and global data collaboration

-

(2)

Green growth strategy and green transformation-related measures to support companies pursuing carbon neutrality

-

(3)

Efforts to revitalize regional areas

Manufacturing

Overview

Digitalization and Decarbonization Will Be the Driving Trends of Japan’s Manufacturing Industry.

The Japanese economy is the fourth largest in the world in terms of GDP, and the manufacturing sector accounts for approximately 20% of the nation's GDP, positioning it as a vital segment of the economy.1 Japan's electronics and automotive components are particularly competitive globally. The country holds over 60% of the global market share in 220 product categories, greatly surpassing the United States, Europe and China.2 In addition, Japan's manufacturing industry is expected to improve production efficiency and create new value through digitalization and decarbonization, driving further growth in the overall manufacturing market.

Although Japan's manufacturing industry experienced a temporary decline in sales due to the impact of the COVID-19 pandemic, it recovered in FY 2022 and achieved growth rates exceeding pre-pandemic levels (Figure 1).

Figure 1: Trends in the total sales of the manufacturing industry

*Total manufacturing sales for FY 2023 are based on the sum of 2023 Apr-Jun, Jul-Sep, Oct-Dec, and FY 2024 Jan-Mar, and the year-on-year growth rate is calculated as the average of the respective periods.

Source: Created by JETRO based on data from the Ministry of Finance (MOF) , 3, 4

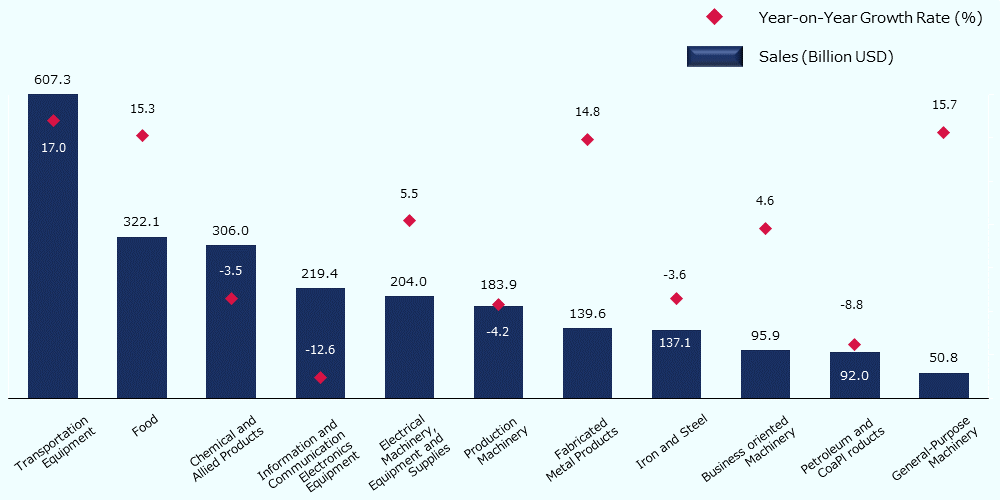

In the manufacturing sector, sales of transportation equipment, food, fabricated metal products, and general-purpose machinery have significantly increased year-on-year, driving overall sector growth (Figure 2). Among these, transportation equipment recorded outstanding sales and a high year-on-year growth rate, positioning it as a particularly promising market with strong potential for continued expansion.

Figure 2: Manufacturing industry sales and year-on-year growth rate for FY 2023

*The sales figures are the sum of 2023 Apr-Jun, Jul-Sep, Oct-Dec, and 2024 Jan-Mar sales, and the year-on-year growth rate is calculated as the average of the respective periods.

Source: Created by JETRO based on data from MOF 5

The manufacturing sector in Japan is also a key player in the domestic employment market, accounting for approximately 15% of total employment as of 2023.6 Although the proportion of manufacturing within all industries is lower in Japan due to the transition to a service economy, its proportion is still comparable to countries such as South Korea, Thailand, and Malaysia, which are the next largest major manufacturing hubs in Asia behind China and Vietnam.7 Globally, Japan has a high proportion of its workforce employed in the manufacturing sector.

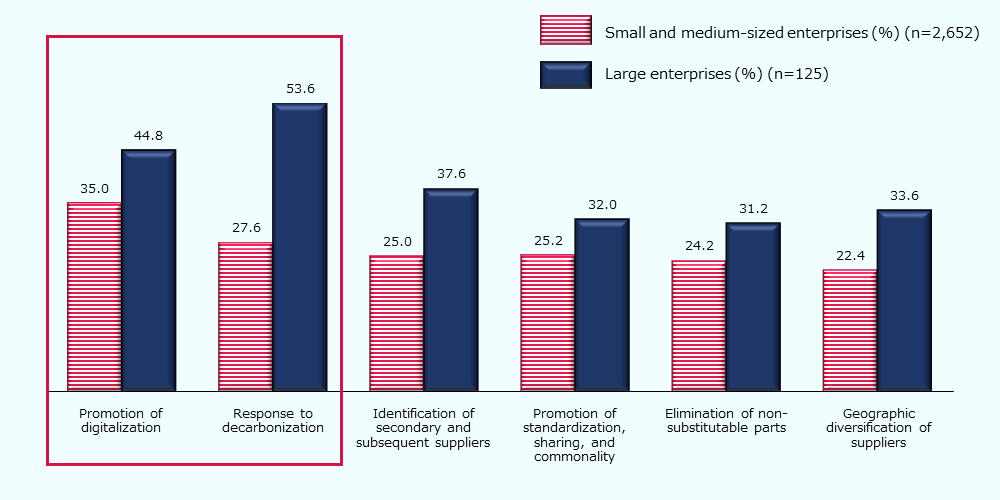

On the other hand, the global manufacturing environment has become increasingly uncertain in recent years. Russia's invasion of Ukraine has led to increasing resource and energy prices, higher material procurement costs, and shortages of critical components such as semiconductors. These challenges demonstrate the importance of strengthening supply chains. According to the 2022 survey of Japanese manufacturers, almost 50% of large companies intend to pursue digitalization and decarbonization to build a stable supply chain. Although the proportion of small and medium-sized enterprises (SMEs) is lower than that of large companies, SMEs show the highest enthusiasm for digitalization, followed by decarbonization efforts (Figure 3). Large companies are actively utilizing their abundant resources and capital to drive digitalization and decarbonization, to stabilize their supply chains. SMEs, on the other hand, are more likely to prioritize digitalization for efficiency and cost reduction.

Figure 3: Future initiatives planned to achieve a stable supply chain (selected survey results)

*Multiple responses

Source: Created by JETRO based on data from the Ministry of Economy, Trade and Industry (METI) 8

(1) Digitalization

In Japan's manufacturing industry, both the public and private sectors are promoting digitalization to improve production processes and data utilization. The Japanese government is pursuing several policies for promoting digital transformation in the manufacturing industry, including the development of guidelines, evaluations, and metrics in collaboration with companies, governments, and academia, as well as the promotion of data integration and standardization among companies.9。

