Chapter 2 Japan’s Business Environment and Foreign-Affiliated Companies

Assessment of Japan’s Business Environment

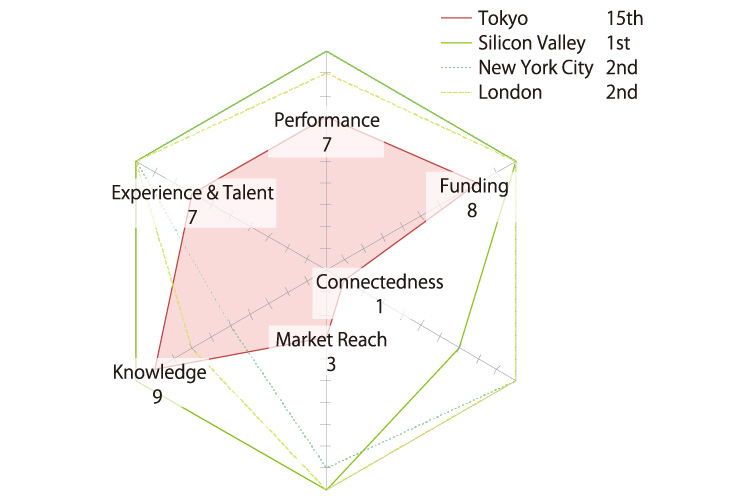

- According to the “Global Startup Ecosystem Report (GSER) 2020,” Tokyo was ranked at 15th in its worldwide research on startup ecosystems. Tokyo was highly evaluated for “Knowledge” and “Funding,” while “Connectedness” regarding cooperation between people and technologies in the region scored a mere one point.

Comparison of Tokyo and the Top Three Cities in GSER

-

Note:

Numbers indlcate the scores o Tokyo

-

Source:

"GSER2020"(Startup Genome)

- According to the 2019 version of the “Survey on Attitude of Western and Asian Companies toward Investment in Japan,” conducted by Ministry of Economy, Trade and Industry once every two years, Japan was considered as the most attractive R&D base among the 19 Asian countries and regions surveyed.

| Function (# of reponse) | Japan | Top Country/Region | ||

|---|---|---|---|---|

| Ranking | Response(%) | Country | Response(%) | |

| R&D(91) | 1 | 38 | - | - |

| Regional HQ (94) | 3 | 10 | Singapore | 49 |

| Sales (85) | 3 | 15 | China | 42 |

| Manufacturing (84) | 3 | 8 | China | 55 |

| Logistics (77) | 3 | 8 | China | 36 |

| Finance (76) | 4 | 8 | Singapore | 46 |

| Back Office (77) | 4 | 4 | India | 56 |

Toward Improving the Business Environment

Strengthening City Functions

- In May 2020, a bill to amend the National Strategy Special Zones Act was enacted. This revision’s major purpose is to realize the “Super City” initiative.

- The “Super City” initiative aims to accelerate the realization of a future society for 2030 by implementing urban planning while encouraging citizens’ participation in areas that span all civil lifestyles.

| Characteristics | Outline |

|---|---|

|

1) Cover all aspects of citizen life |

The provision of new services in a wide range of fields, such as covering more than half of the 10 areas. 10 areas include ① mobility, ② logistics, ③ payment, ④ administration, ⑤ medical and nursing care, ⑥ education, ⑦ energy and water, ⑧ environment and waste, ⑨ crime prevention, and ⑩ disaster prevention and safety. |

| 2) Implement at a society level rather than temporary demonstration | The selection of areas designated as super cities is based on critical factors for achieving the plan in the area, such as the strength of commitments by public and private parties and the ability of business operators in each area comprising the proposed smart city. |

| 3) Accelerate the realization of a future society from residents' perspectives | Local governments are required to make efforts to understand residents' opinions prior to submitting applications for the super city designation. Upon proposing the basic concept after designation, the local government is required to obtain the consent of the residents in certain ways, such as by referendum if there are existing residents. |

- To help create and grow startups in the domestic market, the Cabinet Office is improving the domestic business environment under “Beyond Limits. Unlock Our Potential: Strategies for creation of startup ecosystem to compete with the world top ecosystems.”

- The initiative comprises seven strategies to strengthen the ecosystem comprehensively. Among those, Strategy 1 aims to create base cities that compare with cities with advanced ecosystems in the world by selecting domestic cities that form consortiums among industry, government, and academia in the region as “Global Startup Cities” or “Startup Cities.”

| Base cities | Outline |

| Global Startup Cities | |

|---|---|

|

Startup Ecosystem Tokyo Consortium |

Members (as of January 2020) include 113 organizations, mainly companies and organizations, universities, and local governments in Tokyo. Kawasaki City, Ibaraki Prefecture, and Tsukuba City participate as wider-area collaborating organizations. Consolidation of R&D bases in the region and the commercialization of R&D results by collaboration with leading universities. |

|

Central Japan Startup Ecosystem Consortium |

A consortium comprising two organizations: "Aichi-Nagoya Startup Ecosystem Consortium" formed around the Central Japan Economic Federation, Nagoya University, Aichi Prefecture, Nagoya City, etc., and "Hamamatsu City Startup Strategy Promotion Council." Promote collaborative business projects in priority areas such as mobility and healthcare. |

|

Osaka, Kyoto, Hyogo Kobe Consortium |

It is a joint consortium formed by the consortia of Osaka, Kyoto, and Hyogo Kobe. On top of each consortium's independent efforts, the three organizations will collaborate to strengthen the regional ecosystem in preparation for the Osaka Expo. |

| Fukuoka Startup Consortium | A consortium (as of July 2020) consisting of 61 organizations, the primary player of which is Fukuoka City, with participants including local industry associations, businesses, including those supporting startups, and universities. Strengthen support for entrepreneurship and startups, and create innovation through demonstration projects and public procurement. |

| Starup Cities | |

|

Sapporo and Hokkaido Startups Ecosystem Promotion Council |

A consortium of 31 organizations, including the Chair-City of Sapporo (as of February 2020). It targets primary industries, biotechnology/healthcare, space industries, etc. |

|

Sendai Startup Ecosystem Promotion Council |

Chaired by the Mayor of Sendai. In the future, it plans to hold pitch events in Sendai City and implement startup support programs. |

|

Hiroshima Regional Innovation Strategic Meetings |

Meeting members include key persons from businesses, universities, financial, and governments in the Hiroshima region. Developing bases to attract diverse human resources in the area. |

|

Kitakyushu City SDGs Startup Ecosystem consortium |

This consortium, chaired by the Mayor of Kitakyushu, supports startups in the digital transformation, environment, and robotics areas, which are the city's strengths, and provides fields for demonstration tests of small unmanned aerial devices and IoT. |

Efforts to Stimulate Domestic Innovation

- In efforts to stimulate domestic innovation, a new tax system to promote open innovation was introduced. The Open Innovation Promotion Tax System allows corporations or CVCs in Japan to get income tax deductions equal to 25% of their investment in startups if they invest more than a certain amount to conduct open innovation.

| Requirements | Outline of requirements |

|---|---|

| 1) Eligible Corporates | The investor businesses eligible for tax rate deductions include joint-stock companies and mutual companies submitting blue returns or investment limited partnerships or partnerships under the Civil Code with a majority of interest held by companies mentioned above subject to certain conditions. |

| 2) Requirements for Target Startups | The investee company (under this tax program) must be an unlisted joint-stock company less than 10 years old. In terms of its share ownership, a single corporate group cannot have a majority while entities other than corporations (investment limited liability partnerships, partnerships under the Civil Code, individuals, etc.) must have at least one-third of the shares. |

| 3) Requirements for investment |

Major investment requirements are as follows. ① Investment size: If the investee company is a domestic startup, the investment must be ¥100 million or more. However, if the investor is an SME, investment of more than ¥10 million shall be eligible. Investment in an overseas startup must be at least ¥500 million per investment. ② Purpose of investment: The investee corporation has innovative technologies or services which the investor company needs to conduct highly productive business or develop new business. Upon collaboration, the investor company should provide necessary support to the startup and contribute to its growth. ③ Others: The investment must be paid in by cash and be to increase share capital of the startup. Also, the investor must hold the acquired shares for five years or more. |

Government’s Measures to Furthering Digitalization

- With the aim to furthering digitalization, the Japanese government introduced 5G investment promotion tax system for investment in local 5G and 5G base station facilities. In addition, in efforts to improve the business environment of the digital economy/society, the government amended the Act on Protection of Personal Information and enacted the Act on Improvement of Transparency and Fairness in Trading on Specified Digital Platforms.

