JETRO Global Connection -Accelerate Innovation with Japan-

Report

About Japan’s Innovation Ecosystem

(JAPAN)

Mar 26, 2020

This report is authored by for Startups, Inc., commissioned by JETRO.

1. General Conditions and Characteristics of Industries in Japan

Characteristics of Japan’s Industries and Changes

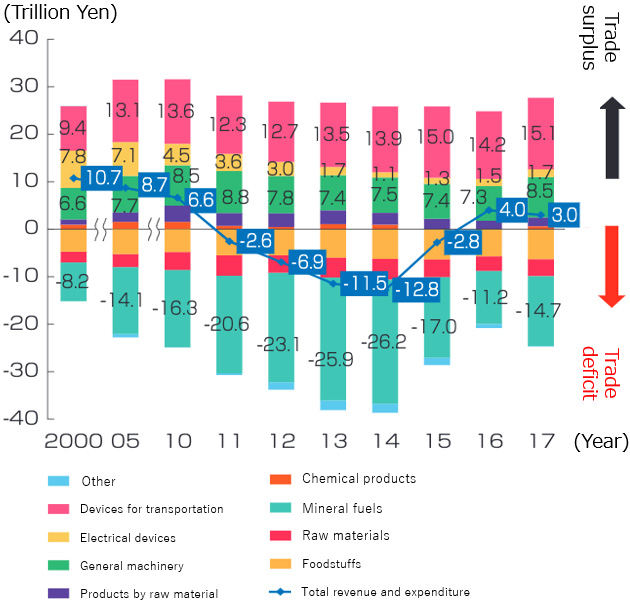

Remarks: Categories of items are based on the status of items in the Balance of Trade

Source: Trade Statistics, Ministry of Finance Remarks

This report begins with an overview of the current conditions of industries in Japan. The above graph shows transitions in Japan’s balance of trade. Looking at products from industries that are in the black, we see many are in fields relating to the manufacturing industry, such as devices for transportation, general machinery, products classified by raw material, electrical devices, chemical products, etc. In particular, devices for transportation are a major industry in Japan, accounting for half of this trade surplus, with representative companies in this field including Toyota Motor Corporation, Honda Motor Company, and Nissan Motor Co., Ltd.

The competitiveness of many industries in Japan, including the automobile industry, the country’s main industry, are said to have been developed against a backdrop of “groups” with a pyramid-type supply chain structure, with the manufacturer situated at the apex, as well as a process of “comparing and adjusting” in which companies cooperate from product development to production based on strong relationships of trust within the group.

However, the competitive environment surrounding these industries is currently being buffeted by waves of change.

Specific examples include the rise of developing nations, the rise of new technologies including AI, a change in the source of value from the manufacturing industry to service industry as epitomized by GAFA, the tightening of environmental regulations such as decarbonation, and the progression of import restrictions placed by foreign governments.

In order to maintain and improve the competitiveness of Japanese companies in the face of such changes to the industrial structure and competitive environment, there is a need for even more concerted efforts to create innovation and accelerate the speed of product development. However, it will be difficult to achieve this if companies simply continue to rely on their own business resources in the form of technologies and human resources, as well as the traditional business model of groups and comparing and adjusting.

What is more, these waves of change facing Japan are not only related to changes in the industrial structure. Japan is also facing major changes in terms of its social structure, such as a contraction of markets due to population decline, an insufficient working population, and social issues and costs stemming from the country’s increasingly elderly population. As of 2020, the population of Japan is 125,320,000 people. Forecasts suggest that this will drop to 110,920,000 people by 2040, and 92,840,000 people by 2060. In addition, the ratio of elderly persons in the population is 29.1% in 2020, and is predicted to increase to 36.1% by 2040 and 38.1% by 2060.

Japan is a nation facing new challenges stemming from major changes to its industrial and social structures.

As such, Japanese companies need to move away from the principle of self-sufficiency in business resources in the form of human resources, technologies and capital, as well as so-called enclosed forms of organizational management like groups and comparing and adjusting, and to reform their business models to create more open and collaborative forms of organizational management that make proactive use of external resources (*2). In addition, Japanese companies also desperately need to create innovation of a kind that will lead to technologies and business ventures which will help solve social issues such as depopulation and its increasingly elderly population.

In order to meet these challenges, Japan is currently focusing on open innovation that incorporates resources from outside organizations and overseas.

Governmental Support for Open Innovation

Let us now take a look at the kinds of action that the Japanese government has been taking to address these challenges.

In light of these changes to the country’s industrial and social structures, the Japanese government has set out policies such as “Society 5.0,” a vision for a human-oriented society that strikes a balance between economic growth and the solution of social issues through the sophisticated integration of cyber and physical spaces, as well as “DX (digital transformation),” the development of novel business models using new digital technologies (*3).

These initiatives also have a high affinity with the so-called 4th Industrial Revolution. The 4th Industrial Revolution refers to technological innovation relating to the utilization of data such as IoT, big data, and AI. Specifically, these are a part of the initiatives taking place under this revolution, which include the utilization of AI and robots, the revitalization of the sharing economy, and the development of fintech (*4). Expectations are running high that this 4th Industrial Revolution will enable Japan to set a global precedent by achieving Society 5.0 and thus solving a range of social issues by incorporating technological innovation into all kinds of industries and social settings.

The essence of the 4th Industrial Revolution is said to reside in the rapid development and fusion of the “real from digital” and the “digital from real,” with models for data utilization being the source of added value. Because of this, new business models the likes of which have never been seen before are being created as a matter of urgency. Therefore, companies are now prioritizing “ambidextrous management” in which they carry out both of the following simultaneously: 1. The putting in place of reforms for data utilization models in the company’s own core businesses; and 2. Ventures into total new business fields (real stemming from digital, and digital stemming from real). In addition to making ongoing improvements to their core technologies through research and development and investments in facilities and equipment, innovative startups with the capacity to set things in motion rapidly along with open innovation are the keys to future competitiveness (*5).

The Japanese government has come up with a range of measures to help put in place robust foundations for the next phase of economic growth, such as the improvement of corporate governance. However, in order to put in place direct incentives for open innovation aimed at the creation and acquisition of new added value while further stepping up pressure for companies to make investments for growth, from fiscal year 2020 the Tax System for the Promotion of Open Innovation is set to be established as a means of encouraging Japanese companies with high internal reserves (*6) to make investments in startups.

In order for this tax system to encourage the supply of new capital to startups, the torchbearers of innovation, and for this to translate into growth, it provides companies and corporate venture capital (hereafter, “CVC”) in Japan with a tax deduction of 25% on investments of 100 million yen or more (10 million yen or more in the case of SMEs) made to unlisted venture companies that have been established for less than 10 years (*5). Overseas venture companies also qualify for this tax system if investments amount to 500 million yen or more.

2. Open Innovation in Japanese Companies: Current Status, Characteristics and Trends

Importance of Cooperation with Startups

The above kinds of changes to the industrial and social structures along with the 4th Industrial Revolution have come together to provide the momentum for the creation of new business models. Recent years in Japan, there is a great deal of enthusiasm for initiatives related to open innovation.

Kazuhiko Chuman is the General Manager of KDDI Corporation’s Business Incubation Development, Corporate Strategy Planning Division, and spearheads KDDI ∞ Labo(KDDI MUGEN Labo), a support program for ventures, along with KDDI Open Innovation Fund, An investment fund for ventures. Mr. Chuman made the following remarks in respect to the above.

Mr. Chuman: “With the widespread uptake of 5G and progression of IoT, real assets around the world will come to take on different significance. Digital gives new meaning to things, but there can be no meaning without real assets such as stores, cars and products.

In Japan, 80 – 90% of stores, distribution networks and other things are owned by large companies. However, these large companies will probably have difficulty generating new business models and entering into the field of GAFA. That is why the existence of startups with technologies and ideas is vital.

Large companies with real assets and startups with the capability to generate new business models. Both can work together to bring about true innovation (*7)”

As these remarks suggest, there are real expectations among large companies in Japan that they can accelerate the pace of innovation through partnerships which utilize the strengths of their own real assets coupled with the ideas and technologies possessed by startups.

Current Status and Challenges concerning Open Innovation in Japan

Compared with the US, Japan does not have such a long history of open innovation and there are still few precedents. Behind this lack of precedents for open innovation in Japan are various challenges are relating to "system to support open innovation involving both domestic and overseas" and "Speed of cooperation between major companies and startups" that the effective issues seen in each of them have.