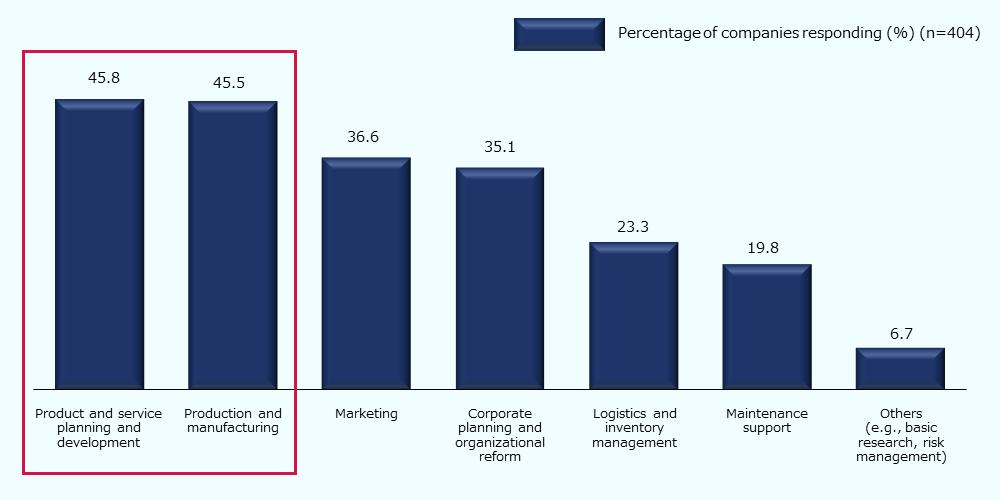

Additionally, as digitalization progresses, private companies are increasingly focusing on leveraging data. A 2020 survey found that more than 80% of manufacturing companies use data in at least one operational area10, surpassing the level of data used in information and communication, energy and infrastructure, trade and distribution, and services. The use of data is particularly advanced in "Product and service planning and development" and "Production and manufacturing" (Figure 4). It can be observed that the simplification and optimization of production and manufacturing processes through digital technologies, as well as the use of data for planning and development, are gaining attention in the manufacturing industry.

Figure 4: Operations in the manufacturing industry where data is being utilized

*Data utilization includes not only data analysis but also activities such as data browsing and automated data collection by computers, which can include decision-making and issuing alerts.

Source: Created by JETRO based on data from the Ministry of Internal Affairs and Communications (MIC) 11

Digitalization is also gaining momentum in the automotive and electronics industries in particular. On the other hand, experts believe that digitalization has lagged in the chemical and materials industry because it is difficult to digitize chemical processes in the first place, in addition to the difficulty of digitizing years of technological accumulation. To improve the digitalization of the industry, initiatives are being taken to achieve higher productivity through data utilization, which helps provide support for on-site technicians.12 As the chemicals and materials industries digitalize, they have the potential to catch up with other sectors, leading to further growth in the future.

The use of AI and digital twin technology is gaining significant attention among digital initiatives in the manufacturing industry. For example, industrial robots and automation systems that can operate reliably even in emergencies13 are expected to see increased use in manufacturing. Additionally, Japan's manufacturing sector faces the challenge of an aging workforce. The use of digital twin technology to record the work of experienced workers is recognized as a way of streamlining and facilitating the transfer of their expertise.14 In this context, the adoption of digital technologies in the manufacturing sector is expected to increase. Overseas companies with cutting-edge technologies are expected to enter into the Japanese manufacturing industry, along with increased technology partnerships and collaborations with Japanese companies.

(2) Decarbonization

In the wake of the Paris Agreement, global momentum towards decarbonization has accelerated, and Japan is also moving forward with the decarbonization of its industries. The manufacturing sector is particularly important, accounting for around 36% of the country's CO2 emissions, surpassing other sectors such as transport, households, tertiary industries, and energy. In FY 2020, CO2 emissions from the manufacturing sector reached 370 million tonnes, with the majority coming from materials industries such as steel, chemicals, paper and pulp, and ceramics and cement. 15。

In 2022, the Cabinet Office conducted a survey targeting Japanese private companies and reported that a significant proportion of companies intend to increase capital and R&D expenditure through green investment by FY 2030. This is particularly evident in the steel and electrical equipment industries (Figure 5). The rising focus on controlling CO2 emissions is believed to have influenced the green investment level within the steel industry, which emits a large amount of CO2 during the manufacturing process. The electrical equipment industry is also likely to be influenced by the growing demand for CO2 emission control in power generators, as highly efficient power generators are expected to contribute to energy savings and decarbonization in a wide range of industries.

Figure 5: Percentage of companies expecting to increase total capital expenditure and R&D expenditure through green investments by FY 2030 (manufacturing sector only)

![76% of the electric equipment companies chose the option [capital expenditure] and 67% [R&D expenditure.] 71% of the iron and steel and non-ferrous metal companies chose the option [capital expenditure] and 80% [R&D expenditure.] 67% of the other manufacturing companies chose the option [capital expenditure] and 62% [R&D expenditure.] 64% of the chemical companies chose the option [capital expenditure] and 42% [R&D expenditure.] 62% of the general machinery and tools companies chose the option [capital expenditure] and 75% [R&D expenditure.] 60% of the metal products companies chose the option [capital expenditure] and 50% [R&D expenditure.] 56% of the paper and pulp companies chose the option [capital expenditure] and 40% [R&D expenditure.] 53% of the transportation machinery companies chose the option [capital expenditure] and 44% [R&D expenditure.] 14% of the precision machinery companies chose the option [capital expenditure] and 0% [R&D expenditure.] A significant proportion of companies intend to increase capital and R&D expenditure through green investment. This is particularly evident in the iron and steel and non-ferrous metal industry and the electric equipment industry.](/ext_images/en/invest/img/attractive_sectors/manufacturing/overview/5.png)