- The Japanese government aims to promote digital technologies and services in areas such as finance, mobility, administration, and healthcare.

| Sectors | Outline |

|---|---|

| Finance | Aim to increase cashless payments, promote Japanese unified QR Code (JPQR), including overseas, and promote NFC payment as well. Upgrade financial services using FinTech. |

| Mobility | Aim to realize full self-driving on expressways and start and expand unmanned automated driving services on land travel. Regarding air travel, target the use of drones for off-sight flights over inhabited areas by fiscal 2022. For sea, continue to discuss the promotion of automated vessels and crewless submarines. |

| Administration | The government will promote its use of cloud services and expand one-stop services. For corporations, the government will introduce one-stop procedures, including the Articles of Incorporation certification and the registration of incorporation, by February 2021. Besides, developing a roadmap for digitalizing tax and social insurance certification procedures is scheduled for fiscal 2020. |

| Medical care | The government plans to begin full-scale operation of the "online verification of health insurance coverage," which allows for the use of My Number Card as a health insurance certificate and enables individuals and family members to access necessary information via My Number Portal. Also, utilizing ICT, robots, AI, and other technologies and conducting reviews, the government aims to expand telemedicine, including safe and effective online medical treatment. |

Perception of the Business Environment in Japan among Foreign-affiliated Companies

Foreign-affiliated Companies Located in Japan

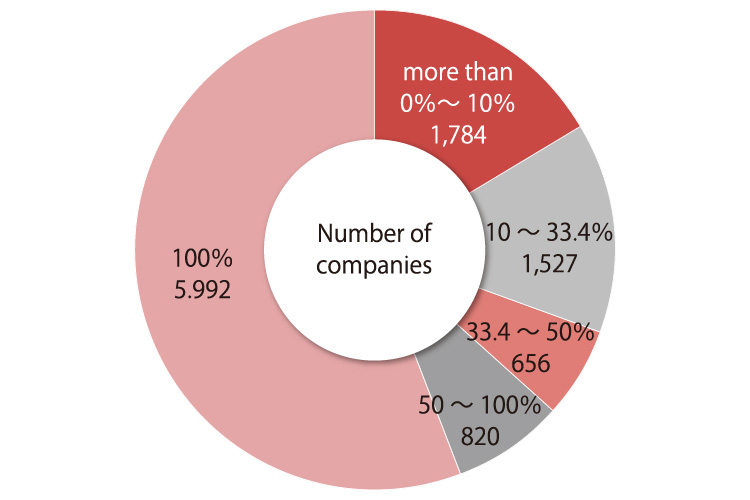

- According to the “Economic Census-Activity Survey” conducted by the Ministry of Internal Affairs and Communications and the Ministry of Economy, Trade and Industry in 2016, the number of enterprises with foreign capital was 10,779. In terms of foreign capital ratio, the number of companies with 100% foreign capital was the largest at 5,992 companies.

Foreign-affiliated Companies in Japan by Foreign Ownership Ratio

-

Source:

"Economic Census-Activity Survey"(MIC,METI)

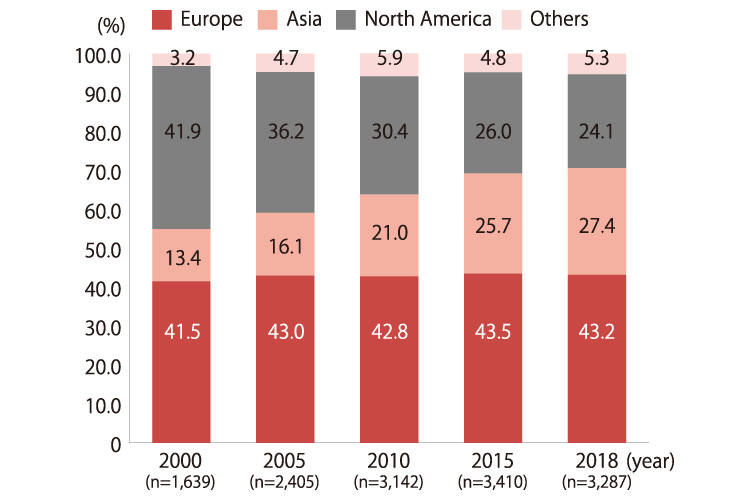

- According to the “Survey of Trends in Business Activities of Foreign Affiliates” conducted by METI on foreign-affiliated companies in Japan, by the parent company’s location, 43.2% were Europe, 27.4% in Asia, 24.1% in North America, and 5.3% in others.

