Latest UpdatesSingapore-based fintech company Moneythor establishes corporation in Tokyo

Dec 11, 2019

Moneythor![]() is a fintech company established in Singapore in 2013. The company develops and provides software to enhance customer engagement (improving the relationship between product and service providers and their customers) in the field of online banking. Its engine enables personalized recommendations to be sent to customers within a short period of time utilizing data analysis on digital channels owned by financial institutions. Since its founding by three engineers with over 15 years of experience in financial institution technology, the data-driven digital banking software has been adopted by 30 major international financial institutions who have taken the lead in digital channel strategies, including DBS.

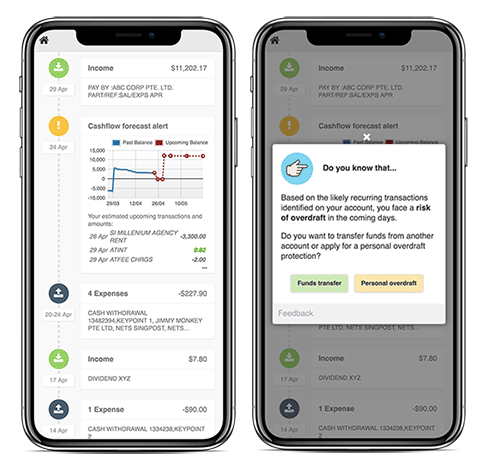

is a fintech company established in Singapore in 2013. The company develops and provides software to enhance customer engagement (improving the relationship between product and service providers and their customers) in the field of online banking. Its engine enables personalized recommendations to be sent to customers within a short period of time utilizing data analysis on digital channels owned by financial institutions. Since its founding by three engineers with over 15 years of experience in financial institution technology, the data-driven digital banking software has been adopted by 30 major international financial institutions who have taken the lead in digital channel strategies, including DBS.

Moneythor had been preparing to enter the Japanese market by participating in the first accelerator program organized by the Tokyo Metropolitan Government, “Fintech Business Camp,” in 2017 and at the pitch event “FIBC,” called the gateway to fintech in Japan, where it took the podium as a finalist in March 2019. The company was also selected for Summer/Fall 2019 Fintech Batch 3, the acceleration program operated by Plug and Play Japan, where it has been engaged in discussions toward collaboration with other participating companies.

With opportunities for profit shrinking due to low interest rates in recent years, banks have been striving to increase the efficiency of branch operations. Progress is being made in enhancing digital channels, which create new profit opportunities as contact points with customers on behalf of branches. To meet these growing needs in the Japanese market, Moneythor established Moneythor Co., Ltd in Tokyo in June 2019. Utilizing its experience with major financial institutions across the Asia-Pacific, Europe and North America—including DBS, Standard Chartered and ANZ—it aims to provide full-fledged support services targeting Japanese financial institutions for strengthening customer relations utilizing digital technology and data.

To assist with the establishment of the company’s base in Japan, the JETRO Invest Japan Business Support Center (IBSC) provided temporary office space, consultation on tax and labor matter and business matching. It also introduced service providers (an administrative scrivener, a tax accountant, certified social insurance labor consultants, banks, lawyers and a PR agency).

Digital Banking

Contact Us

Investing in Japan

We will do our very best to support your business expansion into and within Japan. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices