JETRO Global Connection -Accelerate Innovation with Japan-

Report

Startups now taking up the challenge of carbon neutrality

(World)

February 1, 2022

*This article was originally published in Japanese. All information in this article is as of November 15, 2021.

Investment in new technologies in the environmental field has been expanding as awareness of the importance of carbon neutrality grows. Startups utilizing digital technologies such as the Internet of Things (IoT) and artificial intelligence (AI) to help improve energy consumption efficiency and make the shift to a low-carbon society are now garnering attention.

Environmental tech boom reignited

The “clean tech” (Note 1) boom in environment-related technology investment got its start in the US’s Silicon Valley in the latter half of the 2000s but, with some exceptions such as Tesla and SolarCity, most American companies saw the boom end before they were able to procure long-term financing. Among the factors researched as causes of this failure are the lack of basic technology needed for business expansion and exposure to price competition from Chinese companies in solar power and other renewable energies (Note 2). In some European countries and Japan, however, renewable energy feed-in tariff systems were introduced from the 1990s to the 2010s and investment in related technologies has moved forward. However, no data is available on "environmental technology investment" per se, so it cannot be confirmed whether this investment went to startup companies. This initial clean tech boom seems to have mainly reflected trends in the US, where significant investment funding can be easily directed toward startups and other emerging companies.

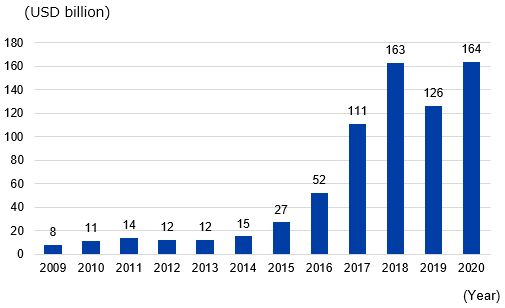

Amid today’s second clean tech boom, investment in startup companies pursuing eco-friendly business is regaining momentum. Characterizing this renewed boom is the creation of startups that address climate change issues across a wide range of industries, including the construction (energy conservation measures in office buildings and housing) and transportation (reduced use and automation) sectors as well as the energy industry. Venture capital (VC) investment in environmental technology expanded rapidly from around 2015, reaching a record high of $16.4 billion worldwide in 2020 (see Figure 1). One reason for the expansion in investment is that the Paris Agreement (Note 3) adopted in December 2015 set clear country-/region-specific numerical targets for reducing greenhouse gas emissions.

Figure 1: VC investment in environmental technology (worldwide)

Source: Created from Statista

There has been a steady stream of climate change-related funds and other frameworks for startup investment launched since 2021. Union Square Ventures (USV), an American VC firm, formed the USV Climate Fund in January 2021 with an exclusive focus on investing in climate change technology. Another US company, TPG Capital, has put together TPG Rise Climate, the largest investment fund ever in this sector, aiming to collaborate with companies, researchers and entrepreneurs who have developed innovative climate change solutions in fostering feasible technologies for addressing climate change. Apple, Google and Boeing, as well as Sumitomo Mitsui Banking Corporation from Japan, have invested in this fund. In Japan, KDDI announced in October 2021 that it would be collaborating with SBI Investment to set up an investment fund – KDDI Green Partners Fund – that specializes in the environmental sector. Over the next five years, the fund will invest about five billion yen in startups working on decarbonization technologies and recycling services that can be expanded beyond the energy field across a large swath of industries. In addition, Mpower partners has established Mpower partners fund L.P.![]() as Japan’s first VC fund concentrating on ESG (environmental, social, governance) factors. Its purpose is to support entrepreneurs seeking to resolve social issues, including those pertinent to the environment and sustainability, through the power of technology in order to promote sustainable growth.

as Japan’s first VC fund concentrating on ESG (environmental, social, governance) factors. Its purpose is to support entrepreneurs seeking to resolve social issues, including those pertinent to the environment and sustainability, through the power of technology in order to promote sustainable growth.

Startup ecosystems that generate clean tech

Startups and other emerging enterprises will leverage new technologies such as digital technology to take up the challenge of carbon-neutral business. In doing so, the presence of a startup ecosystem that supports the creation of startups in terms of network construction and financing will be vital for entrepreneurs. Startup Genome, a US research company, has released its "Global Startup Ecosystem Report 2021"![]() , which evaluates about 280 such ecosystems around the world (Note 4). The six locations introduced in the report as having robust climate change-related technology, i.e., “clean tech”, sectors were Stockholm, Singapore, Austin, Calgary, Pittsburgh, and Sri Lanka (see Table 1).

, which evaluates about 280 such ecosystems around the world (Note 4). The six locations introduced in the report as having robust climate change-related technology, i.e., “clean tech”, sectors were Stockholm, Singapore, Austin, Calgary, Pittsburgh, and Sri Lanka (see Table 1).

| Location | Details on the "clean tech" sub-sector introduced in report |

|---|---|

| Stockholm | Stockholm declared in its action plan its intent to decarbonize by 2040. Nordic Clean Tech produces 25 clean tech-related startups annually. Companies are coming together to form a new hub for clean tech in the Högdalen district, where R&D on recycling is being pursued. |

| Singapore | Public projects totaling S$19 billion, including a plan to issue green bonds, have been selected under Singapore Green Plan 2030. A Sustaintech Xcelerator program has been launched and has produced numerous entrepreneurs. |

| Austin | The University of Texas at Austin, one of the world's leading energy research institutions, has been supporting clean tech startups. The Pecan Street Research Center has been conducting demonstration experiments of new smart grid technologies. |

| Calgary | Calgary enjoys support as a North American energy hub via extensive government subsidies, and 70% of Alberta's clean tech companies have a presence here. The geothermal technology-based energy company Eavor has successfully raised $4 billion in funding from BP and Chevron. |

| Pittsburgh | Host to a United Nations center, Pittsburgh is committed to achieving the SDGs. Seventy-three clean tech companies have set up operations in the city, and $100 million has been invested in university-related R&D over a five-year period. |

| Sri Lanka | Sri Lanka is aiming to improve its self-sufficiency by using renewable energy, and the government provides incentives for wind and solar power. |

A clean tech-related enterprise cluster and examples of successful enterprises are presented as features of Stockholm’s ecosystem. The Högdalen district in the city’s suburbs is becoming a new hub for clean tech companies, and among the successful startups there is Nilar International, a developer of battery technology for electric vehicles (EVs) that received €47 million in financing from the European Investment Bank (EIB) in October 2020.

In Singapore, the government plays a central role in fostering startups. It has released an environmental action plan (Singapore Green Plan 2030), and green finance has been arranged for procuring the funds needed for environmental projects with the aim of creating new business opportunities. The Solar Energy Research Institute of Singapore also conducts R&D focusing on solar cells, modules and systems with support from the National University of Singapore, the National Research Foundation Singapore, and the Singapore Economic Development Board (EDB), helping bring attention to Singapore as “Asia’s clean energy hub”.

Japanese environmental startups struggling to raise long-term funding

Japan's startup ecosystem has gained worldwide recognition, and Tokyo ranked ninth in the world in 2021. The Startup Ecosystem Tokyo Consortium was organized in Tokyo in 2020 for the purpose of forming an ecosystem that connects startups with large companies, small and medium-sized enterprises, universities/research institutes, and government agencies.

Nevertheless, there are only a limited number of startups oriented around carbon neutrality. The US Cleantech Group, which studies clean tech, has released a "Global Cleantech 100"![]() report on a worldwide selection of 100 companies possessing innovative clean technology. This lineup comprised 62 companies in North America, 33 companies in Europe (including Israel), and five companies in Asia, but no Japanese companies were included. The " Green Growth Strategy Through Achieving Carbon Neutrality in 2050"

report on a worldwide selection of 100 companies possessing innovative clean technology. This lineup comprised 62 companies in North America, 33 companies in Europe (including Israel), and five companies in Asia, but no Japanese companies were included. The " Green Growth Strategy Through Achieving Carbon Neutrality in 2050"![]() (1.2MB) published by the Japanese government in March 2021 noted the importance of innovation created by startups in describing the current state of Japan’s climate change-related ecosystem, and pointed out (1) the difficulty of raising investment funds because of the relatively long time required to yield practical applications and (2) the lack of information (on precedents, environment-related technologies, investor trends, etc.).

(1.2MB) published by the Japanese government in March 2021 noted the importance of innovation created by startups in describing the current state of Japan’s climate change-related ecosystem, and pointed out (1) the difficulty of raising investment funds because of the relatively long time required to yield practical applications and (2) the lack of information (on precedents, environment-related technologies, investor trends, etc.).

In this context, the Ministry of the Environment’s Environmental Startup Awards, for which CIC Tokyo, a provider of co-working spaces for entrepreneurs, serves as secretariat, were announced in February 2021. Pirika, Inc., received the Minister's Award, and WOTA Co., Ltd. won the Business Concept Award. Four other finalists were also announced (see Table 2).

| Award | Company | Business description |

|---|---|---|

| Minister's Award | Pirika, Inc. | Pirika conducts surveys on marine debris, particularly floating microplastics, operates the “Pirika” garbage clean-up SNS and provides the “Takanome” litter survey/analysis service. |

| Business Concept Award | WOTA Co., Ltd. | WOTA has developed "WOTA BOX", a portable water recycling plant that enables the use of water for showers, etc., even in the event of a disaster by employing an AI-based autonomous decentralized water circulation system, as well as “WOSH”, a portable water recycling hand-wash stand. |

| Finalists | Umitron Pte. Ltd. | Umitron develops data platform services for aquaculture companies using technologies such as IoT, satellite remote sensing, and machine learning. |

| Polar Star Space Co., Ltd. | Polar Star Space proposes solutions using microsatellites, drones, ground-based measuring instruments, etc. | |

| Gryllus Inc. | A startup from Tokushima University that cultivates edible crickets containing abundant proteins and nutrients, Gryllus provides crickets as raw materials and offers its own brand of processed and functional foods. | |

| Enephant Co., Ltd. | Enephant is involved in renewable energy sales and construction, the retail power business, and the EV rental business, and it promotes the introduction of renewable energies while at the same time circulating energy fees flowing out of its region back into the region. |

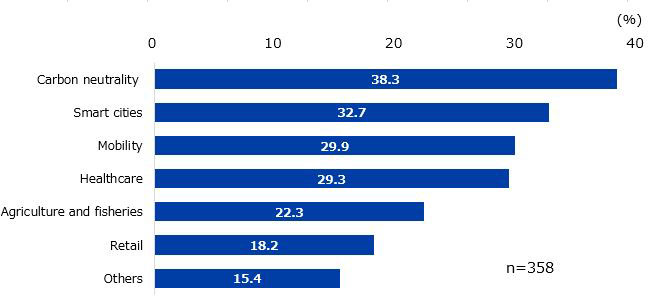

With startups in the area of climate change only gradually emerging in Japan, major companies are embarking on collaboration with startups overseas. The single greatest area of interest for the Japanese companies whose overseas cooperation/collaboration JETRO supports is carbon neutrality (38.3%; see Figure 2). Tokyo Gas has set up a joint venture with the UK’s Octopus Energy, which is engaged in retail sales of electricity derived from renewable energies using digital technology (comprehensive IT platforms), that has begun business operations in Japan. In addition, ORIX has agreed to acquire an 80% stake in the Spanish firm Elawan Energy, which develops and operates wind and solar power plants, and it is making renewable energy business development an important steppingstone in its management strategy.

Figure 2: Areas of interest among Japanese companies for overseas cooperation/collaboration

Note: n is the number of persons in charge at J-Bridge member

Source: Compiled from a questionnaire survey of companies supported by JETRO.

Ecosystems in the area of clean tech have been formed around the world with the ambitious goal of achieving carbon neutrality and with an abundance of funds made available by the private sector. In Japan, though, few startups have been created to seize the new business opportunities arising therefrom. Companies working with a sense of urgency to reduce emissions have thus begun seeking out collaboration with overseas startups.

Note 1: “Clean tech” refers to technologies used to realize products, services or processes that use small amounts of resources or renewable resources to provide value and/or to reduce waste far better than conventional products (Pernick and Wilder, 2007). In recent years, this has also come to be known as "green tech" or "climate tech".

Note 2: See, for example, Benjamin Gaddy, “Venture Capital and Cleantech: The Wrong Model for Clean Energy Innovation”, 2016, etc.

Note 3: The agreement calls for achieving equilibrium between the amount of greenhouse gas emissions from anthropogenic sources and the amount removed by sinks (i.e., carbon neutrality) in the latter half of the 21st century.

Note 4: Six evaluation criteria were used: (1) "performance" showing the market value of startups, (2) "funding" quantifying the financing indicators key to the success of startups in the early stages, (3) “connectivity” indicating whether there are global connections within the ecosystem, (4) “market reach” illustrating the growth potential and overseas deployment of the startup business model, (5) “knowledge” showing the adequacy of research and patent activities, and (6) “human resources” indicating an environment in which startups can access skilled human resources

- Report by:

- IOKI Tomoko, International Economy Division, Overseas Research Department, JETRO

-

Overview of Japanese Startup Investment for US Venture Capitalists

May 2025

-

TBM, a Japanese Unicorn, is taking its environmentally conscious materials and solutions global

April 2025

-

Algal Bio’s Plan to Scale-up Microalgae Solutions for Food, Health, Climate, and more

March 2025

-

From Complexity to Clarity: How Veritus Helps Professors and Research Labs Innovate 5X Faster

February 2025

-

Biodata bank: Innovating Heat Risk Solutions for a Warming World

February 2025

-

Thermalytica’s Improved, Nano-scale Insulation Technology Could Change the World

January 2025

-

Techstars Tokyo Demo Day shows how Japan is Making Strides Towards Becoming a Global Startup Hub

December 2024

-

Redefining Health Through Better Movement with Shosabi

December 2024