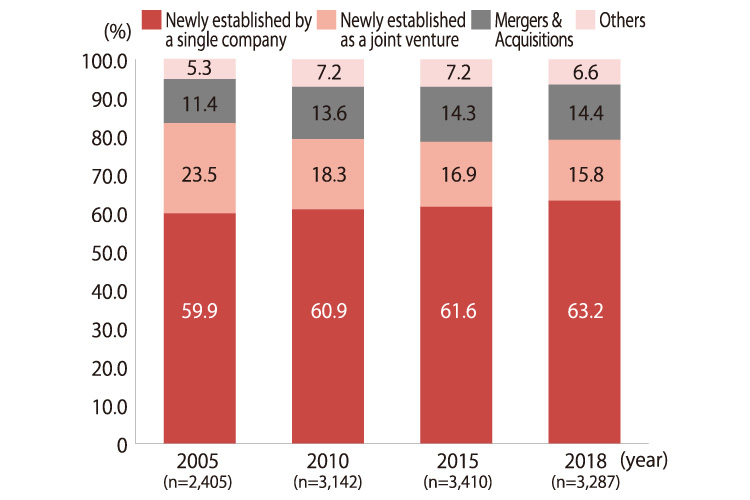

- To a question of how the foreign ownership exceeded one-third of the total (=how foreign-affiliated companies were established in Japan), 63.2% of the responding companies answered “newly established by a single company,” 15.8% answered “newly established as a joint venture,” 14.4% answered “mergers&acquisitions,” and 6.6% answered “others.”

Foreign-affiliated Companies in Japan by Parent Company’s Locations

>

>

-

Note:

"Year"represents the fiscal year respondents based their answers on.

-

Source:

"Survey of Trends in Business Activities of Foreign Affiliates"(METI)

Method of Establishing Foreign-affiliated Companies in Japan

-

Note:

"Year"represents the fiscal year respondents based their answers on.

-

Source:

"Survey of Trends in Business Activities of Foreign Affiliates"(METI)

Although Negatively Impacted by COVID-19, the Majority are Continuing Business in Japan

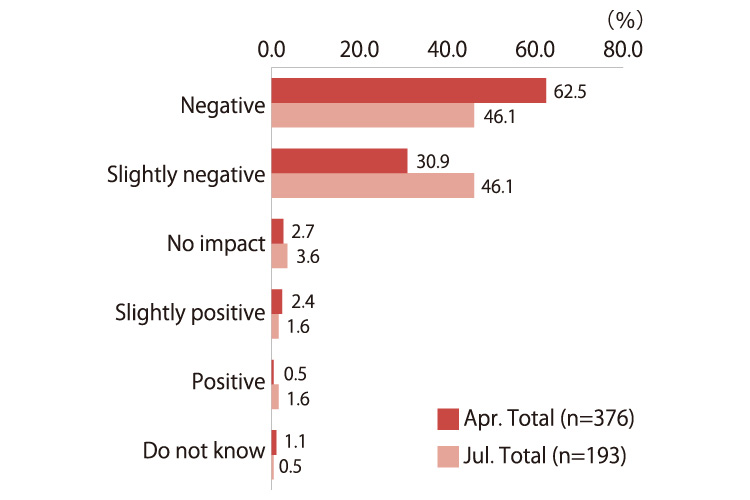

- According to the surveys conducted in April and July 2020 by JETRO, primarily targeting its clients, 93.4% of the companies responded that COVID-19 had “negative impacts” or “slightly negative impacts” in the April survey and 92.2% in the July, both exceeding 90%.

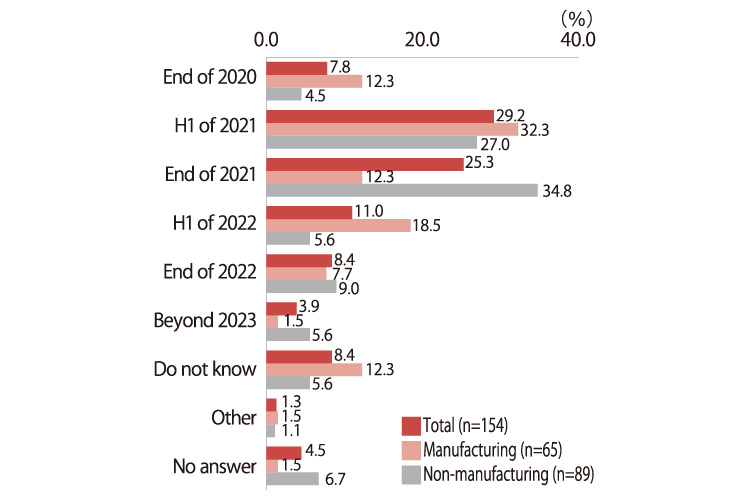

- Many companies cited a decline in sales as a specific impact, and the largest number of respondents, 29.2%, answered that it would take until the first half of 2021 to compensate for the sales decrease, followed by those who answered until the end of 2021 (25.3%).

