JETRO Invest Japan Report 2019 (Summary)3. Perception of the Business Environment in Japan among Foreign-affiliated Companies

Positive about open innovation with universities, research institutions and Japanese companies

- JETRO conducted a survey research targeting about 2,100 companies, mainly consisting of foreign-affiliated companies supported by JETRO in their entry into and/or expansion in the Japanese market and member companies of foreign chambers commerce in Japan, 213 from which valid responses were taken (Survey period: June to July, 2019).

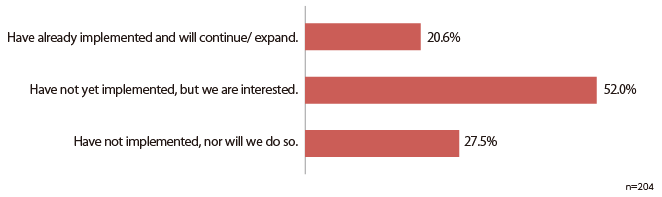

- More than 70% of the companies answered they have implemented or are interested in open innovation with Japanese companies/universities.

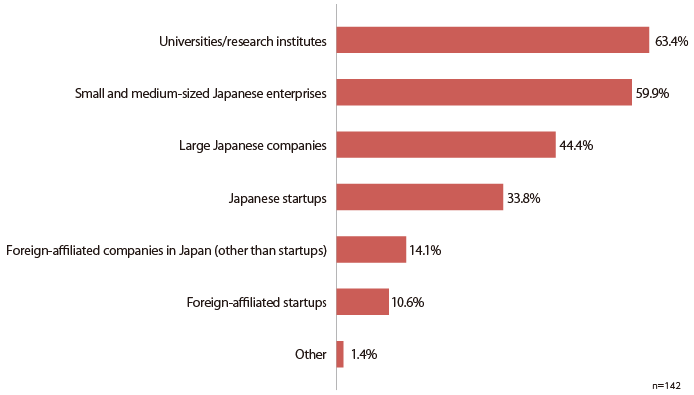

- About 60% of the companies are interested in universities/research institutes as well as small and medium-sized Japanese enterprises.

Your efforts regarding open innovation with Japanese companies/universities, etc.

The kinds of partners you are interested in (multiple answers)

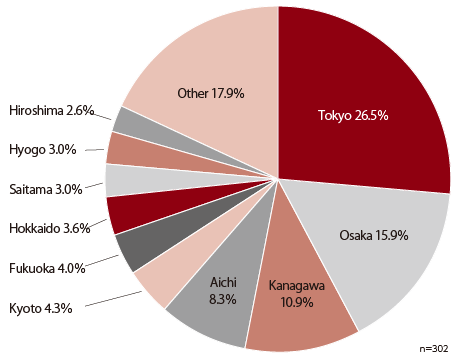

Over 70% of target locations for their secondary investment/expansion are areas outside of Tokyo

- As a destination for secondary investment/expansion, although Tokyo(26.5%) is the most popular choice, a number of companies also choose others such as Osaka (15.9%) and Kanagawa (10.9%), and prefectures other than Tokyo recorded more than 70%.

- Regarding the reasons for selecting their secondary investment locations in the top-ranking ones, “Proximity to customers,” “Market size,” and “Existence of relevant industrial clusters” are generally among the most-cited reasons.

Where to make secondary investment/expansion(multiple options)

Where to make secondary investment/expansion, the type of business, and the reasons (multiple options)(-: no data is available)

| Rank | Prefecture | No. of projects | Tyoe of business (top 3) | Reason (top 3) |

|---|---|---|---|---|

| 1 | Tokyo | 80 | Sales/customer service | Proximity to customers |

| Research & development | Market size | |||

| Back office operations | Existence of relevant industrial clusters | |||

| 2 | Osaka | 48 | Sales/customer service | Market size |

| Research & development | Proximity to customers | |||

| Back office operations | Relative positioning compared to other bases in Japan | |||

| 3 | Kanagawa | 33 | Sales/customer service | Proximity to customers |

| Research & development | Market size | |||

| Manufacturing | Existence of relevant industrial clusters | |||

| 4 | Aichi | 25 | Sales/customer service | Proximity to customers |

| Manufacturing | Market size | |||

| Research & development, Regional head office function | Existence of relevant industrial clusters | |||

| 5 | Kyoto | 13 | Sales/customer service | Proximity to customers |

| Research & development | Market size | |||

| Back office operations, Liaison services/PR/collecting information, Other | Existence of relevant industrial clusters, Preferential measures or incentives provided by local government | |||

| 6 | Fukuoka | 12 | Sales/customer service | Proximity to customers |

| Back office operations | Market size | |||

| Liaison services/PR/collecting information | Existence of relevant industrial clusters | |||

| 7 | Hokkaido | 11 | Sales/customer service | Market size |

| Back office operations | Proximity to customers | |||

| Procurement | Existence of relevant industrial clusters, Preferential measures or incentives provided by local government, Low cost (land, personnel expenses) | |||

| Other | 80 | - | - | |

Greatest appeal lies in the Japanese market, with the spotlight on its huge and stable market

- The top answer for the perceived attractiveness of doing business in Japan is “Japanese market,” as observed in 2018.