Source: Created by JETRO based on data from the Cabinet Office16

The manufacturing sector is actively working to improve process efficiency, reduce environmental impact, and create new business value through digitalization and decarbonization. Overseas companies with innovations that align with the needs of Japan's manufacturing industry, particularly in digital and green technologies, are expected to have greater business opportunities in Japan, including entry into the Japanese market and collaboration with local firms.

References

- Cabinet Office. "3. Gross Domestic Product classified by Economic Activities, IV. Main Time Series," National Accounts for 2022 (2008SNA, benchmark year = 2015).

- Ministry of Economy, Trade and Industry (METI), Ministry of Health, Labour and Welfare (MHLW), Ministry of Education, Culture, Sports, Science and Technology (MEXT). FY 2022 Measures to Promote Manufacturing Technology (JP), p. 146.

- Ministry of Finance (MOF). Press Release: Financial Statements Statistics of Corporations by Industry, Annually (FY 2022), p. 1.

- MOF. Press Release: Financial Statements Statistics of Corporations by Industry, Quarterly (Q1, FY 2024), p. 1.

- See Note 4, p. 1.

- Ministry of Internal Affairs and Communications (MIC). Labour Force Survey / Basic Aggregates: Long-term time series data for all prefectures.

- Our World in Data. Manufacturing jobs as a share of total employment, 2000 to 2020.

- METI. FY 2022 Survey of Manufacturing Infrastructure Technologies: Report on Challenges and Directions for Japan’s Manufacturing Industry (JP), p. 106.

- METI. Current State and Challenges of the Manufacturing Industry: Future Policy Directions (May 2023) (JP), p. 61.

- MIC. Report on the Research Study of the Measurement and Utilization of the Economic Value of Digital Data (JP), p. 47.

- See Note 10, pp. 25, 47.

- METI. Digital Transformation Stocks | DX Stocks | 2024 (JP), pp. 31, 32, 72.

- JETRO. Impacts of Changes in GVCs [AI/Sensors × Robotics and Automation (Industry)] (JP), p. 15.

- JETRO. Impacts of Changes in GVCs [Metaverse and Digital Twins (Industrial Applications)] (JP), p. 15.

- See Note 9, p. 68.

- Cabinet Office. Overview of the analysis results of the survey on Japanese companies' decarbonization efforts (JP), pp. 12, 13.

-

Government Initiatives

The Government-Led Promotion of Digitalization and Green Transformation Is Expected to Strengthen the Supply Chain, Expand the Market, and Enhance Cross-Border Cooperation.

-

Attractive Markets

In This Report, We Focus on the Following Four Attractive Markets in the Manufacturing Industry.

-

(1)

Semiconductors: Strong investment support from the government

-

(2)

Industrial robots: Rising demand due to declining labor population

-

(3)

Automobiles: Rapidly moving toward decarbonization and autonomous driving through government support

-

(4)

Aerospace: Increasing cross-border cooperation

-

Manufacturing Report

You can download the whole report on the webpage free of charge. Please simply fill out the form below to get information on promising industries in the Japanese market. Download now and use the information for your success in business.

-

- Business Expanding

- Other

- Mobility & Transportation

- Australia

Komodo PRX Pty Ltd., a Provider of Environmentally Friendly Road Solutions, Establishes an Office in Tokyo

-

- Business Expanding

- Semiconductors, Robotics, and Machinery

- Yokohama city

- Taiwan

Global Unichip Japan, the Japanese subsidiary of TSMC Group’s design specialist GUC, relocates to a new office in Yokohama as part of its business expansion

-

- Business Expanding

- Semiconductors, Robotics, and Machinery

- Taiwan

Semiconductor-related company Marketech International Corp. has established a new office building in Kumamoto Prefecture and has officially commenced operations

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices