JETRO Global Connection -Accelerate Innovation with Japan-

Interview

Japanese Start-up GOYOH is helping global real estate investors accurately and efficiently manage ESG efforts

(Japan)

May 2, 2024

According to the World Economic Forum,buildings are responsible![]() for as much as 40% of global greenhouse gas emissions. As investors increasingly adopt ESG (Environmental, Social, Governance) standards into their decision-making process, the need for greener, more sustainable properties is growing.

for as much as 40% of global greenhouse gas emissions. As investors increasingly adopt ESG (Environmental, Social, Governance) standards into their decision-making process, the need for greener, more sustainable properties is growing.

For property owners, though, measuring and finding ways to reduce the environmental impacts of their buildings, while also incentivizing social benefits, is a challenge.

“It was very surprising,” said Yukihiko Ito, GOYOH’s founder and CEO. “ESG was not sustainable for most of the real estate investors because there were so many challenges. They don't have resources, they don't have tools, they just have responsibilities.”

Ito first got into real estate when he started an asset management company in the United States in 2006. Over the years, Ito worked with major global real estate ESG leaders and saw an opportunity to meet this growing need for real estate-focused ESG technology and data platforms, and thus launched GOYOH![]() in 2018.

in 2018.

Since then, they’ve taken a unique approach, built on the fact that both Ito and GOYOH’s head of Sustainability Analytics and Social Impact, Weidi Zhang, have years of experience in the global real estate sector.

In fact, after launching, Ito, Zhang, and their team spent time deepening the understanding of the challenges that ESG was bringing to investors, and then developed a strategy focused on creating tools specifically tailored to the needs of their initial target customers -- large institutional investors.

”Our experience working with global real estate players exposed us to sustainability leaders. By interviewing key investors and developers, we identified three critical challenges in their daily operations: lack of quality ESG data, lack of tenant engagement channels, and quantifying social impact. GOYOH focuses on solving these problems, by providing SaaS solutions for them to transform sustainability practices from costly duties to value-adds for buildings.” said Zhang.

“We decided to start providing digitized tools for real estate players in Japan and globally,” said Ito. “Most of the solutions we are delivering provide unique value-adds to the clients from a social and financial returns’ perspective, which differentiate us from most of the existing environmental-focused ESG data solutions in the market right now.”

Today, GOYOH has created, based on the needs of investors, a unique real estate technology services platform that uses innovative SaaS solutions to offer a suite of services catering to the growing ESG real estate sector.

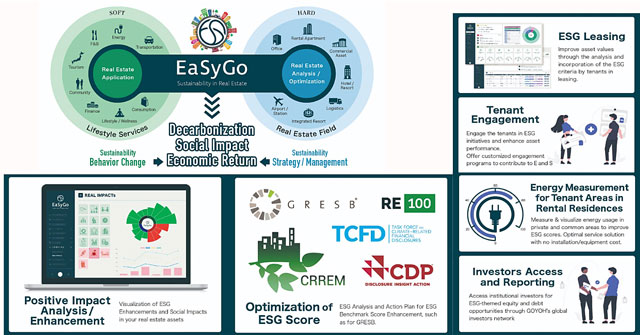

The image of product & service (provided by Goyoh)

For example, their main offering is called EaSyGo![]() , an ESG-focused real tech service that aims to elevate property value by quantifying and showcasing social impact, delivering actionable ESG strategies, and fostering stakeholder engagement through sustainable behavior incentives. It serves as a comprehensive platform for tenant involvement and investor transparency.

, an ESG-focused real tech service that aims to elevate property value by quantifying and showcasing social impact, delivering actionable ESG strategies, and fostering stakeholder engagement through sustainable behavior incentives. It serves as a comprehensive platform for tenant involvement and investor transparency.

Many of EaSyGo’s functions were developed to solve challenges global real estate investors had.

For example, GOYOH can help track energy usage in the exclusive tenant areas in residential buildings, by gathering data from electricity providers about each tenant, data that was, previously, hidden to owners. It also allows property managers to organize decarbonization and sustainability events or promote SDG actions such as waste reduction or community exchanges.

“If you want to take action on ESG in buildings, the institutional investors or owners themselves cannot do it alone by themselves. They have to approach tenants and workers, look at transportation, consumption, waste management, energy use and lifestyle,” said Ito. “That's very difficult. Our service creates a bridge between end users and investors/landlords and empowers the landlords with more accessibility to greater scale of decarbonization initiatives and positive social impact.”

So far, the response from customers such as AXA Real Estate Investment Manager Japan has been very positive and they have increased the number of buildings to adopt the EaSyGo services across their bigger portfolios, added Ito.

“Our business position approach is unique,” added Ito. “Our services are really in demand by leading global investors.”

One project, announced in late 2023, will see GOYOH partner with Mitsubishi Estate, one of Japan's top developers, for the Be Smart Tokyo initiative. This Tokyo Metropolitan Government-led project aims to enhance Tokyo residents' Quality of Life with sophisticated technology in selected Mitsubishi Estate buildings in Otemachi-Marunouchi-Yurakucho central business district in the heart of Tokyo.

“We are analyzing ESG of buildings and the companies in the area, and we are finding the gaps between the owners and tenants and are identifying potential improvement solutions via AI tools and data science,” said Ito.

Photos of buildings that Goyoh provides services to (provided by Goyoh)

Currently, GOYOH is working with global real estate companies, but primarily in the Japanese market. The challenge will be localizing their product to fit vastly different real estate markets, and also finding a way to reach smaller and medium sized investors, who own, in some cases, the majority of properties in a market.

“The support from JETRO has been instrumental for our global expansion preparation,” said Zhang. “They have introduced us to many opportunities to connect to potential customers and VCs in the overseas market.”

Reducing emissions from buildings will likely become a bigger focus, as investors expand the scale and scope of ESG and focus more on social returns alongside financial returns. For GOYOH, this means the opportunity to scale up is immense, if they can continue to develop tools to meet investor’s growing ESG needs.

“The global real estate market expansion is challenging but we are positive on the outlook as our service is designed to solve the problems for global real estate players since the launch of GOYOH, with a global vision,” said Zhang. “To better deliver our solution globally, we need to tailor and differentiate our strategies for international markets. ”

Group photo at Cleantech Forum North America 2024 (Photo by JETRO)

Profile of Yukihiko Ito, Commander in Chief of Goyoh Inc.

Linkedin![]()

Yukihiko Ito founded ASTERISK Inc. in New York at the age of 23, focusing on innovative real estate investment and management since 2006. Specializing in enhancing the soft values of real estate, he has catered to global investors and HNW individuals since 2008 and is a pioneer in Japan's real estate and hospitality sectors. In 2018, Ito established GOYOH Inc., a PropTech startup offering ESG real estate solutions via the 'EaSyGo' platform, focusing on creating soft value and social impact. Ito also serves on the CRREM Global Scientific & Investors Committee.

Profile of Weidi Zhang, Chief Strategy and Innovation Officer of Goyoh Inc.

Linkedin![]()

Weidi Zhang is the Chief Strategy and Innovation Officer at GOYOH, an ESG PropTech startup in Tokyo. She brings a decade of experience in global real estate, specializing in ESG, sustainability, fundraising, and cross-border transactions. Weidi has worked in Los Angeles and Hong Kong, engaging in significant deals across the US and APAC. She holds a BS from the University of Southern California and is pursuing a master’s in computer and Info Tech at the University of Pennsylvania, focusing on AI and NLP.

- Report by:

- UEDA Momoka, Startup Support Division, JETRO

-

Japan Origin. Creating a New Future. -A Pioneering Alliance Unlocking the Metaverse's Potential-

May 2024

-

Fermelanta is using fermentation to create safer, cost-effective alternatives to chemicals

May 2024

-

Japanese Start-up GOYOH is helping global real estate investors accurately and efficiently manage ESG efforts

May 2024

-

Final Aim’s blockchain smart contracts aim to transform the design process – and more

April 2024

-

Techstars is bringing its world-renowned accelerator to Tokyo

April 2024

-

The Innovative Collaboration Bringing Kyoto’s Zen Wisdom into the Virtual World

April 2024

-

Caster’s is reinventing Remote Work and aiding Startups in Japan and Germany

March 2024

-

Spatial Pleasure, the Japanese startup aiming to use data to makes cities more sustainable

March 2024