- In particular, the size of the Japanese market attracts attentions.

Attractiveness of doing business in Japan (select each from 1st to 3rd positions)(n=213)

| Answer | Votes | Points | ||

|---|---|---|---|---|

| 1st | 2nd | 3rd | ||

| Japanese market | 133 | 12 | 8 | 431 |

| Existence of suitable partners (companies, universities) with outstanding technology or products | 24 | 37 | 23 | 169 |

| Stability of country and society | 13 | 42 | 44 | 167 |

| Existence of renown global companies | 17 | 33 | 15 | 132 |

| High quality of R&D | 15 | 25 | 15 | 110 |

| Infrastructure (traffic, logistics, ICT, energy) | 4 | 25 | 36 | 98 |

| Potential for securing talented human resources | 2 | 12 | 11 | 41 |

| Japan’s location (e.g. position as a gateway to Asia, advantage as a base for regional headquarters) | 0 | 14 | 13 | 41 |

| Well-maintained living environment | 3 | 4 | 23 | 40 |

| Expected increase in demand and sales toward the 2020 Tokyo Olympic and Paralympic Games | 2 | 5 | 8 | 24 |

| Well-structured legislation regarding intellectual property | 0 | 4 | 7 | 15 |

| Other | 0 | 0 | 10 | 10 |

Challenging issue of doing business is "difficulty in finding human resources"

- A lot of companies raised “Difficulty in finding human resources” as obstacles to doing business in Japan.

- In particular, companies are finding “Lack of human resources with foreign language ability” and “Difficulty in finding experts” as challenges.

Obstacles to doing business in Japan (select each from 1st to 3rd positions)(n=213)

| Answer | Votes | Points | ||

|---|---|---|---|---|

| 1st | 2nd | 3rd | ||

| Difficulty in finding human resources | 70 | 33 | 26 | 302 |

| Difficulty in communicating in non-Japanese languages | 49 | 47 | 31 | 272 |

| High business costs | 20 | 44 | 43 | 191 |

| Complicated administrative procedures | 23 | 25 | 29 | 148 |

| Rigid regulations | 19 | 33 | 19 | 142 |

| Difficulty in finding business partners | 21 | 11 | 16 | 101 |

| Difficulty in financing | 5 | 7 | 14 | 43 |

| Immigration control system | 5 | 5 | 16 | 41 |

| Difficulty in living conditions for foreigners | 0 | 6 | 3 | 15 |

| Other | 1 | 2 | 16 | 23 |

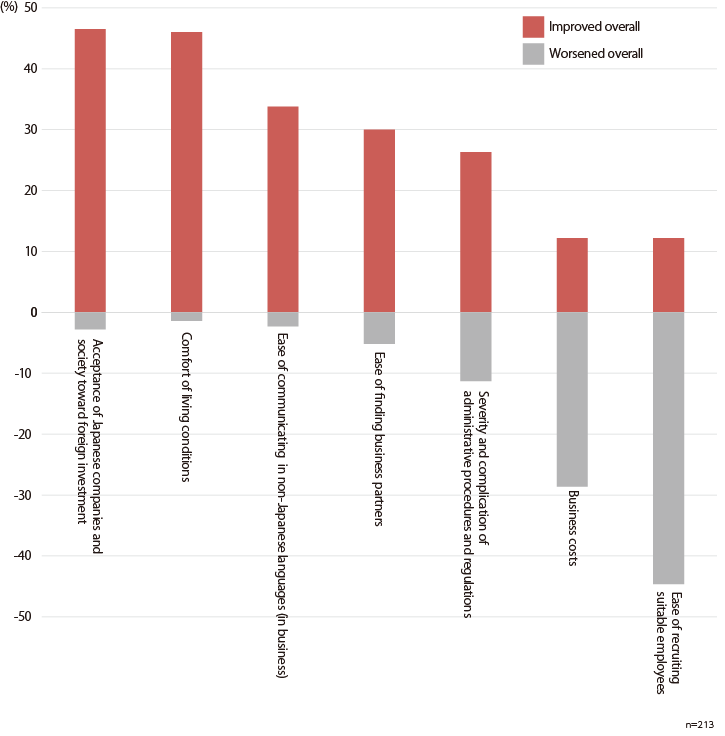

Japan’s business environment heading for improvement

- Companies felt improvement for the past one or two years in 5 out of 7 items of business environment.

- A number of companies see improvement in “Acceptance of Japanese companies and society toward foreign investment” and “Comfort of living conditions for foreigners.”

Business environment in Japan –changes in comparison with past one or two years

Contact Us

Investing in and collaborating with Japan

We will do our very best to support your business expansion into and within Japan as well as business collaboration with Japanese companies. Please feel free to contact us via the form below for any inquiries.

Inquiry FormJETRO Worldwide

Our network covers over 50 countries worldwide. You can contact us at one of our local offices near you for consultation.

Worldwide Offices