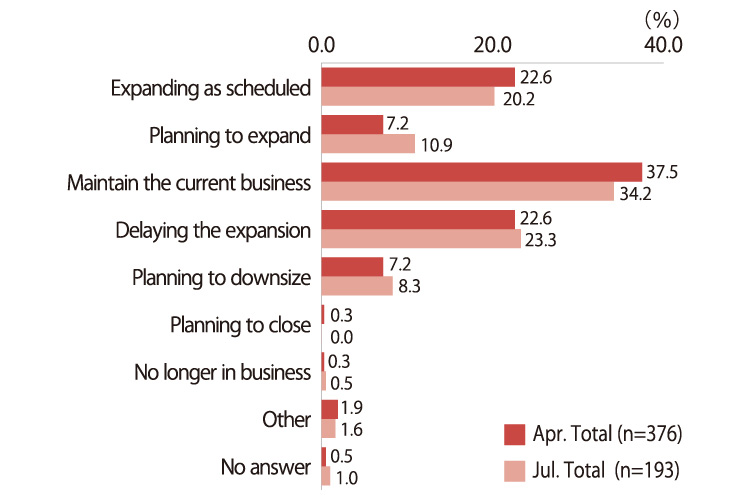

- When asked about future business development and business expansion plans in Japan through the COVID-19 pandemic, less than 10% of companies would consider downsizing or withdrawing business in Japan, and the majority said that they would continue their business.

Impact of COVID-19

-

Note:

"Year"represents the fiscal year respondents based their answers on.

-

Source:

"Survey on Operations of Foreign-affiliated Companies in Japan" (JETRO)

Period Required to Make up for the Decline in Sales

-

Note:

n is companies taht answered they have experienced the decline of sales due to the COVID-19 in 2020, compared to the same period of 2019.

-

Source:

"Survey on Operations of Foreign-affiliated Companies in Japan" (JETRO)

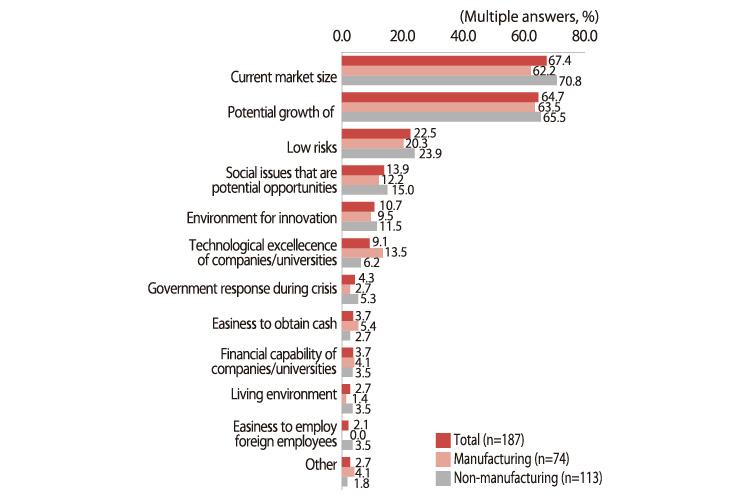

- Regarding the attractiveness of the Japanese market, more than 60% of companies cited the current market size and potential growth of relevant industries.

Future Business Development in Japan

Future Business Development in Japan

-

Source:

"Survey on Operations of Foreign-affiliated Companies in Japan" (JETRO)

Attractiveness of the Japanese Market

-

Note:

n is companies that answered they would continue their business in Japan. Companies could choose up to three choices.

-

Source:

"Survey on Operations of Foreign-affiliated Companies in Japan" (JETRO)

2020

-

1. Macroeconomic and Inward Foreign Direct Investment Trends in the World and Japan

(1.5MB)

(1.5MB)

-

2. Japan’s Business Environment and Foreign-Affiliated Companies

(1.3MB)

(1.3MB)

-

3. Changes and Business Opportunities Brought to the Japanese Market by COVID-19

(1.3MB)

(1.3MB)

-

4. JETRO’s Efforts to Promote Investment in Japan

(1.2MB)

(1.2MB)

Contact Us

Investing in Japan

We will do our very best to support your business expansion into and within Japan. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices