Meet Japanese Companies with Quality

Cloud-Based Fraud Detection Caulis Inc. IP

Website: Caulis Inc.![]()

Category: IT

FraudAlert stymies identity theft through Cloud-based artificial intelligence

Japan-based cyber-security startup Caulis Inc. is using artificial intelligence (AI) and Cloud technology to fight account hijacking and identity theft. Its FraudAlert risk detection engine analyzes past user behavior to predict fraudulent access patterns, notifying clients of high-risk accesses and enabling them to implement countermeasures.

“The more data FraudAlert stores, it learns what’s common for the user, and what activity would be out of the ordinary,” explains Caulis Founder & CEO Atsuyoshi Shimazu at his office at FINOLAB, a shared facility for FinTech start-ups located in Otemachi, one of Japan’s key financial centers.

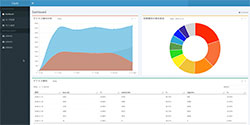

Clients embed JavaScript codes in their sites, enabling them to communicate user behavior information to the Cloud-based FraudAlert system. Rather than requiring manual settings, the AI learns the regular times at which users log in, using which browsers and from which locations, enabling an increasingly accurate estimation of whether an access attempt is legitimate. “The more data it stores, the more accurate its analysis becomes,” Shimazu says.

Expanding Security Web

Providing FraudAlert as a Cloud-based service minimizes integration time and allows low monthly premiums compared to other anti-fraud solutions. FraudAlert already protects some 50 million users registered with major communications companies, e-commerce sites, ticketing services and more.

Shimazu is presently applying to patent a mechanism that shares the system’s database of suspicious internet protocol (IP) addresses through application program interfaces (APIs) between clients’ business operators, making it easier to spot regular offenders. Shimazu is also working to develop more functions unique to Caulis services, with plans to patent these internationally.

FraudAlert was featured at the 2016 Infinity Ventures Summit startup pitch contest, and in November 2016, it was showcased at TechCrunch Tokyo and the inaugural Singapore FinTech Festival. Shimazu has an eye on the ASEAN market, and particularly Singapore, where he intends to establish a branch office and begin test marketing in the next year. With a multilingual version of FraudAlert’s client dashboard in the works, Shimazu aims to win over major companies such as banks and mobile carriers there within the next five years.

Caulis Inc. Founder & CEO Atsuyoshi Shimazu at his office in FINOLAB.

Future Identity

Shimazu anticipates that the number of hackers targeting Japan will only increase as the Tokyo 2020 Olympic and Paralympic Games approach, as was the case for the 2016 Games in Rio de Janeiro and the 2012 Games in London.

“If the danger of identity fraud escalates, we need to employ other measures to confirm users’ identities,” he says. He’s now looking to form partnerships with companies, particularly overseas, dealing with identity theft protection technology such as fingerprint authentication. He also says he wants to set up a cyber-insurance service to handle cases of cyber-attacks.

“We want to focus our energy on becoming a company that can offer identity protection on a large scale, prior to and beyond 2020,” Shimazu says.

Based on interview in December 2016

Website: Caulis Inc.![]()