Systems of providing support for open innovation in Japan and overseas are slowly but surely being put in place. In the US during the 2000s, entrepreneurs and investors were already working to establish startup ecosystems. Meanwhile, in Japan at this time, there was very little venture capital (hereafter, “VC”), and not many investments were made in startups.

However, currently in Japan, collaboration between industry and academia and large companies established CVC also the movement has become active of Acceleration programs for English.

Concerning the speed of collaboration between large companies and startups, the other issue mentioned here, it is sometimes a case of differences in the speed of decision making. Many startups have a CEO or someone in a similar position who retains many powers and who makes decisions on the frontline, allowing decisions to be made a rapid speed. In contrast, large companies often have people in charge at the departmental level, and need to seek the authorization of their superiors before taking action. They have to assign priority to many projects at the same time, therefore it’s happen to decisions take times.

A range of efforts have been made for recent years to resolve these differences of speed in the decision making process. Therefor separating their innovation departments from the main company unit and establishing organizations in charged with making decision. Numbers of companies are trying to solve such issue of "speed of decision making" In this way.

Examples of companies that have taken such steps include KDDI Corporation, Dentsu Inc., and the East Japan Railway Company. KDDI Corporation has separated its innovation department and established a fund worth in the region of 30 billion yen, as well as the acceleration program KDDI MUGEN Labo. Likewise, Dentsu Inc. has assembled a team of specialists under what it calls the Dentsu Cross Design Unit, and since January 31, 2020 has been providing a service which facilitates cooperative ventures between large companies and startups. The East Japan Railway Company has established an innovation department in the form of JR East Start Up Co., Ltd., pouring its energy into setting up cooperative ventures with startups.

In addition, as initiatives such as industry-academia collaboration, establishment of CVC, and establish an innovation section specializing in collaboration with startups are increasing. The important point is the cooperation of various stakeholders such as universities and financial institutions.

3. Current status of Innovation Ecosystems in Japan, Characteristics and its Trends

Current Status of Innovation Ecosystems

Although the momentum for open innovation is increasing in Japan, the rate of implementation of open innovation seems to be still low compared with companies in Europe and the US. In addition, there is a major disparity in the rate of selecting entrepreneurs and startups as partners (*8).

When it comes to the kinds of innovation ecosystems that free up funds, technologies, human resources and knowledge, and which facilitate collaboration between a diverse range of stakeholders, a prerequisite for providing stimulus to startups and open innovation, there is no denying that Japan still has some way to go compared to countries in Europe and the US.

Startup Genome, a company specializing in the analysis of startup ecosystems, published its “Global Startup Ecosystem 2019” report in May 2019 (*9). This report ranks the level of maturity of startup ecosystems in cities around the world, focusing on factors such as the performance of startups, fundraising, market surveys, networks, human resources, experience, and knowledge. This report includes a ranking of the 30 best startup cities in the world, with Silicon Valley occupying first place. No Japanese cities were included in this ranking.

However, the tide has been changing in recent years in Japan, too. For example, Tokyo was mentioned for the first time in this report for being in the Early-Globalization Phase, the stage at which Startup Genome states that global collaboration in startup ecosystems has started to take off. The initiatives which led to this evaluation in the report include Tech Business Camp Tokyo, an accelerator program initiated by the Tokyo Metropolitan Government, and J-Startup, a program of the Ministry of Economy, Trade and Industry. This suggests that perhaps the growth of startup ecosystems in Japan is gradually being recognized in the global community. Two areas in particular were highlighted for praise: Manufacturing & Robotics, and Fintech.

The following sections provide a brief overview of the key points that make these two areas particularly worthy of praise.

- Manufacturing & robotics

Japan is home to some of the world’s leading robotics manufacturers, producing over half of the world’s supply volume. The Japan Robot Association, the world's first robot trade association, was formed in Tokyo in 1971 together with companies including among others DENSO Corporation, Hitachi, Ltd., Sony Corporation, Toshiba Corporation, Yamaha Motor Company Limited, Kawasaki Heavy Industries Ltd., and Mitsubishi Electric Corporation. ispace, inc., a company focusing on the exploration of resources in space using micro robots, was listed in the report as a startup in the Series A Round which has raised $90 million in funding. - Fintech

According to the Global Financial Centres Index, Tokyo ranks 5th in the world as a competitive financial centre. The Tokyo Metropolitan Government received praised for the initiatives it has been taking, such as developing the concept of “FinCity.Tokyo” and launching FinTech Business Camp Tokyo, a government accelerator program focusing on FinTech.

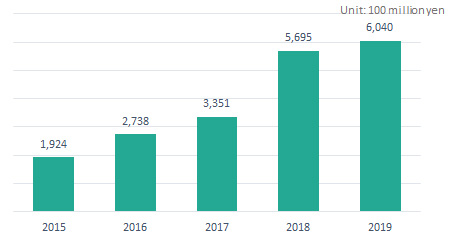

In addition, the amount of financing for startups in Japan is increasing every year, and the environment for providing support to startups continues to grow.

Transition of investment amounts in Japanese startups

*1: Feb. 7, 2020

*2: Includes funds raised partially through investments and company bonds

Data source: STARTUP DB

In fact, Japan only had two unicorn startups one or two years ago, but as a result of the growth of startup ecosystems, this has increased to seven as of February 2020 (*10). What is more, of these seven unicorn startups, five are in the field of deep tech (groundbreaking technologies with a high impact). So pay more attention to those startups in the field of deep tech Japan for the future.

—Efforts to construct Innovation Ecosystems

As a result of the growth of startup ecosystems in Japan, initiatives for open innovation seeking to encourage partnerships between major Japanese companies and startups are becoming increasingly diverse. Among these, overseas startups are also being targeted.

For example, in terms of acceleration programs, there is Open Network Lab, which is run by Digital Garage and has a track record of providing support to more than 100 companies; KDDI MUGEN Labo, run by KDDI Corporation; and PLUG and PLAY JAPAN, the Japanese version of an innovation platform from Silicon Valley that pairs large companies and startups.

The number of other overseas support programs being launched here in Japan is gradually increasing, such as the launch of Google for Startups Campus, US company Google’s startup support facility located in Shibuya, Tokyo; acceleration programs by 500 Startups, an American seed investment fund; and the establishment of the Japanese subsidiary of Rainmaking Innovation LTD, which is based in the United Kingdom.

In terms of the innovation community, the various events include WeWork and Fabbit, as well as Venture Café, an innovation promotion program originating in Boston, and M's Salon, a matching event for large companies and startups run by Mizuho Bank, Ltd.

One example of an initiative spearheaded by private sector companies is the MONET Consortium, a joint venture between SoftBank Corp. and Toyota Motor Corporation aimed at achieving mobility innovation. Many startups have also joined this program in a bid to increase their global competitiveness.

The Japanese government has also been unfurling a range of initiatives aimed at creating innovation ecosystems, including the formation of centers of innovation that can be expanded on a global basis based on the Strategy for the Creation of Startup Ecosystems, as well as support for J-Startup, a program for nurturing global startups. In addition, JETRO, an government organization overseen by the Ministry of Economy, Trade and Industry, is also working to turn Japan into a global innovation hub by dispatching Japanese companies with a proactive stance on open innovation to major ecosystems overseas to scout out promising collaborative partners and entice promising overseas startups to Japan.

4. Potentials and Expectations for Partnerships between Japanese Companies and Overseas Companies

Status of Investment by Japanese Companies in Overseas Startups

While there are still few examples of partnerships between Japanese companies and overseas startups compared to those in European countries and the US, in recent years we are beginning to see Japanese companies making investments in overseas startups. One recent notable example is the SoftBank Vision Fund. This fund does not place industries and businesses in which investments have been made under the umbrella of the SoftBank Group. By doing this, SoftBank aims to form partnerships with only the most outstanding companies in the world in line with the times, thus assembling a group of companies which can achieve growth over the long term.

Major investment destinations among companies that have entered the Japanese market include Slack Technologies, Uber Technologies, and OYO Hotels & Homes. Cal Henderson, joint founder of Slack Technologies, states that the SoftBank Group is an important partner in cultivating the Japanese market (*11). And Japan is the market with the second largest number of users after the US. In regard to Uber Technologies, the SoftBank Group has agreed to make an investment in this company along with Toyota Motor Corporation and DENSO Corporation. This investment makes the SoftBank Group a ride-sharing company with a global share of 90%.

In addition, Sony Corporation and Daiwa Capital Holdings Co., Ltd. have established Innovation Growth Ventures, and are seeking to establish bases not only in Japan but also North America and Europe and make investments mainly in AI and robotics.

Status of Investment by Overseas Companies in Japanese Startups

There are also examples of the reverse taking place – i.e. investment by overseas companies in Japanese startups. These include among numerous others PLAID, Inc., a company which runs KARTE, a real-time customer experience platform implemented with capital from Google, as well as from scratch Co., Ltd., a company which runs b→dash, a marketing platform implemented with capital from ABEJA, KKR, a provider of deep learning systems.

And there are also examples of cross border M&A. M&A which took place in 2019 include the acquisition of Pocket Concierge, an online restaurant reservation and payment platform, by the American Express Company, as well as the acquisition of Gengo, a company administering translation crowdsourcing services, which was acquired by Lionbridge Technologies, Inc. in the US.

5. Conclusion

This report provided an overview of open innovation and innovation ecosystems in Japan.

Given the dizzying changes taking place to Japan’s industrial structure, social structure and competitive environment, Japan cannot afford to cling to traditional business models if it is to maintain and improve its competitiveness. Rather, it needs to actively incorporate resources from both inside and outside the country, and create Japan-led innovation in the world.

In order to do so, it needs to free up the real assets and technological capabilities possessed by Japanese companies and form partnerships with startups while seeking to construct innovation ecosystems that encompass not just Japan but the whole world. It is hoped that the further promotion of open innovation will help put in place the kind of environment that allows investment by Japanese companies in overseas startups and vice versa, one that will facilitate mutual investment and partnerships.

- Sources and reference links

-

(*1) Source: “Challenges and Prospects facing Japan’s Manufacturing Industry” (Ministry of Economy, Trade and Industry)

(7.5MB) (available only in Japanese)

(7.5MB) (available only in Japanese)

(*2) Source: “Challenges and Directions for Industrial Structures aimed at the 4th Industrial Revolution” (Ministry of Economy, Trade and Industry) (441KB) (available only in Japanese)

(441KB) (available only in Japanese)

(*3) Source: “Science,Technology and Innovation” (Cabinet Office)

(*4) Source: “Impacts of the 4th Industrial Revolution” (Cabinet Office) (available only in Japanese)

(available only in Japanese)

(*5) Source: “Concerning Fiscal Year 2020 Tax Reforms related to the Economy, Trade and Industry” (Ministry of Economy, Trade and Industry) (4.1MB) (available only in Japanese)

(4.1MB) (available only in Japanese)

(*6) Source: “Corporate Enterprise Statistics, Drop of 2.6% in Turnover in all Industries... First Decrease in 3 Years” (The Yomiuri Shimbun) (available only in Japanese)

(*7) Source: “Strategies for the Joint Development of New Industries from 2020 onward as envisaged by Kazuhiko Chuman, Standard Bearer of Open Incubation” (STARTUP DB) (available only in Japanese)

(available only in Japanese)

(*8) Source: “Open Innovation White Paper 2nd Edition (Digest Edition)” (NEDO) (3.1MB) (available only in Japanese)

(3.1MB) (available only in Japanese)

(*9) Source: ”Global Startup Ecosystem Report 2019” (Startup Genome)

(*10) Source: “Japan Startup Market Capitalization Ranking Report, Latest Edition (February 2020)” (STARTUP DB) (available only in Japanese)

(available only in Japanese)

(*11) Source: “US Slack Founder keen to expand into Japan Aggregate Market Value of Two Trillion Yen” (The Nikkei) (available only in Japanese)

(available only in Japanese)

-

* The graphs etc. extracted from METI’s report are used in accordance with the following Terms of Use.

-

Overview of Japanese Startup Investment for US Venture Capitalists

May 2025

-

TBM, a Japanese Unicorn, is taking its environmentally conscious materials and solutions global

April 2025

-

Algal Bio’s Plan to Scale-up Microalgae Solutions for Food, Health, Climate, and more

March 2025

-

From Complexity to Clarity: How Veritus Helps Professors and Research Labs Innovate 5X Faster

February 2025

-

Biodata bank: Innovating Heat Risk Solutions for a Warming World

February 2025

-

Thermalytica’s Improved, Nano-scale Insulation Technology Could Change the World

January 2025

-

Techstars Tokyo Demo Day shows how Japan is Making Strides Towards Becoming a Global Startup Hub

December 2024

-

Redefining Health Through Better Movement with Shosabi

December 2024