Medical Market in Japan

Jan 28, 2011

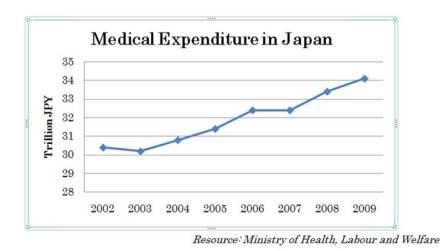

Medical expenditure in Japan for FY 2009 was estimated at JPY 3.4 trillion. Since Japan is an ageing society, and the personal savings of over 60 year-olds is estimated to be JPY80 trillion, medical expenditure in Japan is expected to continue to increase. The Kan administration released the economic stimulation policy package which included a reform for the medical market which would boost the economy by 5 trillion JPY and create 2.8 million jobs.

Indeed, major multinational companies around the world are focusing on medical business ventures more recently. Toshiba aims to increase its medical-related sales to 1000 billion JPY by 2015.

However, Japanese medical industries have been facing difficulties in recent years. 90% of municipal hospitals and 45% of private hospitals are in deficit. Long approval process by governments and regulated prices of drugs have hindered development of new medicines. While the multinational pharmaceuticals utilize biotechnology in order to develop new medicines, the Japanese pharmaceuticals still mostly depend on chemical technology. Furthermore, the patent of Japanese pharmaceuticals will have expired as of 2010, that means we can expect generic drugs to take over the market in place of the originals. As for the medical device sectors, Japan is an import country. The approval process by government normally takes at least 3 years, and the price regulation system does not differentiate between old types and renewed types of products. Even if the medical companies are intending to M&A foreign companies, their finances would be insufficient due to the obstacles on accumulating profits.

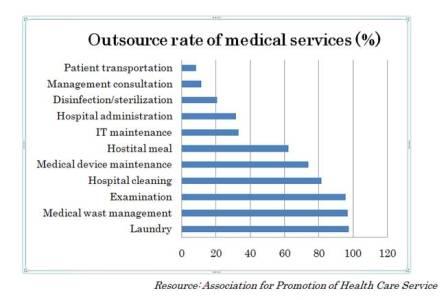

The Japanese government is in the process of deregulation. Pricing systems and universal insurance schemes are being reformed to be more competitive and profitable for medical companies. The Japanese government has been attempting to shorten the length of the approval process as well. As the medical sector is one of the significant sectors nominated in the economic stimulus package by the government, further deregulation would be welcomed. The concepts Japanese people have towards medical sectors have also been changing recently. Hospitals and medical/welfare institutes in Japan are now relatively open to outsourcing their services for the sake of efficiency and profitability. The pharmaceuticals and medical device makers are entering M&A competition in the international market.

A turning point in Japanese medical industries would also be a good opportunity for multinational companies. The medical market in Japan is huge and promising, and the Japanese governments would drive deregulation. Hospitals would more actively outsource their services, and the pharmaceuticals will look to acquire new technology from domestic and multinational ventures. The approval process for new medicines and medical devices would be shorter and generic drugs would be more popular in Japan.